UPDATE 1/12/2016: The American Express for Target card has been discontinued

I recently posted “The 5X everywhere backup plan” where I showed how people unable to buy Vanilla Reload cards could still earn 5 points per dollar everywhere by making use of the American Express for Target card. I consider it the backup plan to the “One card to rule them all” trick. I also plan to follow-up with one or more additional posts showing how best to leverage this card.

In this post, I’ll tell you how to go about getting one of the Target Amex cards.

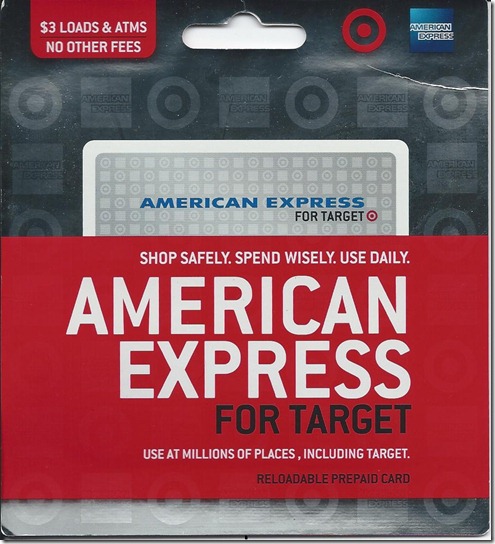

Unlike the regular American Express Prepaid cards and the new Bluebird card, the Target Amex cards cannot be ordered online. Instead, you need to first buy a temporary card at a participating Target and then wait for a permanent card to (hopefully) arrive. I found the whole process surprisingly difficult. To save you some headache, I’ve laid out below everything you need to know:

Find a participating Target

In order to get the American Express for Target card, you need to go in person to a Target store that carries them. You can find those stores here.

Find the temporary card in the store

Finding the card isn’t easy. In my case, I had to ask four or five employees before I found someone who knew what I was talking about. Most employees pointed me towards regular Amex gift cards. In the end, I found the card I wanted by one (and only one) of the many checkout lanes. Here is what to look for:

My advice is to look at all of the displays near and above the checkout lanes until you find a card that looks like the one pictured above. Make sure it says “reloadable prepaid card.” Otherwise you may be buying a simple, uninteresting gift card.

Buy the card

Now that you’ve found the card, it should be easy to buy it right? I wish! The surprising thing here is that when you buy this card, the cashier will be prompted to ask you all kinds of questions that you probably don’t really want to answer while a line of angry customers forms behind you. They’ll ask for your full name and address. They’ll ask you to input your SSN on the keypad. I can’t remember all of the questions I had to answer, but I’m pretty sure they asked me to describe my life’s most embarrassing moment (“easy – this one!”). Finally, after sharing all of your personal information with the cashier and the angry mob behind you, you can pay for the initial card load with any credit card. There is a $3 fee for each load.

NOTE: In case you’re worried that a credit card load will be treated as a cash advance: I have tested loads and reloads with Chase, Amex, and Citi credit cards. All transactions were credited as regular Target purchases, not as cash advances (that’s a good thing).

Wait and hope

The card you just bought at Target is a temporary card that cannot be reloaded. You can use it for regular credit purchases, but not for ATM withdrawals. If all goes well, you will receive your permanent card in the mail in a few weeks. If not, you’ll receive a letter or email stating that they were unable to verify your identity. That’s what happened to me. So, I called and they resubmitted my application. A few weeks later I received another letter stating that they were unable to confirm my identity (Really? You know I carry a gazillion Amex cards, right?). Ultimately I had to buy another temporary card in order to try again. The second attempt succeeded. I have no idea why the first attempt failed, but I’ve heard from others who have had similar experiences so don’t be surprised if it happens to you too!

Good luck!

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

| Chase 5/24 semantics ("Subject to" vs. "Count towards"): Most Chase cards are subject to the 5/24 rule. That means the rule is enforced in making approval decisions. In other words, you probably won't get approved if your credit report shows that you opened 5 or more cards in the past 24 months. Meanwhile, most business cards (such as those from Chase, Amex, Barclaycard, BOA, Citi, US Bank, and Wells Fargo) are not reported on your personal credit report. These cards do not count towards 5/24. Example: Chase Ink Business Preferred is subject to 5/24, so you likely won't get approved if over 5/24. If you do get approved, it won't count towards 5/24 since it won't appear as an account on your credit report. |

