If you are a business owner, its worth looking at the many perks offered by small-business credit cards. If you are not a business owner, some of these perks might just be tempting enough to get you started!

Note: Regarding card offers and benefits described here, terms & conditions apply.

New cardmember bonuses

Some of the best credit card welcome bonuses are offered only for business cards. For example, the Chase Ink Plus card currently offers 50,000 points after $5K spend. And American Express often targets businesses with even better offers (check your mail!).

In some cases, banks offer business cards that are virtually identical to their non-business counterparts. A good example is the American Express Starwood card which comes in both a personal and business flavors. Even though the welcome bonuses don’t tend to be higher for business cards in this situation, you can apply for both the business and personal cards in order to get both intro bonuses.

Automatic rebates

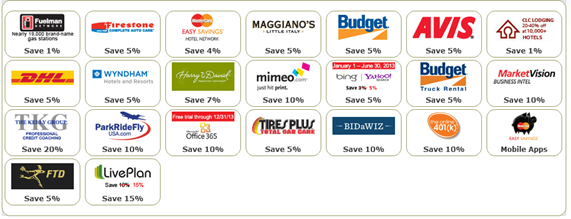

All American Express small business cards are part of the OPEN Savings program in which you can automatically earn cash back (as statement credits) at various specific merchants. Be sure to read the fine print about what qualifies. Details can be found here: OPEN Savings.

Similar to the American Express OPEN Savings program, MasterCard has a program for MasterCard small business cards. Unlike American Express’ program, you do need to register your MasterCard to qualify. Details can be found here: MasterCard Easy Savings.

Terrific point earnings

The Chase Ink cards, in particular, have terrific earning rates for your business expenditures. In particular, they offer:

- 5X for purchases made at office supply stores

- 5X for phone (landline & cellular), internet, and cable charges

- 2X for gas

- 2X for hotels (Ink Bold, Ink Plus, and Ink Classic)

- 2X for restaurants (Ink Cash only)

American Express also has some goodies. The Business Gold Rewards card, for example, offers 3X points in your choice of categories (and 2X in the remaining categories):

- Airfare purchased directly from airlines

- U.S. purchases for advertising in select media

- U.S. purchases at gas stations

- U.S. purchases for shipping

- U.S. computer hardware, software, and cloud computing purchases made directly from select providers

Another good choice is the Capital One Spark business card that offers 2% cash back for all purchases.

Other perks

Business cards often (but not always) come with the same perks often found in consumer cards such as extended warranties, return protection, etc. I’ve heard especially good things about American Express’ extended warranties. It’s worth reading the fine print to get to know what your cards offer. Here are a few perks of the Chase Ink Bold and Ink Plus cards that you may not be aware of:

- Primary auto rental collision damage waivers: This includes reimbursement for damage due to collision or theft, loss-of-use charges, and towing charges. (note: no benefit is provided for vehicles rented in Israel, Jamaica, or Ireland)

- Lounge Club: Airport lounge access (2 free visits per year).

- Travel Insurance: Including travel accident insurance, trip cancellation / interruption insurance, trip delay reimbursement, lost luggage reimbursement, and baggage delay reimbursement.

- Ink Insiders Program: Chase has a special program for Ink cardholders in which you can qualify for all of the following benefits: $150 in Adwords Express credit; Avis faster rewards & up to 30% off; Expedia business rewards; and more. Details here.

Qualifying for business cards

To qualify for a business credit card, you do need to own a business. Examples of valid businesses include (but are not limited to): lawn/gardening services, housekeeping, sales (online or in-person), blogging, etc. If you are just starting out with your business you might not have a business tax ID, and that’s OK. You can describe your business as a sole proprietorship and use your social security number as the tax ID. Also, you might not yet have much (or any) business revenue. That’s OK too. Be honest on your application. If your business has earned nothing, then report $0 in revenue/sales. You can report income from all sources (not just your new business) in the field for “Gross annual income”.

