The Jet Airways co-branded credit cards were much looked forward to by me, because these are perhaps going to be the only Indian co-branded cards for a while ahead. I wrote about the Jet Airways HDFC Bank Credit Card about a month back.

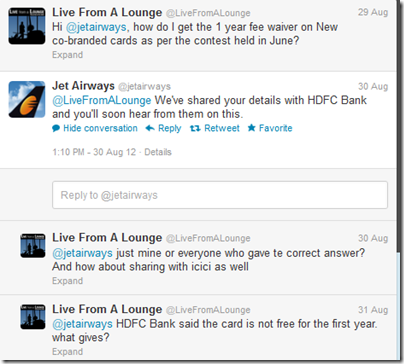

While I am not very impressed by the card and decided not to apply initially, to inform all of my readers about the “Wheel of Fortune” contest outcome, I tweeted to Jet Airways to ask what was the outcome going to be. Have a look at our exchange here:

Now Jet Airways passed on my details to HDFC Bank who subsequently called me, but claimed ignorance of the fee waiver. If you picked HDFC Bank as your answer and were promised the 1-year fee waiver, I would encourage you to pick up the phone and get across to JetPrivilege and enquire about how will Jet Airways make good the offer.

Tip 1: Get the HDFC Bank Jet Airways Credit Card for free for the 1st year if you have a Citibank credit card.

I already had the HDFC Bank World MasterCard, which comes to me free of cost. But when HDFC Bank called me, they enquired if I had a Citibank credit card. This would allow them to flip my existing card to the highest end JetPrivilege HDFC Bank World MasterCard, with a fee waiver of Rs. 2,499 (plus taxes) for the first year.This comes with all the bells and whistles and sign-on bonus (5K JPMiles on 1st Transaction, 5K JPMiles on spend within 90 days), the free one-way base fare waived ticket and a Rs. 750 discount code for a return ticket on Jet Airways.

The executives confirmed the same process for new applications as well. So, if you want an HDFC Bank Jet Privilege credit card free of cost, you just need to be holding a Citibank Credit Card. While there was no specific card variant asked for, I suspect HDFC Bank is trying to chase the same audience which perhaps holds the Citibank PremierMiles Card. I am not complaining, neither should you!

Tip 2: If you have an existing ICICI Bank Credit Card, you can switch to the ICICI Bank Jet Airways Card easily.

If you call up ICICI Bank to request a card upgrade/flip, you will usually get the answer that this is not possible and the bank is only sourcing applications for new credit cards at this moment. However, if you read out the riot act to them, i.e., “Get me a supervisor, I know I can switch to the new card”, this should do the trick. The sales teams are not up to speed with the product yet, and people inside ICICI Bank are hard at work to educate them about the right things.

If you are however expecting this card to come for free, then that is not the case. ICICI Bank is not giving out any discounts or fee waivers, except to Platinum members of JetPrivilege for their credit cards.

Remember, if you book the card by 30th September 2012, you get a 50 percent bonus on the sign-on miles coming your way, so act quick if you are interested.

I am still waiting for Jet Airways to tell me how do they intend to honour the “Wheel of Fortune” offer and I will come back to you if they come back to me with information.

Related Posts:

- Jet Airways ICICI Bank Credit Card is better than the Jet Airways HDFC Bank CC

- Details out about the new Jet Airways ICICI Bank card

- Jet Airways’ HDFC Bank co-branded credit card does not raise the bar!

- Sunday Plastic: Jet Privilege HDFC Bank World Credit Card

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

hi, how many master card annual lounge visits are free on the hdfc jet world credit card?

@AJ ,The thing that surprises me..why so much craze after JP miles..is nt it because we do not have any competing loyalty program.

@D Dasgupta, the only homegrown program left with some international flavour u see!

@AJ Thanks, can you also confirm if you got the voucher code (750/base fare waiver). HDFC tells me I am not eligible since I got a fee waiver 🙁

Not yet

Dear AJ

Applied for the HDFC world card online about 4 weeks ago.Rep came collected all papers,including photocopy of my CITI BANK, AMEX platinum travel card and my Jet privilage Platinum card.Refused the ITRs photocopies which I had kept ready and finaly after a 4 week wait, on checking up yesterday I was informed that my application was declined.Could not figure out the reason.

