Arguably the biggest news of the year in the loyalty program world is the integration of Marriott and Starwood’s loyalty programs. We’re talking about two popular loyalty programs being combined, with over 100 million members.

What makes this especially challenging is that the programs are merging mid-year, creating even more confusion for members.

While we’ve seen quite a few loyalty program mergers over the years, this is easily the most complex we’ve seen, and I get more questions about this than anything else. So I wanted to create a thorough guide that answers virtually any question you could have about the new program. My intent is to keep this post up to date as time goes on, so that it can be a useful resource going forward.

Obviously this post is really long, so bookmark this page, then feel free to skip around to the sections that matter most to you using the table of contents below.

In this post:

Marriott & SPG program overview

As I mentioned above, the combined program is complicated. The nuances of elite recognition, earning and redeeming points, and outside partnerships all have to be addressed, with most being a change for either former SPG or Marriott members (and sometimes both).

Here’s everything you need to know about the Marriott merger, including how best to prepare and maximize your points ahead of time.

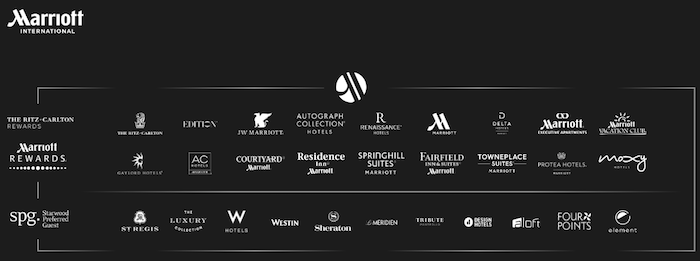

Hotel brands under the combined umbrella

Now that Marriott’s takeover of Starwood is complete, the “new” Marriott has 30(ish) brands. As consumers we still have two different experiences, as we have the choice of being loyal to Starwood’s roughly dozen brands, or otherwise being loyal to Marriott’s brands, which represent the balance. At least that’s the case until the loyalty programs are formally integrated.

These ~30 brands will eventually have to function in harmony, even though in reality they’re all competing with one another.

When airlines merge, all planes are eventually used interchangeably. The planes go from competing with one another to complementing one another. Meanwhile hotels are individually owned, and continue to remain competitors with one another, often unhappy when mergers happen, since it means they have more direct competitors and less that makes them unique.

With that in mind, Marriott is really having to grasp at straws to market individual hotels differently. That’s why I was interested to find Marriott’s current “brands” page, which shows all 31 brands of the combined Marriott and Starwood.

The brands are broken up into the categories of “Luxury,” “Premium,” “Select,” and “Longer Stays,” and within each category they’re further broken up into “Classic” and “Distinctive.”

Categorization | Brands |

|---|---|

Classic Luxury | The Ritz-Carlton St. Regis JW Marriott |

Distinctive Luxury | Ritz-Carlton Reserve The Luxury Collection BULGARI W Hotels EDITION |

Classic Premium | Marriott Hotels Sheraton Marriott Vacation Club Delta |

Distinctive Premium | Le Meridien Westin Autograph Collection Design Hotels Renaissance Hotels Tribute Portfolio Gaylord Hotels |

Classic Select | Courtyard Hotels Four Points SpringHill Suites Protea Hotels Fairfield Inn & Suites |

Distinctive Select | AC Hotels Aloft Hotels Moxy Hotels |

Classic Longer Stays | Marriott Executive Apartments Residence Inn TownPlace Suites |

Distinctive Longer Stays | element |

There’s nothing terribly surprising here, though I guess what I find interesting is that they break down each category by “classic” and “distinctive.” In many cases it seems that by “classic” they mean “brands without an identity,” though that’s not true across the board.

Still, when you really look at all of these brands side-by-side, you realize how much overlap there is between the two groups…

Merger details

Marriott will be forming a unified loyalty program as of Saturday, August 18, 2018. The Saturday transition makes sense, as it will minimize the impact it has on members.

As you might expect, migrating systems for a program with over 100 million members will be no small project. As they explained to me, this will be a technically challenging day, which is probably an understatement.

We can expect that starting in the morning on, August 18 Marriott websites will be down for several hours. Then we can expect that for most of the day the loyalty systems will be down, so it won’t be possible to redeem points, attach numbers to reservations, etc. So they ask for everyone’s patience, which is fair enough.

Phone agents won’t be able to book awards during that period either, so don’t expect to be able to redeem points at the new rates until late in the day on the 18th, at the earliest.

When this happens, members should see that all of their points automatically transfer from Starwood Preferred Guest to Marriott Rewards at a 1:3 ratio. Furthermore, those who haven’t yet linked accounts or signed up for a Marriott account will receive a new nine digit account number. This account number should be emailed to members, and will also appear when trying to log into your account with your old member number.

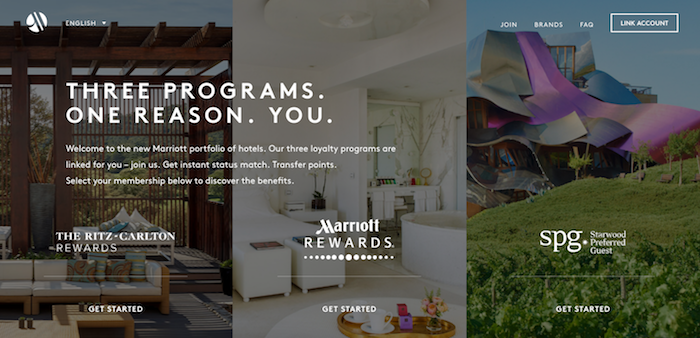

Linking accounts

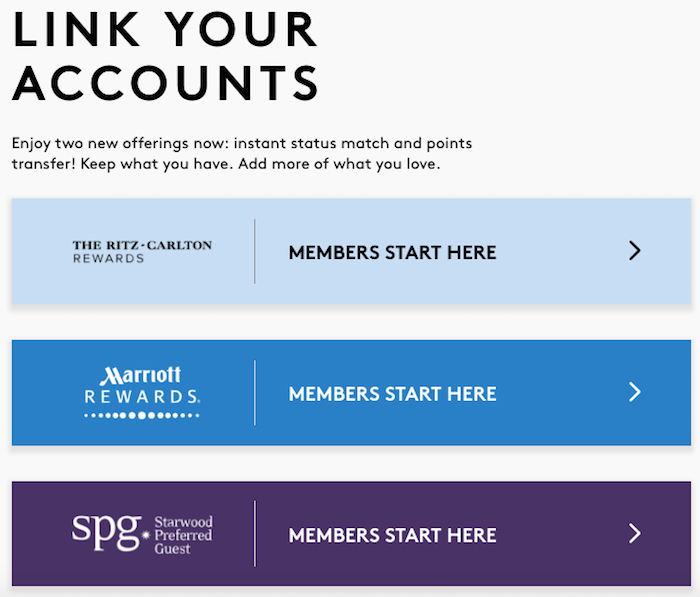

While all accounts will be combined on August 18th, you can link and move points between accounts already.

To do so, first you’ll need to visit the Marriott Member page and click “Link Account” at the top right of the page.

