I’ve been on the case for looking out for a GOOD mileage earning credit card out of India for a few years, but I think I finally have found one. Mileage earning is not a big phenomenon in India, at least not as much as the USA. However, for a few of us travel nuts who like to be in the know and optimise ‘travel well’ while still not paying a bomb, this is an important tool in the wallet.

There are all sorts of travel cards in India now, but I was just not going to go out to sign up for a few for the heck of it. If mileage earning is based on spend, then I could only spend so much and hence I thought it was beneficial to keep one rather than many.

Earlier this year, the Citibank Jet Airways CC’s program got re-structured extensively. I’ve cribbed about it enough already, so it stopped serving its purpose and I needed to get it out of my wallet. Eventually, I swapped it for a Citibank Premier Miles Credit Card *drumrolls* which arrived last week.

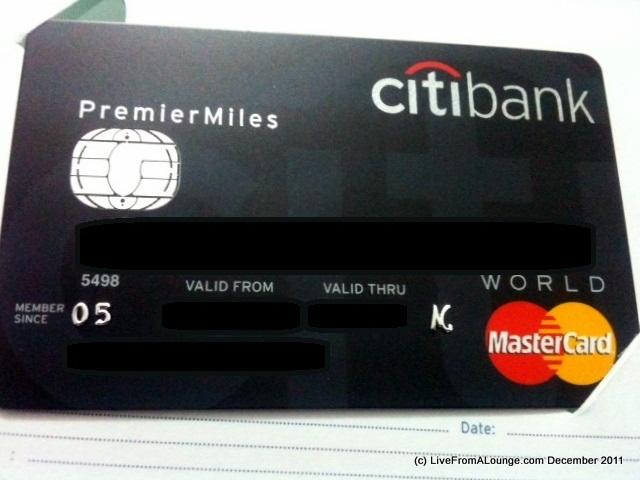

I felt a big pit in the stomach when the courier company called to say they were going to deliver the card a day later than promised due to some issues at their end. Heck, they did deliver it eventually on the same day. Here is how it looks

Mileage Redemption

Now here is the beauty of the card. This one, allows me to earn Premier Miles which are freely transferable to 6 domestic and international airline programs (Jet Airways, Kingfisher Airlines and Air India included). The better part, they transfer 1:1 ratio, so I do not need to worry about how many miles I was earning while swiping that card. If you believe in the Star Alliance, you could also transfer to SQ KrisFlyer or TG Orchid Plus, or use it to top off your account in Cathay Pacific.

I could also choose to burn these Premier Miles on the PremierMiles portal, and not worry about looking up for an award ticket. So, for instance, if I wanted a BOM-DEL award ticket, which comes at 11,000 JP miles/10,500 Kingfisher Miles, I could use 10,500 Premier Miles and book it on any airline that flies the route. So, all of a sudden, award availibility looks GOOD!

Mileage Earning

That is just not it. They are giving 10 Premier Miles per INR 100 ($2) spent on ticket booking on any airline website or airline counter, or if I chose to use their travel portal www.premiermiles.co.in. That means 10 miles per 100 INR spent on all my domestic tickets, and the occassional international ones I buy on my own dime! This looks like a better deal to people like me who ticket on their own most of the times, and better than the 8 JP Miles per 100 INR on Jet Airways Citibank Platinum CC and matches the 10 Kingfisher Miles per 100 INR spent on the Kingfisher First American Express CC.

If using a travel portal such as Travelocity or ClearTrip, or for any other expenses I get to earn 2.5 Miles, which is a fair deal I suppose, worse off than my older Jet Airways CC but better off than 2.5 MR points earned which would not translate into 2.5 miles. And MasterCard anyways gets accepted much more PoS than the AX.

What Else…Where are the freebies?

Digging deeper into the envelope, there were more goodies/privileges in store:

There were tonnes of vouchers in the docket which allowed me to get a night free on staying 2 nights at Hyatt properties in South Asia, or getting a free cellphone with pre-loaded credit when travelling to the US or UK, and free upgrades on car hires. To start, I also got 2 vouchers, which allow me to book tickets on any airline in India and get upto INR 1200 off on each ticket ($60). First year, the card comes free. The next year, you could pay for it with 5000 Premier Miles, or pay with money and get 5000 Premier Miles added to your account!

So there, I’ve been racking in Premier Miles for all my new payments. And I highly recommend, if you want to travel well, you should join the bandwagon!

Related Posts:

Dear A2A ,Just noticed that Citibank PM lounge access policy has changed. I am not sure if you covered that in your blog !!!

I am planning to go for the new Amex jet card. What would you recommend between the Citi premier miles and the Amex jet? Thanks in advance.

Somewhere you have mentioned that Hdfc is giving jet card free to Citi card holder. But surprisingly My application was rejected by Hdfc for world jet card due to some tiff with cibil due to wrong Billing by Icici inspite I have good standing with citi jet plat card which is converted to premier miles card.Amex has also approved my travel plat card.

@agarwal, the issues are unrelated. citi is only to determine free card or not. CIBIL gives your credit report to every bank who is authorised by you to look it up, and they then interpret it according to their internal rules of credit appraisal. HDFC is a conservative bank so the refusal. contact CIBIL, get your report corrected and apply again

Thanks for the info AJ! Now I have something to recommend to the folks back home. 🙂

What is the annual fee for the card?

@hyderago, The first year is free, and next year you can pay in 5000 miles, or pay 5000 and get 5000 bonus miles. basically, its largely free, and your entire value is being refunded in the second year!

This is the Indian version of Amex Premier Rewards Gold. What is the earning on normal spending?

On normal spending 2.5 PM per 100 rs.

The pic of the package still has your name/CC# on it…

@Colleen, not my details. That is a dummy card they put in there.