Any way as soon as I put the phone down ,I got a call from ICICI bank who promptly sent their rep collected the application for their twin card offering “AMEX and VISA”.They also took my ITR and hope fully I should get my cards this time.

I was eagerly waiting for the HDFC card to book return tickets for my wife and self to EWR the comming year by 9W and use my kitty of over 100000 jp miles and some upgrade vouchers to travel BIZ class.Any way I am now waiting for the ICICI card and if it is also declined ,I would book KLM using my PM CARD and probably use up the JP Miles for domestic travel.

AJ I now realise that you were correct ,when U had remarked in reference to the CITI 9W fight that 9W was the one in the wrong .I am particularly Cheezed off that 9W did not even give a list of its JP PLATINUM menbers to the two banks after the break up with CITI,and it hurts to think that this is the way they treat their loyal customers.THIS ALSO IS INDICATIVE OF A GENERAL CONFUSION ON PART OF 9W.SOME THING YOU MENTION IN ANOTHER ARTICLE REGARDING ETHIAD TIE UP.

As on date even if I dont take a single more flight ,I am qualified to retain PLATINUM TIER till JAN 2014.This having been achieved by paying higher fares on many flights just to travel 9W.

SO my message to JET AIRWAYS would be ,”If you want your loyalty program to be effective try to be equally loyal to your loyal members also or else you end up loosing them”.

@AJ Did you get the bonus JP Miles on converting your reward points to JP Miles? I was told by JP customer care that the bonus miles promo offer is only valid on purchase of JP Miles done on the jet website.

@Manish, when you move to co-branded cards, no transfer promotions are valid anymore since these are meant for non-cobranded cards usually. As it is there is no promotion on on transfer of JPMiles as of now. So no bonuses!

@AJ.. How to send a secure MSG?

Log into HDFCBank.com using your relationship number, look out for a Mailbox on the left hand side panel. send message !

@Manish, I think the link is only for new applications and not upgrades..

@Gaurav You can track your application online at http://www.hdfcbank.com/personal/credit_card/cc_track

@AJ Did you receive the jet vouchers promised with HDFC card? I called up the customer care and was told that I am not eligible for these vouchers since fee was waived for first year.

I submitted on 12th.. till date Call Centre have no idea about my documents.. 🙂

@Gaurav please contact your RM or send a secure message via HDFCBank.com after logging into your account. Usually, it would take a week for the new card number to be generated.

@D Mine took 7 working days after I submitted my documents for the card to arrive at home.

How long does it take to get the upgraded card..submitted my documents a week back..not heard back since then

@AJ Got my HDFC card today. wanted to know your opinion, is it worth spending 75K on Jet HDFC card to get additional 5000 JP miles? Or should I rather spend that on Citi PM card. I don’t necessarily fly Jet all the time.

@Manish, purely your call. I wouldn’t spend extra, but put my regular spend on this card for the first 75K. Inspite of how difficult it is to redeem them, I still do collect JP Miles. Spending 75K INR in 90 days should not be a challenge I presume, only 25K per month on this card!

Hey, sign up benefit is fine, but what about regular spends on cards with different banks? Doesn’t HDFC World card with 18 JP miles per 150 rupees spent give the best returns? ICICI Bank is giving 15 according to its site. Or am I missing something?

@Goyal, 18 JP Miles is only for booking Jet airways tickets via the website of 9w on the HDFC Card, and similarly ICICI 12 is for 9w spend. On regular spend, HDFC offers 6JPmiles/Rs. 150 spend (i.e., 1 mile/Rs. 25) whereas ICICI CC offers 7/100 Rs on domestic and 9/100 Rs. on international spend. So, better on all counts for ICICI, though more expensive card fees.

@AJ Do let me know if you get your card. Spoke to the HDFC guy again. He said income documents weren’t necessary but he is trying to up my credit limit and hence asked for new income documents. The other card I held was with me since 2004.

@Manish I got a limit hike without the income documents. The card is home now, so will check it out once I have it in my hands. I just hope they did not put a new query on my credit report.

@AJ My case was exactly same as yours (World MC to JP Card and Citibank card waiver offer) but the guy insisted on income documents. Any how documents are submitted, waiting for the card to arrive.