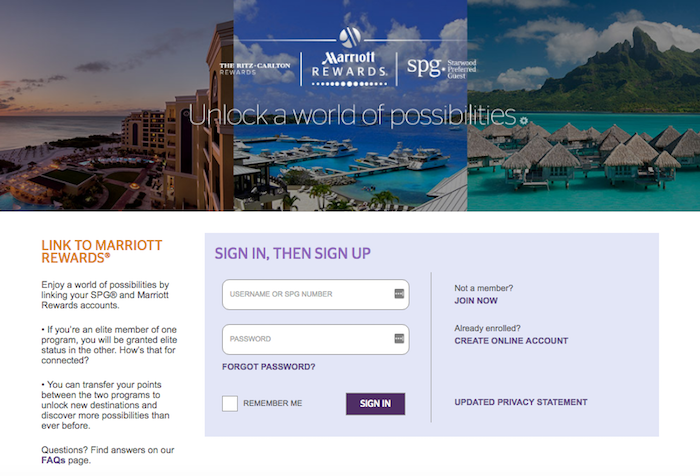

Once there, you’ll be prompted to choose the program from which you want to start (presumably the program with which you have the highest status and are looking to match). In my case, that would be SPG.

Since I selected SPG as my program, on the next page I was prompted to enter my SPG username and password.

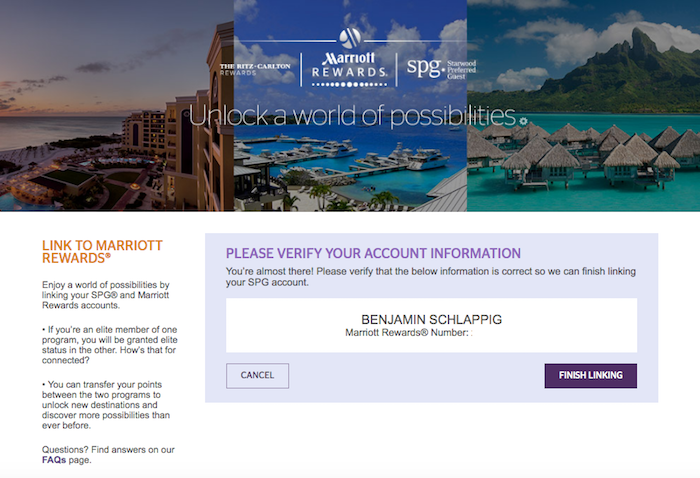

On the next page I was given the option of linking to either Marriott Rewards or Ritz-Carlton Rewards. Keep in mind that you can only be a member of one program or the other, so you can’t match to both Marriott and Ritz-Carlton Rewards.

I chose to link to Marriott Rewards. Amazingly enough the next page already had my Marriott Rewards information pre-populated, even though I didn’t do anything to link it. I guess they matched the name, email address, mailing address, etc. Impressive! I then clicked “Finish Linking.”

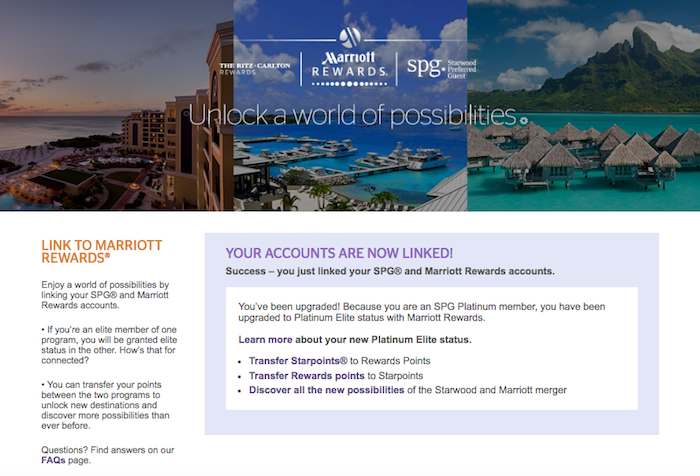

The next page confirmed that I had been upgraded to Marriott Platinum on account of my SPG Platinum status.

Sure enough, when I logged into my Marriott Rewards account it confirmed that I’m already a Platinum member. Dang, that was fast!

You don’t have to have elite status in either program to link your accounts, and once you’ve done so you’ll be able to transfer points freely, as I’ll get into below.

Status matching

One major point of confusion has been regarding who gets Marriott Platinum status this August.

For example, Marriott has stated that Marriott Gold members receive Marriott Platinum status, while Starwood Gold members receive Marriott Gold status.

However, since Starwood Gold converts into Marriott Gold, how exactly does that work?

There’s an update there. Nights earned will determine status in the new program, but not linking SPG and Marriott accounts.

This means that SPG Gold members who earned Marriott Gold from linking accounts will not receive Marriott Platinum status come August. However, United RewardsPlus members would earn Marriott Platinum status, since they didn’t earn the status by linking their SPG account.

Transferring points between programs

You first need to link your accounts, which can be done as explained above. Once you’ve done that, you can transfer points either through the same site as above, or you can use the Marriott or Starwood websites directly.

Using the SPG site as an example, you can click on “Redeem Points” and will then see “More Options,” which specifically mentions the possibility of transferring points to Marriott Rewards.

On the next page you’ll see “Access More Possibilities Worldwide,” which is what you’d want to click.

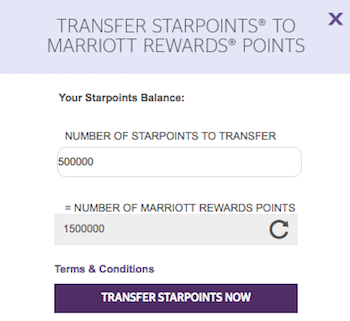

The next page gives you the option to transfer points between programs, and as you can see, the 1:3 transfer ratio automatically auto-populates. Since your accounts are linked, you just need to click “Transfer Starpoints Now.”

It’s worth noting that points transfers aren’t instant, but rather take a few hours.

How points will be combined

If you don’t transfer points manually, they will be automatically combined at some point on August 18th.

Either way, one SPG Starpoint will become three Marriott or Ritz-Carlton Rewards points.

Elite program

Like other hotel chains, the new Marriott Rewards incentivizes hotel guests based on how frequently they stay with affiliated properties. Brand loyalty is rewarded with enhanced points earning, and increasingly valuable perks based on the number of nights you stay each year.

Elite night credits accumulate during the calendar year, so you have until December 31st to earn a given status. You then receive the benefits for the year you earn the status, and the entire following year. If you don’t re-qualify during that year, your status expires on January 31st of the next year.

Now, let’s get into the various elite tiers.

Elite tiers

The combined Marriott Rewards program will have five elite tiers, with credits being awarded based on nights, not stays. All elites receive access to a dedicated reservation line, though my experiences with Marriott’s call center have not been great in the past, so I wouldn’t get too excited there.