Summary

Whether you have a long established business or are just starting out, business credit cards offer many ways to earn points and save money. For example, suppose you need to travel for business, here is an example of how you can use your business cards for maximal savings and point earnings:

- Airfare 3X: Pay with the Amex Business Gold Rewards card (if you selected airfare as your 3X category)

- Car rental 5% back: At Avis or Budget, you’ll get 5% cash back if you pay with your business MasterCard (such as a Chase Ink card) once it is registered with the Easy Savings program. Further, with Chase’s Ink Insiders program you’ll earn Avis rewards twice as fast and save up to 30% off rentals! At Hertz, if you pay with your Amex business card you’ll earn 5% cash back for each dollar spent above $500 per calendar year, and 10% cash back for each dollar spent above $2500. Clearly the latter is only good if you spend a lot at Hertz!

- Gas 2X or 3X: The Amex Business Gold Rewards card offers either 3X or 2X for gas purchases in the US. The Chase Ink cards offer 2 points per dollar at gas stations. At certain gas stations in the Fuelman network you’ll also get 1% cash back when using your MasterCard registered with the Easy Savings program.

- Hotels 5% back and/or 2X: At Hyatt (in the US) hotels, pay with your Amex business card for 5% cash back. At Wyndham hotels, pay with your MasterCard registered to the Easy Savings program for 5% back. At any hotel, if you pay with your Ink Bold, Ink Plus, or Ink Classic you’ll earn 2 points per dollar.

- Dining 2X and/or 5%: Use the Chase Ink Cash MasterCard to get 2 points per dollar at any restaurant. If your card is registered to the MasterCard Easy Savings program you can also get 5% cash back at Maggiano’s restaurants.

Note that there are some cases where you can do better with personal cards. Please see “Best Category Bonuses” for details. Also, with either business or personal cards, you can increase point earning or cash back by booking your travel through online point earning or cash back portals. And, link your credit cards with your favorite Rewards Network program in order to automatically get more points at certain restaurants.

[…] Amex cards offer American Express OPEN Savings (see Business card benefits). The OPEN Savings program offers automatic cash rebates when you use your Amex business card at […]

[…] Hat tip to Frequent Miler for his post on business credit cards. […]

I see. Thank-you. I thought it was 3 additional membership rewards points. But it is only 2 additional points.

FrequentMiler: When I do the math I calculate receiving the extra membership rewards points through open savings is more valuable then 5% cash back.

@ Hyatt for a $500 stay: $500 x 3 = 1,500 membership rewards points. 1,500 points x 1.9 cents = $28.50.

Cash back: $500 x 5% = $25.

The points being more favorable is even greater if you factor in membership rewards transfer bonuses.

What am I missing? I guess it partially depends on what value you are assigning to the points.

Mark: I think you’re forgetting one piece. When you take cash back, you still get 1X MR for the purchase itself (after the 5% cash back). So, in your scenario, you would get $25 cash back and 475 MR points. If you value MR points at 1.9 cents each, then the total rebate is: $25 + 475 points x 1.9 cents = $25 + $9 = $34.

Sorry I missread. You are clear on it. Forget my last question.

But Travelocity do not count for amex because it is not bought directly from the airline. Right?

Then it certainly seems that Ink Plus card I have is the right card to use for rental cars?

JustSaying: Yep, it looks that way.

I need to put spending on my amex gold biz and I need to do some traveling to mex . United is the best way to go. It’s not clear to me the x3 on traveling. How to get it an if I only can get the x3 using certain airlines. So far my best choice has been sapphire/travelocity (x4 UR POINTS). It’s just a pity that I cannot be done with the min spending of the amex biz gold.

Have you found a good way to use the x3 on traveling?

luchex: When you pay for flights with your Amex Gold biz by booking directly with the airline, you’ll automatically earn 3X Membership Rewards points. Another option for you is to go through a portal to Travelocity and pay with your Amex. So you would get up to 2X portal points and 1X Membership Rewards points. It used to be the case that you would get 3X MR when buying flights from Travelocity, but some people have told me that it no longer works.

FM,

Just a helpful insight to pass along as some of us play the cashback game as well as the miles game.

Sears recently had a promo of 10% cashback when you clicked through shopdiscover and a 5% promo for “home improvement stores”

I wound up buying a lawnmower through sears and clicked through shopdiscover. Shopdiscover came back and did not give me the 10% because it said it could not be used with any other promotions. The “promotion” I used was redeeming 23 cents of shopyourway rewards against the lawnmower.