| Amex credit and charge card limits: If you apply for a new Amex credit card, you may get turned down if you already have 5 or more Amex credit cards; or 10 or more Pay Over Time (AKA charge) cards. Both personal and business cards are counted together towards these limits. Authorized user cards are not counted. See also: Which Amex Cards are Charge Cards vs. Credit Cards? |

| Applying for Business Credit Cards Yes, you have a business: In order to sign up for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale, or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort. When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website. Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so. |

| Manufacturing Spend Caution: Many, many things can go wrong when manufacturing spend. If you suddenly increase credit card spend, your accounts may get shut down. If you cycle your balance often (e.g. spend to your limit, pay the bill, repeat) within a billing cycle, your accounts may get shut down. If you repeatedly pay your credit card bill from an anonymous bill payment source, your accounts may get shut down. If you buy lots of gift cards you may lose money due to gift card fraud, theft, loss, or simply mishandling those gift cards (e.g. maybe you thought you already used a gift card and tossed it into your “used” bin). If you rely on only one method to liquidate gift cards, you may be stuck unable to pay your credit card bill when that method gets shut down. In other words, don’t try this at home unless you know what you’re doing, and you understand and accept the risks.. |

| Chase Ultimate Rewards points are super valuable and super flexible. At the most basic level, points can be redeemed for cash or merchandise, but you'll only get one cent per point value that way. A better option is to use points for travel. When points are used to book travel through the Ultimate Rewards portal, points are worth 1.25 cents each with premium cards (Sapphire Preferred or Ink Business Preferred, for example) or 1.5 cents each with the ultra-premium Sapphire Reserve card. Another great option is to transfer points from a premium or ultra-premium card to an airline or hotel program when high value awards are available (see this post for details). If your points are tied to a no-fee "cash back" Ultimate Rewards card, then first move those points to a premium or ultra-premium card before redeeming them in order to get better value. |

| Amex Membership Rewards points can be incredibly valuable if you know how to use them. In general, if you use Membership Rewards points to pay for merchandise or travel, you won't get good value from your points. One exception is with the Business Platinum card where you'll get a 35% point rebate when using points to book certain flights. This gives you approximately 1.5 cents per point value, which is pretty good. Another exception is with the Business Gold Card where you'll get a 25% point rebate when using points to book certain flights. This gives you approximately 1.33 cents per point value. If you don't have either card, then your best bet is to transfer points to airline miles in order to book high value awards. More details can be found here: Amex Membership Rewards Complete Guide. |

| Marriott points can be redeemed for free night awards, travel packages, airline miles, or experiences. 5th Night Free Awards: When redeeming points for free nights, the 5th night within a single reservation is free. Airline miles: Points can be converted to airline miles at a rate of 3 points to 1 mile. With many programs, a bonus is added on when you transfer 60,000 points at a time, such that 60,000 points transfers to 25,000 miles. Also, you'll get a 10% bonus when transferring points to United Airlines. Everything you need to know about Marriott's rewards program, Bonvoy, can be found here: Marriott Bonvoy Complete Guide |

| Editor’s Note: This guest post was written by the same guy who showed you how to fly round trip to Africa (DC to Senegal) for 50,000 points, how to book business class to Europe for 80,000 miles roundtrip, and more. You can find John’s website and award booking service here: theflyingmustache.com/awardbooking. -Greg The Frequent Miler |

Amex Application Tips

Check application status here. |

Chase Application Tips

Call (888) 338-2586 to check your application status |

Citi Application Tips

Check application status here. |

Bank of America Application Tips

Click here to check your application status |

Barclays Application Tips

Consumer: Click here to check your application status |

Capital One Application Tips

To check application status, call (800) 903-9177 or (877) 277-5901 |

Discover Application Tips

Click here to check your application status |

TD Bank Application Tips

Call (888) 561-8861 to check your application status |

US Bank Application Tips

Call (800) 947-1444 to check your application status. |

Wells Fargo Application Tips

Check application status here. |

Under certain circumstances consumer Visa cards don't work with Plastiq. The following payments are fine:

|

In order to meet minimum spend requirements, people often look for options to increase spend in ways that result in getting their money back. These techniques are referred to as "manufacturing spend". American Express has terms in their welcome offers that exclude some manufactured spend techniques from counting towards the minimum spend requirements for the welcome bonus offer. For example, most new cardmember bonuses have terms like this:

Eligible purchases to meet the Threshold Amount do NOT include fees or interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of other cash equivalents.That said, many techniques for meeting minimum spend are perfectly fine. Here are some techniques that are safe for meeting Amex minimum spend requirements (click each link for more information): |

|

| We have added this to our running list of Black Friday deals, which will be constantly updated through Cyber Monday with a mix of gift card deals, merchandise deals, and travel deals. Check back often. |