Silver Elite

Qualification: 10 nights

Benefits:

- 10% Bonus Points on Stays

- Priority Late Checkout (though not with a guaranteed time)

Gold Elite

Qualification: 25 nights

Benefits:

- 25% Bonus Points on Stays

- 2 p.m. Late Checkout (Based on Availability)

- Complimentary Enhanced In-Room Internet Access

- Gold Welcome Gift of Points (250/500 Points, Varies by Brand)

- Enhanced Room Upgrade (Based on Availability)

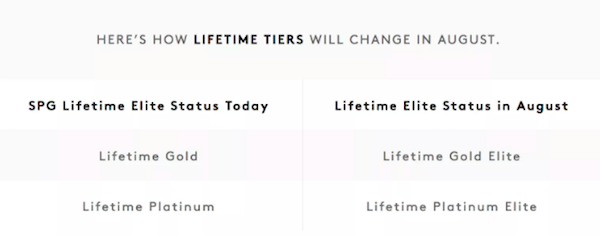

Platinum Elite

Qualification: 50 nights

Benefits:

- 50% Bonus Points on Stays

- Enhanced Room Upgrade, Including Select Suites (Based on Availability)

- Lounge Access (with Breakfast — at JW Marriott®, Marriott Hotels, Delta Hotels by Marriott™, Autograph Collection® Hotels, Renaissance®Hotels, Sheraton®, Westin®, Le Meridien®); Excludes Resorts

- 4 p.m. Late Checkout

- Annual Gift Choice (5 Suite Night Awards or Gift Option)

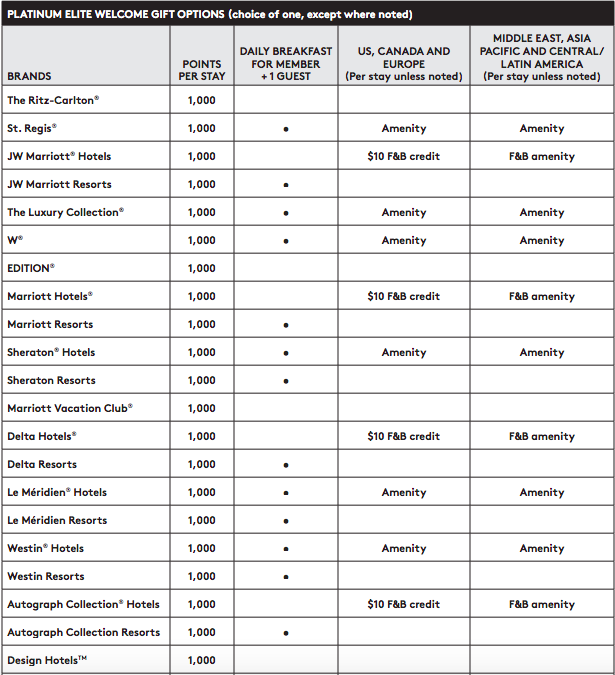

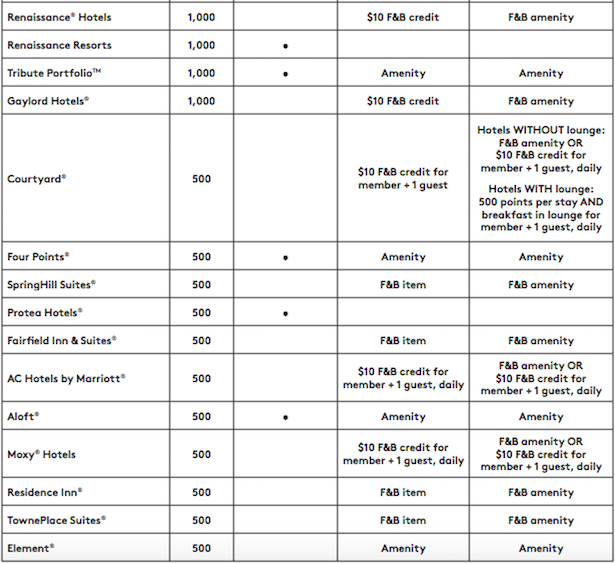

- Platinum Welcome Gift (Choice of 500/1,000 Points, Breakfast Offering or Amenity, Varies by Brand)

Platinum Premier Elite

Qualification: 75 nights

Benefits:

- 75% Bonus Points on Stays

- Enhanced Room Upgrade, Including Select Suites (Based on Availability)

- Lounge Access (with Breakfast — at JW Marriott®, Marriott Hotels, Delta Hotels by Marriott™, Autograph Collection® Hotels, Renaissance®Hotels, Sheraton®, Westin®, Le Meridien®); Excludes Resorts

- 4 p.m. Late Checkout

- 48-Hour Guarantee

- An additional Annual Gift Choice (5 Suite Night Awards or Gift Option)

- Platinum Welcome Gift (Choice of 500/1,000 Points, Breakfast Offering or Amenity, Varies by Brand)

Platinum Premier Elite with ambassador

Qualification: 100 nights and $20,000 of spend at Marriott/SPG properties

Benefits: If you meet the ambassador qualifications, you’ll receive all the Platinum Premier Elite benefits, along with the following:

- Ambassador service — Your point person every time you stay. Your ambassador has the knowledge and resources to make your stays as personal and enjoyable as possible.

- Your24™ — have the flexibility to choose your check-in and checkout time

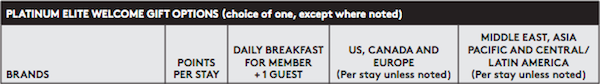

Marriott’s new Platinum welcome amenities

All things considered the new Platinum amenities seem fair to me, though it sure is complicated, which is my biggest complaint about the new Marriott program.

When defining Platinum amenities they break the world into two regions, and break hotels down into 38 different groups. That means there are 76 different Platinum welcome amenity policies. Is that really necessary?!

This just reinforces my main frustration with the new program — could this be any more complicated?! Even if I spend 100+ nights per year with Marriott family properties, I don’t think I’ll ever be able to remember this system.

Platinum breakfast benefits

The breakfast situation is one of the biggest disappointments of Marriott’s new program. Rather than taking the opportunity to streamline the program and include a competitive breakfast benefit, Marriott has stuck with a complex and limited breakfast program. It’s telling that we need a separate section for this, especially when compared to the old SPG Platinum breakfast policy.

High-level, the approach Marriott seems to be taking is that Platinum elites and upget lounge access, where there should be breakfast. But two-thirds of Marriott’s brands don’t offer lounge access, including resort properties, so that’s hardly a comprehensive approach.

Instead, each brand will have slightly different rules (and each of those rules will have exceptions).

Here’s a more detailed overview of the new elite breakfast policies, and then we’ll go through the exceptions.

Categorization | Breakfast Benefit by Brand |

|---|---|

Classic Luxury | The Ritz-Carlton No elite breakfast benefit St. Regis Platinum members can choose daily breakfast for themselves and one guest as a welcome gift JW Marriott Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge* JW Marriott Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift |

Distinctive Luxury | Ritz-Carlton Reserve No elite breakfast benefit The Luxury Collection Platinum members can choose daily breakfast for themselves and one guest as a welcome gift W Hotels Platinum members can choose daily breakfast for themselves and one guest as a welcome gift EDITION No elite breakfast benefit |

Classic Premium | Marriott Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge* Marriott Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift Sheraton Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members can choose daily breakfast for themselves and one guest as a welcome gift Sheraton Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift Marriott Vacation Club No elite breakfast benefit Delta Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region Delta Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift |

Distinctive Premium | Le Meridien Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members can choose daily breakfast for themselves and one guest as a welcome gift Le Meridien Resorts Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members will receive daily breakfast for themselves and one guest as a welcome gift Westin Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members can choose daily breakfast for themselves and one guest as a welcome gift Westin Resorts Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members will receive daily breakfast for themselves and one guest as a welcome gift Autograph Collection Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region Autograph Collection Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift Design Hotels No elite breakfast benefit Renaissance Hotels Platinum members enjoy free continental breakfast for two in the concierge lounge*, or Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region Renaissance Resorts Platinum members receive daily breakfast for themselves and one guest as their welcome gift Tribute Portfolio Platinum members can choose daily breakfast for themselves and one guest as a welcome gift Gaylord Hotels No elite breakfast benefit, though Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region |

