I somehow do hate it when various companies do not give full disclosure on their products. The flavour of the season has been the Air India SBI Credit Card, where the issuing company took a lot of time to come out with the first set of cards. Check out my post a few weeks back, where I discussed the launch of the card, which is also now being used by SBICards as a customer problem resolution centre of sorts with stock replies!

Now a couple of things I could not find out on the website, or I was not informed about when I was signing up for the credit card.

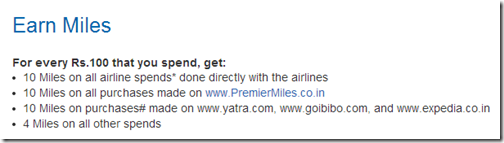

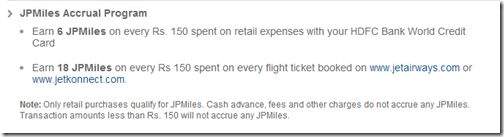

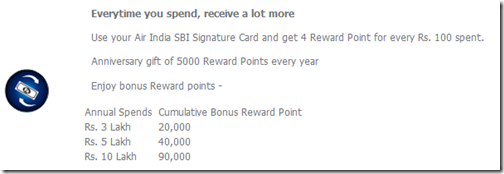

First and foremost, when a credit card company states that it is awarding an x number of miles for Rs. 100 of spend, it means to say that miles are awarded on a pro-rated basis, unless it is like HDFC Bank, which clearly states all transactions under Rs. 150 on the JetPrivilege HDFC Bank CC will not be considered for award transactions. See a few snapshots from various banks:

Citibank: Pro-rata miles are awarded on all transactions, i.e., spend of Rs. 50 would get me 2 PremierMiles.

HDFC Bank: No miles for spend under Rs. 150, but pro-rata above that. However, they make it upfront.

But SBI Cards takes the cake, with rounding down every transaction to the Rs. 100 below it, without even declaring it openly.

On questioning why I got less miles as compared to my own computation, this is the email response I got from them.

We wish to inform you that the reward points are provided to the customer only on the that part of the transaction amount which is in multiplier of Rs. 100 and there is no reward point facility available on the part of transaction amount which is less that Rs. 100.

Now, I don’t mind 1 or 2 or 5 miles lost in a month. But hey, when I make 50 transactions in a month and they will take down a few miles from each one of them, there is a problem of plenty of miles going missing.

Usually, on a co-branded credit card, the miles earned are automatically sweeped into the mileage program as per a pre-defined cycle. SBI Cards, however, wants to offer us a choice of partnerships apparently, and hence decided not to sweep the miles automatically. Which means, between the date of requesting a transfer to actually receiving it, you can wait for a few days. But more than that, they will charge you Rs. 99 plus taxes to activate the transaction for you. And this is hidden somewhere in the fineprint.

11.4.3 A fee of Rs 99/- plus GST will be debited to the card account per redemption request towards delivery and processing charges. The same will be charged to the Cardholder in his/her monthly statement.

Ah, well, the creative traps they come up with are surprising me at the moment. But maybe I should stop being surprised!

Related Posts:

- The SBI Air India Signature Card adds an upgrade voucher!

- My botched up experience applying for the SBI AI Card

- Credit Card Review: Air India SBI Visa Signature

Live From A Lounge is present on Facebook, Twitter & available via email, RSS.

Air India just hiked its miles redemptions and has almost DOUBLED them. DEL-LHR-DEL which was earlier 50,000 miles is now 90,000 miles. This card is effectively useless.

Hi AJ,

I am Etihad Gold but Flying Return ‘Base ‘ member.I wanted to take advantage of AI SBI Status match. I have spent around Rs 3 Lakhs so far on AI SBI card.However I realised that if I apply for Status match now, I will get upgraded to Gold with 2 upgrade vouchers. Instead if I wait on and first get silver status by spending Rs 5 Lakhs, I will be getting 1 upgrade voucher due to silver status and then get a status match to Gold for 2 more vouchers. This means I will have an extra Upgrade voucher. Is my understanding correct?

@Krishnakumar, theoretically you are correct however you are banking your hopes on Air India kits arriving in time, which is a mess.

This Card is the Worst card I have ever used. Their call center has worst service. They will ask you 5-8 questions to verify your identify, including your mother’s name. Points are not automatically transferred to Flying returns accounts, it can be done in multiples of 10000 only.

I am going to surrender this card very soon, but i also want to visit their office and register my dissatisfaction.