@Manish, my card is swapped and in the mail now. Lets see what is coming my way now!

@Manish, @D, not completely sure if all of that information is required. with me, the income proof was not required, only PAN card and proof of address. I also gave them a copy of my current credit card with Citibank to get a waiver on the first year fee. If there is a credit enquiry or not, I am not sure. Maybe for an ‘upgrade’ yes. But in my case, this is swapping a MC world for a co-branded MC world. But you never know…

@D I had the same problem, applied 3 times and each time was promised someone will call from an ‘upgrade’ department. Secure messaging is one option as AJ suggested. I tried that was informed that their system is not capable for taking an upgrade request. If you have a relationship manager at HDFC Bank, then call him up. He can help. Or else call up customer care every day until you hear back from the upgrade department. I did exactly that and now they sent my application for an upgrade. What I learnt during the process is that the upgrade is treated as a new request where they do a credit check etc once again. You will a different form though (upgrade form) but they need all documents (income proof, id, address etc). They can’t even assure you if you will retain your existing credit limit.

HDFC bank called me..but after hearing that I already hold a HDFC card..they said they would pass the lead to their ‘ upgrade’ department ..and eventually I did not get a call.

@D Dasgupta, please send them an email using the secure messaging system on hdfcbank.com, someone should call you back.

I got my icici plat card convrted to jp card.

@AJ Another newbie question: Will the 10K miles on HDFC Jet Card also attract the JP miles bonus offer or that won’t qualify?

@Manish, once you move to a JP card, all your miles will be directly sweeped into your JP accuont once every month. so, you cannot time your transfers. hence, no bonus

@AJ oops! I did read that post and just connected the dots 😉 This card I hardly use and I wasn’t aware they allow JP miles redemption on it since its not mentioned in the catalogue.

@AJ Also if I choose the JP Miles route, will it qualify for 40% bonus miles?

@AJ haha! yea hopefully it should unless they call my bluff :p. I have another problem with the upgrade and I am not sure what the best option is. I have 26000 reward points on my HDFC world card and in the upgrade I can convert them to 11305 JP Miles (2.3 points = 1 JP mile). The conversion ratio sucks. However all the other awards in the HDFC limited catalogue offer items worth 8K INR only. Do you think JP Miles is the best option? Or redeem for other rewards?

@Manish, you mean to say you did not read the blog a few months back? I strongly advised all the reward point collectors to move to JP when there was a 40% bonus on. I made a killing on that (got some 10000 JPM extra). Ratio sucks, agree, but that is the way it is. Look around, on all programs you’ll find JP Miles to be expensive. It is totally upon you to take it or leave it. 🙂

Personally, ever since I started collected miles, I can’t justify redeeming reward points for a tacky watch or something anymore.

@AJ I was thinking the same but if you notice they now have a 499 fee on World card. I am afraid if I switch back, they will start charging this fee. What are your thoughts?

@Manish, did not think of that. but the cancellation call should help 😉

@AJ HDFC bank has some weird policy that they won’t allow customers to hold two cards. I already have an HDFC world master card but would like to take the Jet Card as an additional card for a simple reason that I may cancel the card after few months and don’t want to go through the hassle of getting my original card back. How did you go about the process when you already had an HDFC card?

@manish, I also had the HDFC World MasterCard but for me I flipped it to the HDFC/Jet World MasterCard with a first year fee waiver. after that, we’ll see. At least, I will earn some miles v/s not earning any miles at all 😉 But if you want your original MC back, you can always call and tell them you don’t like the features of this card and hence you should be switched back to the original card.

I think ICICI offer is better if you apply until Sept 30. Remember HDFC offer has a catch that you need to spend 75K within 60 days to claim 5000 JP Miles. No such condition on ICICI card. If only you can have the patience to deal with their customer service 🙂

@AJ,

Which offer is better now ..HDFC or ICICI .Cant decide.

Your thoughts..

@D Dasgupta, personally, I would go for both, but then thats me. I think the ICICI offer is better but more expensive as well:

a) you get 15k miles on the top end for 5000 INR (3 miles per Re 1), compared to 10K miles for 2500 INR +75K INR in spend (4 miles per Re 1).

b) earning on ICICI is going to be way more easier than on HDFC. But it comes with the cap of 60K miles.