Classic Select | Courtyard Hotels No elite breakfast benefit for non-lounge properties, though Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region Four Points Platinum members can choose daily breakfast for themselves and one guest as a welcome gift SpringHill Suites All guests receive complimentary breakfast Protea Hotels Platinum members receive daily breakfast for themselves and one guest as their welcome gift Fairfield Inn & Suites All guests receive complimentary breakfast |

Distinctive Select | AC Hotels No elite breakfast benefit, though Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region Aloft Hotels Platinum members can choose daily breakfast for themselves and one guest as a welcome gift Moxy Hotels No elite breakfast benefit, though Platinum members may be able to choose either a Food & Beverage credit or amenity based on geographic region |

Classic Longer Stays | Residence Inn All guests receive complimentary breakfast TownPlace Suites No elite breakfast benefit, though Platinum members may be able to choose either a Food & Beverage item or amenity based on geographic region |

Distinctive Longer Stays | element All guests receive complimentary breakfast |

As if this wasn’t confusing enough, there are some important caveats.

Closed or non-existent lounges in the US & Canada

At brands that are supposed to provide lounges, but where the lounge is closed, Platinum elites will receive a choice of continental breakfast for two in the hotel restaurant or 750 Rewards points.

This excludes resorts, along with the following properties:

- The Algonquin Hotel Times Square, Autograph Collection

- Boston Marriott Copley Place

- Boston Marriott Long Wharf

- Chicago Marriott Downtown Magnificent Mile

- JW Marriott Essex House, New York City

- JW Marriott New Orleans

- JW San Francisco Union Square

- JW Marriott Washington, DC

- The Lexington New York City, Autograph Collection

- Monterey Marriott

- New York Marriott Marquis

- Philadelphia Marriott Downtown

- Renaissance Boston Waterfront Hotel

- Renaissance Los Angeles Airport Hotel

- Renaissance New York Hotel 57

- Renaissance New York Midtown Hotel

- Renaissance New York Times Square

- Renaissance Washington, DC Downtown Hotel

- San Diego Marriott Marquis and Marina

At the above properties you will at least get 1,000 points if the lounge is closed, if that’s any consolation.

Marriott’s documentation is unclear as to what happens if a given property doesn’t have a lounge at all — we’ll update if that’s clarified.

Closed or non-existent lounges in Europe

For brands in Europe that are supposed to provide lounges, but don’t have lounges at all, Platinum elites will receive a choice of continental breakfast for two in the hotel restaurant or 750 Rewards points.

Marriott’s documentation is unclear as to what happens if a given property has a lounge that is closed for whatever reason — we’ll update if that’s clarified.

Closed or non-existent lounges Worldwide

Marriott hasn’t provided guidance as to what will happen breakfast-wise at hotels outside these two regions. We have limited data points, and it will likely vary by property, but my guess is that worst-case, Platinum’s will be able to use their welcome amenity as a breakfast credit of some sort. When Tiffany stayed at the Marriott in Jordan, as an example, the hotel offered the full breakfast buffet to all Platinum guests.

Once again, if Marriott provides more details we’ll update this section.

Courtyard hotels

Courtyard is Marriott’s largest brand, with over 1,000 hotels around the world. When the details of Marriott’s new loyalty program were first announced in April, one of the positive developments was that Marriott was expanding free elite breakfast to more brands. Specifically, breakfast was supposed to be expanded to Courtyards and to resorts, meaning that the only brands that wouldn’t offer free breakfast are EDITION, Gaylord, Ritz-Carlton, Marriott Executive Apartments, and Marriott Vacation Club.

The breakfast chart, however, tells a different story:

I reached out to Marriott to ask if the chart listing Courtyards as not receiving complimentary breakfast was an oversight, and here’s the response I received:

The amenity can be used for breakfast at the Courtyard Bistro, however, we wanted to make it more flexible for members. If they choose, they may use it for any F&B offered at Courtyard hotels. For example, members may opt to use it for the evening happy hour.

I followed up again to ask if the credit at US, Canada, and Europe properties was really only once per stay, and they indicated that the chart was incorrect, and that they’re working on updating it. That means that at all Courtyard properties around the world you should have the option of selecting a $10 food & beverage credit per person per day.

The issue is still that a $10 per person credit won’t cover breakfast at most properties. For example, the Courtyard Los Angeles Westside charges $18.95 per person for breakfast. This is ultimately an improvement over their old policy, but still not good.

Late checkout

Marriott Platinum members in the new program will receive guaranteed 4 p.m. check-out, except at resorts, where it’s subject to availability. This is great news, and follows the precedent set by Starwood.

Gold members will receive 2 p.m. late check-out, but it will be subject to availability, so that can be denied by the hotel. Then Silver members will receive preferential late check-out, and the interpretation of that is up to the individual hotel.

Your24

Your24 is a benefit that Starwood has offered to those who earned at least 75 elite nights per year. With the new program, Your24 will be limited to those who earn Ambassador status, which requires 100 nights plus $20,000 in eligible spend per year to earn.

For those members, Your24 will continue to be available. With this, eligible members can choose any 24 hour period in which they want to check-in and check-out. The catch is that this is subject to availability, and the hotel will confirm this at most a couple of days in advance.

Personally I’ve found this feature to be of limited use, given the lack of confirmability in advance, which is valuable for these kinds of stays.

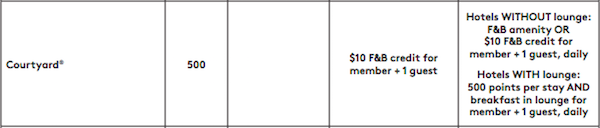

Lifetime status

Under the new program, Marriott lifetime status can be earned at the following thresholds:

Here’s how existing Starwood Preferred Guest lifetime status converts over:

Here’s how existing Marriott Rewards lifetime status converts over:

In 2018 there’s also an opportunity to earn lifetime Platinum Premier status, which won’t be available in the future. Members who have reached 750 nights and ten years of Platinum status by the end of this year will qualify for Platinum Premier, and there will be no opportunities to earn lifetime Platinum Premier in the future.

Other loyalty perks

While most of the best perks kick in if you have status with Marriott, there are some benefits that you get just for being a member. For example, all members who directly through Marriott receive free Wi-Fi for their stay.

Furthermore, being a member of the loyalty program gives you access to Member Exclusive rates, which can offer savings of 5-10%, depending on the type of rate you book.

Upgrades

Complimentary & Elite upgrades

One of the biggest questions that both Marriott and Starwood loyalists had was whether the new program would offer suite upgrades as a benefit:

- At Starwood Preferred Guest, Platinum members are entitled to be upgraded to the best available room, including standard suites

- At Marriott Rewards, Platinum members are entitled to be upgraded, and that upgrade may include standard suites

That’s a subtle but important distinction. At Starwood you’re “entitled” to a suite upgrade subject to availability, while with Marriott you can be upgraded to a suite at the hotel’s discretion.

In other words, with Marriott a hotel can upgrade you to a suite if they want to, but they can also upgrade you to another type of room if they want to.

Marriott’s new policy will (maybe not) mirror Starwood’s

The head of Marriott Rewards, David Flueck, told me that the new policy is intended to mirror Starwood’s policy rather than Marriott’s policy. That was in response to me asking whether suite upgrades were at the hotel’s discretion (like Marriott), or whether they were guaranteed subject to availability (like Starwood). That’s good news.