I have gone through your extensive review on how to earn miles from

credit cards and there are a few more questions i have in order to

pinpoint that 1 final card I want to have.

1. Can I book for my family on the same card?

2. when I have to redeem my miles, can I redeem for my family as

well on my membership card or do I Have to take separate membership

for them? If separate membership is required then can the miles be

transferred to family members from my credit card?

3. Lounge access as mentioned in different cards, is it available for

my family members as well if travelling with me or is it purely for

me?

4. when I redeem miles for a ticket say on Jet airways or Air india

or a partner

airline, does that redeemed ticket earn JP miles as well?

5. There are cards which give great incentives for booking with their

specific airline. for instance Air india is giving 20 points for every

100 on booking air india ticket or similar case is in jet airways

which is giving 16 points per 150 for booking jet airways. Now is this

limited to these specific airlines only or is the same mileage

applicable if partner airline is booked?

@Rajesh you can book for your family using the same credit card. You can redeem for your miles using your own membership itself. when you redeem miles you don’t earn miles on that redeemed ticket. Cards which offer great incentives for specific airline, only offer it basically if those airlines are the issuing carriers of tickets (can include other airlines as well, as long as purchased with AI or 9W)

Hi Ajay

thank you for your reply.

first i will give you my conclusions that i have drawn from your research and my research

1. For someone travelling AIR India, SBI signature card is the best

2. for someone travelling Jet airways, Amex platinum credit card is the best

3. for someone who travels various airlines, citi card premier miles is the best

Now SBI has added a new googly to the card,

rewards can be converted to miles only once 10000 of them get accumulated. secondly redemption can be done in lots of 5000. now is that supposed to mean that if i need say 11000 miles for a flight then I have to give up 15000 miles?

citibank says that transfer miles to airline partners in 2:1 ratio. is there any benefit in doing that?

and what is your suggestion, should I enrol myself in frequent flyer programmes of different airlines and then book tickets using my air miles card to get double benefit?

Rajesh

@Rajesh, if you need 11K miles, you can transfer 15k miles and the rest of the 5k stay in your AI account for your next redemption. Citibank’s 2:1 transfer means 2 Citi PM = 1 Airline mile.

Hi Vivek,

Thanks for your update.

I was about to go for the SBI AI Signature card but i won’t now.

Also, i do not know about Vinod and Ajay, but even if you are told about everything, Still the process of giving rewards for loyalty on so many conditions seems like a sham (so much time and tension is not worth the money you save).

Thanks again Vivek

Dear Vivek

I have been using the Credit card for last few months. All the conditions are clearly given in the brochure. Maybe you have not understood the full procedure to activate your Air India Account and then transfer the miles. I had a very smooth experience and all points were given as promised. In fact I have been using ICICI & HDFC cards from lat many years, but SBI Card credits the points upfront even before the bill is paid which is really great. Also if you use it for about 2,00,000 worth of Air India Tickets you can get back vouchers worth almost Rs.15000- easily. So it all depends on your awareness and usage. Friends this is an excellent card and with unmatched value if you are a frequent traveler on Air India. Don’t even have a second though and just take it provided your Annual expenditure on Air India is definitely above one lakh.

Dear Ajay,

Might be your experience was not that bad because you must be aware of all these challenges.

But in my case nothing was informed to me while selling this card.

I tried many different dates for many different locations but failed to find seats more than 2.

That means,if I have a family of 4 then I can only book the ticket for 2 only.

I request you to check the Dharamshala ticket from Delhi for the entire year. There is no seats available.

Same is the case with Lucknow as well from Delhi.

My only point is that SBI should have informed all this information to the customers before.

No one can assume by their own that every customer knows everything about their T & C’s

It is seriously a pain to keep on following up with customer care people and explaining the issue everytime.

Still, I will say that this card is the worst ever card I have in my wallet.

SBI AIR INDIA SIGNATURE / PLATINUM Credit Cards are a big time pain for you. I would suggest no one to buy it. I am toggling between SBI and AIR INDIA from last 2 months.

Please read the entire story:-

I bought SBI AIR INDIA Signature Card 3 months before by a SBI executive who committed me that I will get 20000 points immediately after the issuance of this card to me.

I gave all my documents and after 15 days got this card but unfortunately I was unable to find any 20000 points available online on their website.

I called the SBI customer care and get to know that 20000 points will be credited only once I pay the first month credit card bill which will include the 5000 Rs. fees of this card.

I waited for my first credit card bill and paid it immediately and waited for one week to get 20000 points but didn’t find anything in my online SBI account.