Additionally, even though Sears is listed as a merchant on the “home improvement” gift card issued by discover it is not coded as such. Sears.com is coded by discover as a catalog merchant. Just an FYI when using Sears and shopping portals to not redeem your shopyourway rewards.

Visa MCC Code Rob: Thanks for that info. I’ve had good luck with most portals when shopping at Sears even when I used SYW points. Maybe shopdiscover is more picky for some reason.

Hello FM, I have a question regarding which card to get. I have a AMEX Plat which will due next month for the fee, I don’t have SPG yet. I am torn between a SPG Biz and the Merc-Benz Plat. I am not quite comfortable getting both regardless of the chance, I would like to hear your kind advice as which one should I go first in this scenario. TIA!

Has Anybody had experience in using the primary auto insurance from biz card on personal trip? I am sure it is in the T&C as “business only”. It would be hard to make up a trip to Hawaii, Las Vegas as for business, especially if you are with family. Then the insurance company can easily deny or pay less for the coverage. Valid concern?

Frugal Guy: I’d like to hear about that too. It seems unlikely to me that they would actually try to figure out if your trip is business or personal, but who knows.

Jonathan: With the Mercedes card, you’ll have to pay $475 up front but you’ll get a nice a 50K Membership Rewards signup bonus. And, you can offset the fee by taking advantage of $400 in airline fee credits ($200 this calendar year, and $200 next calendar year), as well as $100 credit for global entry if you haven’t signed up for that yet. And, of course, it gets you into many airline lounges. With the SPG card, you’ll get a 25K SPG point bonus after meeting the spend requirements. It’s tough comparing the two. The Platinum card has far more benefits and you’ll earn more points, but Membership Rewards points aren’t quite as flexible and valuable as SPG points. Except, under certain circumstances, Membership Rewards are more valuable: 1) they transfer very quickly to airline programs (whereas with SPG you might have to wait about 5 days or more); and 2) they often run transfer bonuses. Soooo, without knowing you its hard to say which I recommend. They’re both great choices. If you value the Platinum perks, then go with that. If you value using points for SPG hotel stays or just want more flexibility to transfer to more partners (AA, for example), then go with SPG. Note that if you wait until mid-August they might up the SPG bonus to 30K as they have done the last few years.

I recently received the Amex Business Rewards card. The open savings documentation I received said I could also choose bonus points on spend instead of cash back. For example, Hyatt gave 3 additional membership rewards points per dollar. I believe the bonus point earning came standard on the card but you can elect once per year to switch to cash back.

With the Ink cards you are also able to access Chase Ink Insider’s program. The most valuable asset here is their relationship with Avis. Some of the perks include: 30% off Avis Rentals, free rental after every 7 rentals, free one-class upgrade, half off GPS rentals, and Complimentary Avis First membership. I believe the last one is an upgrade over their Preferred membership, but I’m still in the process of signing up for it (it takes a phone call to Avis). Also, since the Mastercard EasySavings is a 5% rebate on your statement, the Ink Insider’s program stacks on top of this for a 35% rebate at Avis (at least theoretically). And one last thing to point out. With the Mastercard EasySavings program you can get 1% rebate on gas, making paying for gas with the Ink cards 2X UR pts/$ + 1% cash rebate (sort of 3X?). Thanks for another great post FM!

Ben: Thanks! I forgot about the Chase Ink Insider’s program. That’s a great benefit that I’ll have to add to this post.

Mark: In general you’re better off getting cash back instead of points because choosing points is like paying at least 2.5 cents per point which is not really a great deal unless you’re working towards a specific high value redemption.

All those Marriott brands going away July 1: http://boardingarea.com/rapidtravelchai/2013/04/21/amex-open-savings%C2%AE-dropping-marriott-dun-microsoft/.

Also note that most of those insurance coverages only apply to legitimate business trips and business purposes. I will be testing that with my car smash and grab in Toronto this weekend, fortunately I was attending a conference.

Great writeup FM. A typical post like this in other blogs would have had enough links to make your eye balls come out of the socket.

USAA/FedEx discount, more info please!

DFW: Thanks! I don’t know any details about USAA/FedEx

Rapid Travel Chai: Thanks for the reminder. I forgot that OPEN Savings is dropping Marriott. I’m looking forward to hearing about how well the insurance coverage works for you. When you write it up, feel free to drop a link here to your post.