However, the actual terms and conditions don’t reflect the SPG suite upgrade policies.

Marriott has said they intend to update the terms & conditions to reflect their intent.

There will be a lot of Platinum members

How likely are suite upgrades to actually happen? The first thing to understand is that the new Marriott program will have tons of Platinum members. I imaginal e the percentage of elite members in the new Marriott program will be higher than in the old Marriott Rewards or Starwood Preferred Guest program.

That’s because Marriott will have more properties than any other hotel group, and it takes less effort than ever before to be loyal to them. Platinum status will require just 50 elite qualifying nights per year, and for having a co-branded credit card you’ll get 15 elite nights, so really you’ll only need 35 nights per year to earn Platinum status.

So yes, you’ll be entitled to complimentary suite upgrades, but you’ll be competing with a lot of people, and they’ll still be at the property’s discretion.

I don’t think Marriott will enforce the policy that rigidly

Historically my perception is that Starwood is much stricter than Marriott when it comes to making sure that hotels are compliant. This is true in several ways.

For one, I suspect that there will be a learning curve here for hotels. Given that Marriott has thousands of hotels, there will probably be a lot of hotels that are slow to learn the new policy. Starwood has historically been good at implementing policies across their various hotels, and it’s my understanding that they also charge hotels the most when corporate customer relations has to get involved in a dispute between a hotel and a guest.

I wouldn’t count on all Marriott hotels being onboard with these new suite upgrades overnight, and that’s because of the number of hotels we’re talking about, and also because Marriott isn’t historically as strict as Starwood when it comes to compliance.

How will Platinum vs. Platinum Premier upgrades be prioritized?

Technically both Platinum and Platinum Premier members will be entitled to complimentary suite upgrades subject to availability. With that in mind, how will hotels prioritize these upgrades? Based on my conversation with David Flueck, it seems like hotels will be given guidance as to what these tiers mean, and then based on that they can make their decisions as to how they want to prioritize upgrades.

Let me give an example. Let’s say a hotel has 10 suites available, and has 10 Platinum Premier members and 10 Platinum members checking in on a given day. All those members are entitled to suites, so who should get them?

- Should the hotel block Platinum Premier members into the suites before arrival, since they’ve demonstrated more loyalty?

- Should the hotel not block suite upgrades, and just upgrade all Platinum guests on a first come first served basis?

There’s not a right or wrong answer here, and it will be up to each individual hotel to decide what method they want to use. My guess is that guests may often find themselves in a situation where they’re not proactively offered suite upgrades due to how hotels have blocked rooms. However, I imagine if you want to “pick a fight” with a hotel (which I don’t necessarily recommend doing), you’ll often find that a suite miraculously opens up.

It all comes down to the individual hotel’s management. I know from being an SPG Platinum Ambassador that at some hotels I get a “thank you for being an SPG member” at check-in (so I spend 100+ nights per year with the brand and only get thanked for having signed up for their loyalty program?), while at other hotels I get specifically recognized as being a Platinum Ambassador member.

General suite expectations

Even for us long-time Starwood loyalists, I think we’ve adjusted our expectations of suite upgrades over the years based on where we’re staying. In very general terms:

- I don’t expect to be upgraded to suites at most US properties, since there are so many Platinum members

- In Southeast Asia, the Middle East, India, etc., Platinum members are typically treated extremely well, and upgrades are readily available

- I find that Europe is a mixed bag — at major hotels in London or Paris you often won’t be upgraded, while in secondary markets it’s much easier to get upgraded

Using points for better rooms

Coming soon!

Upgrade certificates & instruments

In addition to complimentary upgrades at check-in, there will also be opportunities for Elite members to earn Suite Night Awards as part of the Choice Benefit:

- You can select five Suite Night Awards for reaching 50 elite qualifying nights

- You can select five additional Suite Night Awards for reaching 75 elite qualifying nights

Note that this is independent of earning status, so if you qualify based on lifetime status or credit card spend, you won’t receive those.

I do think it’s important to manage expectations with Suite Night Awards, though. They clear at most five days before arrival, and they clear at the hotel’s discretion, so they don’t even have to clear these if there are suites available.

While I appreciate the benefit as such, I wouldn’t get your hopes up too high. My general experience has been that when these clear, I feel like I would have gotten a suite upgrade at check-in anyway. Don’t expect to get these to clear on Maui over Christmas, or in Aspen during ski season, or in London during summer, for example.

Earning Points

Base Members

Under the new program, members will earn 10 points per dollar spent. The exceptions are stays at Element, Residence Inn, and TownPlace Suites, where members will earn just five points per dollar spent.

Overall this represents improved points earning rates compared to Starwood, since SPG awarded just two points per dollar spent at all properties. Even when you factor in the 1:3 transfer ratio, that means most members will be earning a lot more points.

Elite Members

On top of the 5-10 points per dollar spent that members automatically earn, there will also be opportunities to earn additional points for having elite status:

- Silver members receive a 10% points bonus

- Gold members receive a 25% points bonus

- Platinum members receive a 50% points bonus

- Platinum Premier members receive a 75% points bonus

So on the high-end, members will be earning 17.5 point per dollar spent, which is quite a good return on spend. That’s the equivalent of nearly six Starpoints per dollar spent, which is more than I’ve ever earned as a Starwood loyalist.

Earning points for multiple rooms

One of the most frequent questions I’ve received is whether or not members will be able to earn points and elite credits for multiple rooms. Starwood Preferred Guest previously awarded points and credit on up to three rooms per night.

Unfortunately, Marriott will only award points and elite nights for one room per night per member.

Buying points

Historically Starwood has been aggressive about selling points to members, and in many cases it has represented an excellent deal. Marriott Rewards, on the other hand, hasn’t historically sold points very often. Only time will tell whether lucrative points sales will be available with the new program, though I’d guess that they will be.

Promotions

Global Promos

Marriott’s global promotions are typically called “MegaBonus.” During Marriott’s MegaBonus promotion last fall, they offered a Category 1-5 free night certificate after making just two stays at any Marriott family property.

The next global promotion has yet to be announced, but we’ll update this post when it is.

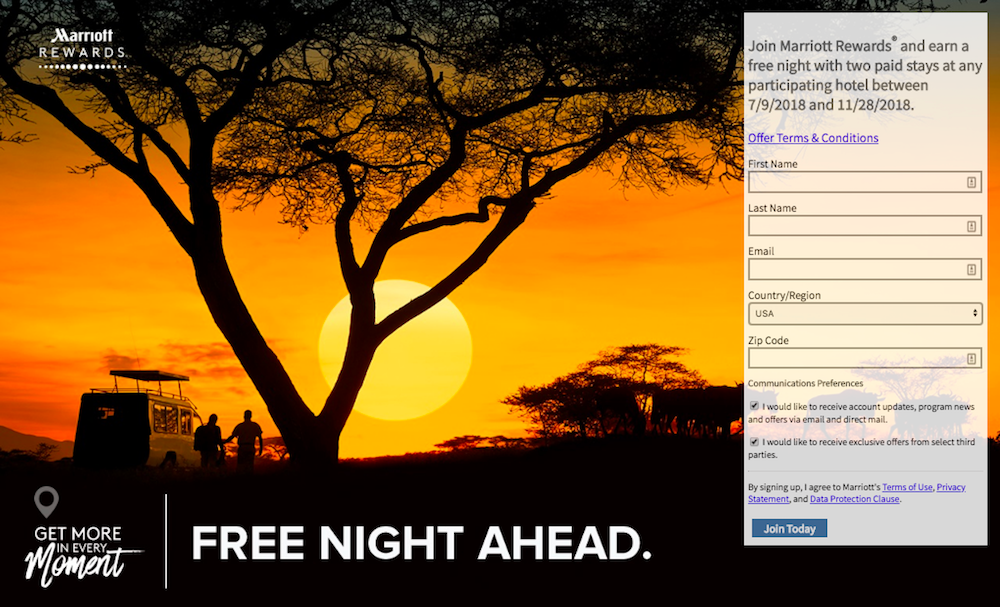

New Member Promos

Marriott Rewards is one of the few hotel loyalty programs that occasionally offers bonuses for new members who join and complete qualifying activity. In April I wrote about how they had an offer for a free night after making two stays, and it looks like this promotion has been renewed, as there’s now a new booking window for the offer.