I called the customer care and they told me that after paying the first month credit card bill, it takes 28 days to get 20000 points.

After many follow ups, I got 20000 points after 28 days then I tried to find the procedure to use these points to book the flight for myself but nothing is mentioned over there.

I called the customer care again and then, they told me that you have to request to trasnfer of your points to miles after which only you will be able to book the flight and this procedure will take 7 more days.

I gave the request to transfer my entire points into miles and then waited for 7 days to get them credited.

I called the SBI customer care to help me booking the ticket with these points but they asked me to call Air India customer care.

I asked the Air India customer care number but they told me to find it on internet.

After getting the number from internet, I called the Air India customer care and they told me that in their records there is no information about my account like, my name, email id , ph. no which should be provided by SBI.

I ask Air India customer care to update all the personal details for myself but they denied by saying that only SBI customer care can help me on this case.

Through internet, I found the email id of the GM of Air India and SBI.

SBI GM didn’t find appropriate to reply to my multiple emails but Air India GM was kind to reply my issue.

I asked Air India GM that how can I book my ticket using the miles and he told me that it is only possible after you travel from Air India once by paying for the ticket.

I told him that all this information was not provided to me at the time of purchase of this credit card but he was helpless with terms and conditions.

However, after many requests and escalations my account got activated finally.

Then, I tried to book the ticket for December month which was sixth month after the current date but I found that only 1 seat was showing as available for booking.

I checked other websites and found that sufficient tickets are available.

I called the Air India customer care again and they told me that there are maximum 2 seats available for the redemptions for any Air India tickets.

Then I tried to book one ticket for Dharamshala for the next year but surprisingly I found that there is no ticket for Dharamshala.

I again called the Air India customer care and they told that there are specific locations only to which you can book the ticket by using your miles.

It was very frustraing and I started reading their brochure but nothing was mentioned like this.

I also found a complimentary upgrade voucher in the kit which was received with this card.

I gave that to my father and called Air India customer care for the procedure to upgrade any existing ticket.

They told me that you have to provide this upgrade voucher at the time of check in and if seat will be available then it will be provided to you.

I hope you can sense that what would have happenned after reading my entire story. My father gave that upgrade voucher at the check in counter.

Firstly, they told him that this voucher is not valid. But, when my father talked to their supervisor about that issue. He told him, that we cannot upgrade your ticket because there is no seat available in the executive class.

It is very frustrating card to buy. SBI have also mentioned that 20000 points will again be credited in the account if we do a purchase of 3 lakh ruppes.

But that is also not true, there is bitter most story behind it as well.

It’s my suggestion to all, not to but at least this card because it is a waste of money, time & energy.

I am planning to file a fraud case against SBI. If someone wants to help or want to be a part of my fight then please mail me.

@Vivek, unfortunately the understanding is all wrong here. I’ve dealt with Air India and the credit card team, and while the processes are a little longer/flawed, all this information is exactly as per how they state it on their website. no credit card issuer gives you the freebies till you pay the fees. I have seen all the points come in after the milestones were met at signup, INR 3 L, INR 5 L as well. Yes, you need to transfer points to Air India’s program to make them miles and then use them. And as non-availability goes, well, I’ve stated this in the past… not all seats on a plane are available to the frequent flyer program. In this case, you should have checked a different date. As for the voucher upgrade, I know of other people who’ve seen success in using their vouchers, so if there was no business class seat available, it is not possible to create one more to get you the upgrade, right?

Does anyone know how long SBI card takes to transfer reward points to Air India? I made a request over a month ago and I am still waiting! I wonder why this cannot be done by the card holder on the SBI card website.

@UM It takes anywhere between 2 days or even a month like you’re experiencing unfortunately. Their stated time is 7 working days.

No fees is charged for transfer. SBi confirmed the same. I did my transfer at no cost.

A fee of Rs 99/- plus GST is not being charged as I had redeemed 3 times and there was no charge on my card.

Given my dad’s experience with SBI Cards, I’m not surprised even a wee bit! I’ll not be surprised if some new fine print on insurance also starts coming up! Or starts appearing in the statement (as Citibank used to do earlier for unsuspecting customers while filling the form! ) For all I know it may be good that I didn’t even get the card. Must be some silver lining in the cloud I guess.

These people are behind the curve and nothing shows that than by charging for transfer on a co-branded card. incompetence or moneygrab. either way, don’t care for them.

Wow, did not see this coming!

Wonder who’s the creative brain behind this – AI’s own bean counters or GE cards.