[…] In order to get the American Express for Target card, you need to go in person to a Target store that carries them. You can find those stores here. Unfortunately, finding the store is just half the battle. It can be surprisingly difficult to find this product in a store that carries it, and even then there are challenges to getting the card. For details of how to get the card, see “How to get the American Express for Target card.” […]

[…] Amex for Target, and more recently the Target Prepaid REDcard (AKA REDbird), have been fantastic options for increasing credit card spend, draining gift cards (including Amex gift cards), and more. It seems likely to me that policy changes caused by the new reloadable debit cards will be applied across the board and will include our old and new Amex friends. That would be very bad. […]

I have already 3 AMEX Prepaid cards. Think tere will be any problem getting one of these Target cards as well?

If you have any problems, I’m sure it won’t be due to having those Amex prepaid cards.

[…] to Frequent Miler, Will Hernadez, Romsdeals for the […]

Has anyone been able to buy this anywhere in Florida lately?

I have been to Target Stores in Miami, Fort Lauderdale, West Palm Beach and Orlando in the last month and they did not have any.

At 2 Super Targets I found the original display for them, but no Amex for target cards where available anywhere. I asked management and they have not received any in a long time.

Please help me, if you know where I might be able to find them.

Thanks

Did you ask management to get more in stock? Usually they are pretty good about that.

They said, they do no longer sell them.

I got the same “Offline to processor – Can’t sell card” error when trying to purchase at two different Target stores. I am in CA.

The problem has been resolved. You should be able to buy a card now.

@Chris – thanks, I will give it a try, just got a new Amex Mercedes-Benz Platinum that I need to give a spin.

Which car dealer is selling the Amex Platinum Mercedes-Benz? Does it come with a rimless stripe?

Thanks you, Chris! Finally I bought one today. Hopefully I will get the permanent card soon, :->

Finally got around to trying to get this, tried two stores in Illinois last week and one in New Jersey this week, multiple POS machines, and all had an error at the last step in the process. After clicking to verify all the information and before payment the system gives an error to the cashier, “Offline to processor – can’t sell card.” These stores rarely sell them and had no idea of the problem. One manager suggested I called the customer support line, which produced a clueless guy who had difficulty understanding the issue and checking with a supervisor had no info on the issue. For more fun I tweeted askamex, they said they would investigate, so far no response. I wonder how long they have been offline. Must not be selling many if no one seems to know they are down.

[…] gift card. I first learned about this card from Frequent Miler’s post last October (post). It hasn’t gotten much attention lately with Bluebird dominating the reloadable space, but […]

has the leading 0 issue been resolved? is this method of MS still viable? thanks

am i the only 1 whos unable to transfer $ from vanilla to bluebird??? plz advise. thanks

My first verification failed also but i do not have the 0 issue. When I called they asked if the address I gave was the one that was linked to my social security card, almost as if they were using that for verification of address which is ridiculous, I got my S.S. card when I was born and have had no need to update the address as most people don’t have need to unless they are receiving S.S. benefits. The guy had me give him my driver’s license number because he said otherwise since all my information was the same as I originally imputed it would just get automatically denied again. Is it just me or does it seem like this guy has enough information already to steal my identity yet cannot verify the information for this card? I mean what is next giving them my passport information?! If this verification does not go through I’m going to take up serious issue with these guys and request they tell me exactly how they are doing this verification that they can have all this information and still not be able to verify something as simple as a re-loadable prepaid card.

@FM, can you load the Amex for target card online or only at Target? And can you use a loaded permanent Amex for Target card with its pen number (when you get it) to load your Bluebird card at Walmart? Thanks

sweetsavage77: Only in-store with a credit card. No, you can’t use it as a debit card to load bluebird (nor for any other debit card use)

gloreglabert: Just adding another data point to confirm. Another ID they can’t verify, and another SS with a 0 at the start. Thanks for shedding light on it! Maybe I’ll contact their CS again to ask if there’s any ETA on the issue.

VR: I had to spend down the balance and couldn’t use an ATM for the card that wasn’t verified.

Alfred: I’m glad that worked out!

gloreglabert: Thanks for shedding light on that issue!

@Alfred — both my and my wife’s initial verifications failed, and both of our resubmissions failed again. We both have socials starting with zero. It may well be that there are multiple bugs in the system, but I’m pretty sure the leading zero issue is one of them.

@gloreglabert, Yes, agreed…there r lots of glitches in the approach this verification works. Hope they fix it soon… I spent like almost 3 hours within last 3 days talking/trying to reach the CSR to make it happen…