New Marriott Rewards members can earn a free night certificate after making two stays between July 9 and November 28, 2018. Stays at all participating Marriott Rewards properties count towards this promotion, and the free night certificate will be valid at Category 1-5 hotels.

The free night certificate will be deposited in the Marriott Rewards account after successful completion of the second stay, and will be valid for one year from the date of issue.

Let me once again emphasize that this promotion is only for new members, and only those who sign up through this link. If you’re an existing member I wouldn’t recommend signing up for a new account, as there’s a good chance they’ll catch you and cancel both of your accounts. However, if you have a family member or friend who doesn’t have a Marriott Rewards account, this could make a lot of sense for them.

Prior to August 18th, only stays at Marriott Rewards properties will qualify. As of that point, stays at Starwood hotels would qualify as well, since they’ll all be considered the same for the purposes of the loyalty program.

The free night certificate offered with this promotion is valid at Marriott Rewards properties, though since a single program is being formed, it should also be redeemable at Starwood hotels as of August. I would expect that a Category 1-5 certificate will be valid at a hotel retailing for up 35,000 points per night, though that’s just speculation on my part, and I could be wrong.

Anyway, I consider this to be an excellent promotion for those who aren’t Marriott Rewards members, but have plans to stay at some of their hotels this fall. This promotion should also be stackable with whatever global promotion Marriott is offering at a given point. Marriott has a global promotion valid through July 20, 2018, though I imagine they’ll offer another one in the fall.

Marriott & SPG Credit cards

Both American Express and Chase will be issuing credit cards for Marriott’s new loyalty program. For now existing cardmembers of all products will continue to be able to maintain their cards, but eventually American Express and Chase will have “rights” to different parts of the market.

So let’s talk about what you need to know about these new cards.

Card options/benefits overview & eligibility

As of August 26, 2018, American Express and Chase will be introducing strict new eligibility requirements with their co-branded Marriott and Starwood cards. Here are the restrictions on each card:

Card | Welcome Bonus Eligibility Restrictions |

|---|---|

You won’t be eligible for a bonus if you currently have or have had any of the following cards in the last 30 days: • The Marriott Rewards Premier Business Credit Card from Chase • The Marriott Rewards Business Credit Card from Chase OR have acquired any of the following cards from Chase in the last 90 days: • The Marriott Rewards Premier Credit Card from Chase • The Marriott Rewards Premier Plus Credit Card from Chase OR have received a welcome or upgrade offer for any of the following cards from Chase in the last 24 months: • The Marriott Rewards Premier Credit Card from Chase • The Marriott Rewards Premier Plus Credit Card from Chase | |

Marriott Rewards® Premier Plus Credit Card | You won’t be eligible for a bonus if you currently have or have had any of the following cards in the last 30 days: • Starwood Preferred Guest Credit Card from American Express OR have acquired any of the following cards from American Express in the last 90 days: • Starwood Preferred Guest American Express Luxury Card • Starwood Preferred Guest Credit Card from American Express OR have received a welcome or upgrade offer for any of the following cards from American Express in the last 24 months: • Starwood Preferred Guest American Express Luxury Card • Starwood Preferred Guest Credit Card from American Express |

Marriott Rewards® Premier and/or Premier Plus Business Credit Card | You won’t be eligible for a bonus if you currently have or have had any of the following cards in the last 30 days: • Starwood Preferred Guest Credit Card from American Express OR have acquired any of the following cards from American Express in the last 90 days: • Starwood Preferred Guest American Express Luxury Card • Starwood Preferred Guest Credit Card from American Express OR have received a welcome or upgrade offer for any of the following cards from American Express in the last 24 months: • Starwood Preferred Guest American Express Luxury Card • Starwood Preferred Guest Credit Card from American Express |

You won’t be eligible for a bonus if you currently have or have had any of the following cards in the last 30 days: • The Ritz-Carlton Rewards Credit Card from JP Morgan OR have acquired any of the following cards from Chase in the last 90 days: • The Marriott Rewards Premier Plus Credit Card from Chase • The Marriott Rewards Premier Credit Card from Chase • The Marriott Rewards Premier Business Credit Card from Chase OR have received a welcome or upgrade offer for any of the following cards from Chase in the last 24 months: • The Marriott Rewards Premier Plus Credit Card from Chase • The Marriott Rewards Premier Credit Card from Chase • The Marriott Rewards Premier Business Credit Card from Chase |

As you can see, eligibility for a business card welcome bonus will be based on whether or not you have a personal card, and vice versa, which is a new precedent. It’s also interesting that eligibility for a Chase card will be based on whether or not you have an American Express card, which we haven’t typically seen from issuers in the past.

As far as the sharing of information goes, it’s my understanding that American Express and Chase aren’t sharing information directly (for obvious reasons), but rather Marriott is communicating with the two, and sharing whether or not a member has a card that would make them ineligible.

With that out of the way, let’s dig into the details of the individual cards.

Marriott Rewards® Premier Plus Credit Card

- Annual fee: $95

- Return on spend: 6x points per dollar spent with Marriott, 2x points on all other purchases

- Other perks: an anniversary free night certificate valid at any property retailing for up to 35,000 points per year, Silver status for as long as you have the card, Gold status when you spend $35,000 on the card in an account year, 15 elite night credits per year (starting in 2019), and more

Marriott Rewards® Premier Business Credit Card

This card is currently not available to new cardmembers, but here’s what you can expect as of August 26, 2018:

- Annual fee: $99

- Return on spend: 6x points per dollar spent with Marriott, 4x points at restaurants, gas stations, wireless telephone services, and purchases for shipping, and 2x points on all other purchases

- Other perks: an anniversary free night certificate valid at any property retailing for up to 35,000 points per year, Silver status for as long as you have the card, Gold status when you spend $35,000 on the card in an account year, 15 elite night credits per year (starting in 2019), and more

Marriott Bonvoy Business® American Express® Card

- Annual fee: $125 (Rates & Fees)

- Return on spend: 6x points per dollar spent with Marriott, 4x points at restaurants globally, gas at U.S. gas stations, wireless telephone services purchased directly from U.S. service providers, and U.S. purchases for shipping, and 2x points on all other eligible purchases

- Other perks: an anniversary free night certificate valid at any property retailing for up to 35,000 points per year, Gold status for as long as you have the card, 15 elite night credits per year, and more

Marriott Bonvoy American Express Card

- Annual fee: $95 (Rates & Fees)

- Return on spend: 6x points per dollar spent with Marriott, 2x points on all other eligible purchases

- Other perks: an anniversary free night certificate valid at any property retailing for up to 35,000 points per year, Silver status for as long as you have the card, Gold status when you spend $35,000 on the card in an account year, 15 elite night credits per year (starting in 2019), and more

It’s worth noting that one of the unique features of the SPG Business Amex is that it has previously offered Sheraton lounge access in conjunction with a stay. That was a really lucrative benefit, though it’s been discontinued as of August 1, 2018.

Starwood Preferred Guest® American Express Luxury Card

- Annual fee: $450

- Return on spend: 6x points per dollar spent with Marriott, 3x points at US restaurants and on flights booked directly with airlines, and 2x points on all other purchases

- Other perks: a $300 annual statement credit for purchases at Marriott hotels, an anniversary free night certificate valid at any property retailing for up to 50,000 points per year, Gold status for as long as you have the card, Platinum status when you spend $75,000 on the card in an account year, a Priority Pass membership, a Global Entry or TSA PreCheck credit, 15 elite night credits per year (starting in 2019), and more

Ritz-Carlton Rewards® Credit Card

This card is currently not available to new cardmembers, but here’s what you can expect as of August 26, 2018:

- Annual fee: $450

- Welcome bonus: unknown

- Return on spend: 6x points per dollar spent with Marriott, 3x points at restaurants, rental car agencies, and on flights booked directly with airlines, and 2x points on all other purchases

- Other perks: a $300 annual travel credit, an anniversary free night certificate valid at any property retailing for up to 50,000 points per year, Gold status for as long as you have the card, Platinum status when you spend $75,000 on the card in an account year, a Priority Pass membership, a Global Entry or TSA PreCheck credit, 15 elite night credits per year (starting in 2019), and more

Anniversary nights

Going forward, several Marriott and Starwood credit cards will offer an anniversary free night certificate. This is something that some Marriott cards have offered in the past, though it’s being expanded to Starwood cards as well. Specifically:

- Marriott Bonvoy American Express Card will offer an anniversary free night certificate valid at a hotel costing up to 35,000 points per night, beginning with the first account anniversary after August 1, 2018

- Marriott Bonvoy Business® American Express® Card will offer an anniversary free night certificate valid at a hotel costing up to 35,000 points per night, beginning with the first account anniversary after August 1, 2018

- The Marriott Rewards® Premier Plus Credit Card also offers an anniversary free night certificate valid at a hotel costing up to 35,000 points per night

- The SPG Luxury Card will offer an anniversary free night certificate valid at a hotel costing up to 50,000 points per night

- The Ritz-Carlton Credit Card offers an anniversary free night certificate valid at a hotel costing up to 50,000 points per night, beginning with the first account anniversary after August 26, 2018

Can you earn an anniversary free night certificate on multiple Marriott & Starwood credit cards?

This has been a point of confusion, but the answer is yes. If you have multiple cards earning free night certificates, then those certificates are stackable, meaning you can get multiple free nights per year.

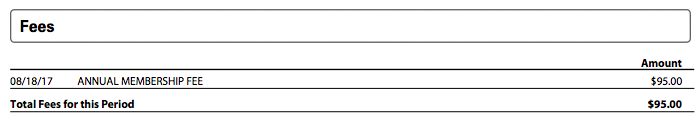

How can you tell when your account anniversary date is?

This is something that’s rather annoying. I went to Amex’s website and looked at a summary of all my transactions over the past year, figuring that would easily tell me when my account anniversary is (based on when I was last billed an annual fee). That’s not the case, apparently, as fees aren’t listed in that summary (someone correct me if I’m wrong please).

So the only way I could see when I was last billed the annual fee was to go to the “Billing Statements” section and download my individual statements.

After going through a few of them, I saw that I was last billed the annual fee for one of my cards on August 18, 2017. That’s fantastic, since it means I should get my first anniversary free night certificate just a couple of weeks after this benefit kicks in.

Do you get to keep your anniversary free night certificate if you cancel your card?

Once your anniversary free night certificate posts it won’t be taken away.

So if you pay your annual fee and then the anniversary free night certificate posts, you can cancel the card and keep the certificate, as it’s linked to your loyalty program account rather than your credit card account at that point.

How many hotels will be eligible for these certificates?

Apparently 6,300 hotels will cost 35,000 points per night or less, so you can redeem these certificates at a vast majority of Marriott and Starwood properties.

Can you pay the difference in points to stay at a hotel costing more than 35,000 points per night?

Nope. You need to stay at a hotel that would cost no more than 35,000 points for a standard room for your one night stay. You can’t pay the difference for a more expensive hotel, and you can’t get any points back if your hotel costs less than 35,000 points.

Is the anniversary free night certificate worth the $95 annual fee?

There are a lot of redundant benefits across the Marriott and Starwood cards, so a lot of people are in a position where they’re trying to decide whether it’s worth paying the $95 annual fee to get an incremental anniversary free night certificate.

Everyone has to decide for themselves, though personally I think the answer is yes. Marriott claims that this free night certificate will be valid at about 6,300 of Marriott’s 6,500+ hotels around the world, and a majority of those hotels would probably retail for over $95 per night.

Personally I’d pick up as many of these free night certificates as I could for $95 per night, so I think it’s a great deal.

Comparison of points earning for various cards

To be honest, these cards aren’t terribly compelling for everyday spend. Personally I value Marriott points at ~0.8 cents each, and all of these cards earn 2x points in non-bonused categories. A return that’s valued at 1.6% isn’t very good for your spend.

The one circumstance under which I think it makes sense to put everyday purchases on these cards is if you’re going for Platinum status with $75,000 of spend, which can be quite a good deal.

Comparison of elite credit potential

As you can see, starting in 2019 all of these cards offer 15 elite nights per year towards status. That’s a fantastic benefit, as it lowers the real requirement for Platinum status from 50 nights per year to 35 nights per year, which is achievable for many.

Do be aware that these 15 elite night credits don’t stack, so if you have multiple of these cards, you’ll still earn at most 15 nights towards status annually.

Other things to consider in choosing a card

On the most basic level, I think the cards can be worthwhile for the anniversary free night certificates alone, given that they can be redeemed at properties that cost significantly more than you’d pay in annual fees.

The other major thing to consider is the restrictions for applying for new cards. Having Amex cards can make you ineligible for Chase cards, and vice versa, so generally you’re going to want to stick to all Amex cards or all Chase cards within the portfolio, if possible.

Meetings & Groups

In addition to earning points for business and leisure hotel stays, Marriott and SPG have had separate programs for those planning meetings and group events and their properties.

New Rewarding Events program

Marriott’s Rewarding Events program offers bonus points for meetings and events planned at any of Marriott’s brands. With this, you can earn two points per dollar spent, up to 60,000 points. Platinum Premier members can earn up to 105,000 points per qualifying event.

On top of that, you can earn 10 elite qualifying nights when you book your first meeting, plus earn another 20 elite qualifying nights for every additional meeting.

SPG Pro

SPG Pro will end in August, though reservations and contracts made beforehand will be honored. Like with other points earned through the SPG program, SPG Pro points will be converted to the Marriott system at a 1:3 ratio.

Going forward, you can earn benefits under the new Rewarding Events scheme, including bonus points based on elite level (if applicable).

Redeeming points

2018 Award categories

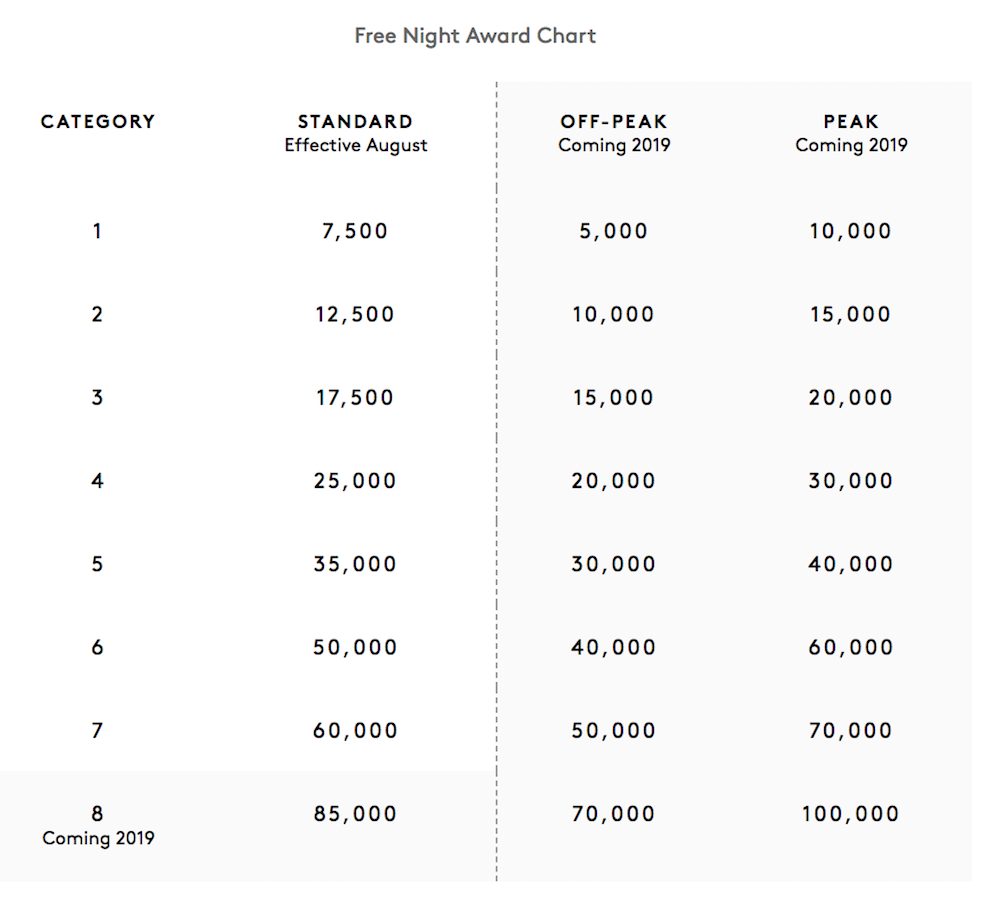

On Augus 18th Marriott will introduce a new award chart valid for members of all three programs. At that point Starwood Preferred Guest points will be converted into Marriott Rewards points at a 1:3 ratio, so all stays will follow this pricing. Here’s the chart:

This compares very favorably to Starwood Preferred Guest’s award chart, though in some cases pricing may be higher than what Marriott Rewards used to charge.

However, there are a couple of things that are potentially especially interesting here:

- Marriott won’t introduce Category 8 hotels until 2019, meaning that stays booked between August and December of 2018 (even if stays are on subsequent dates) will cap at Category 7

- Marriott will only use “standard” award pricing for 2018, and then in 2019 “peak” and “off-peak” pricing will be introduced

That means for awards booked between August and December, the most expensive redemption will be 60,000 Marriott Rewards points per night, which is the equivalent of 20,000 Starpoints per night in today’s currency. You also get a fifth night free on redemptions, so that brings down the average cost for a five night stay to 16,000 Starpoints per night (in today’s currency).

Currently Starwood’s top hotels cost 35,000 Starpoints per night, so that’s the same as getting over 40% off!

Previously in peak season a redemption at the St. Regis Aspen or St. Regis Deer Valley cost 140,000 Starpoints for five nights (with the fifth night free). Starting in August that redemption would cost just 240,000 Marriott Rewards points, which is the equivalent of 80,000 Starpoints.

That’s a huge discount. If you want to redeem for one of the top Marriott, Ritz-Carlton, or Starwood properties in the world, then between August and December of this year is the time to book.

Here’s a list of Starwood’s current Category 7 hotels (the most expensive in the system), where you’d get the biggest savings during this period, since those hotels currently cost the most points. Note that this only applies for hotels with standard rooms — for Starwood’s “all-suite” properties they’re still evaluating what a “standard room” looks like.

2019 Award categories

Marriott should be using the same award chart for bookings made in 2019, except there will be two changes:

- Marriott will introduce Category 8 hotels in 2019, meaning that stays at Marriott’s most expensive properties will be more expensive

- Marriott will introduce peak and off-peak pricing in 2019, so pricing will vary based on the season

On top of that, Marriott may change which hotels are in which categories, as they tend to adjust this on an annual basis.

5th night free

The new Marriott program will continue to offer fifth night free on award redemptions. This applies on all free night redemptions, but doesn’t apply on cash reservations, Points & Cash bookings, etc.

Sweet spots / great redemptions / best ways to use points

Between August 18 and the end of the year, the best way to redeem points will be for Category 8 properties, and for properties where you would otherwise stay during peak season. That’s because while Marriott is already introducing a new chart, they aren’t introducing Category 8 of peak season pricing until 2019.

So for the remainder of 2018 you can book all of the world’s best Marriott properties for just 60,000 points per night, and you can even get a fifth night free. That’s a great deal.

Furthermore, historically “all suite” Starwood properties have been outrageously priced. This includes hotels like the St. Regis Maldives, St. Regis Bora Bora, Al Maha Dubai, and more. Starting on August 18, these properties will be priced according to the standard award chart, so it will be possible to book these for significantly less than before.

Transfering points between accounts

Historically Marriott Rewards and Starwood Preferred Guest have different policies when it comes to transferring points between accounts:

- Starwood Preferred Guest allows unlimited transfers for free within the same household, assuming accounts have been registered at the same address for at least 30 days

- Marriott Rewards limits each member to transferring 50,000 points per year to just about anyone; the fee to do is $10, or Gold and Platinum members have the fee waived

Transfer points to airline partners

With the combined program, members will still be able to transfer points to a variety of airline partners. You can do this by booking a travel package, or by transferring points directly to the airline.

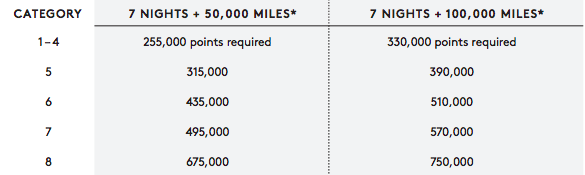

Marriott Travel Packages

Marriott is devaluing their Travel Packages redemption option as of August 18, and the new pricing will be as follows:

Here are the eligible Hotel + Air Package frequent flyer programs (with United you’ll continue to receive a 10% bonus for transfers):

If you are considering a Travel Package under the new program, redeeming for the package that includes 100,000 miles is definitely the better deal. Ordinarily you’d need 240,000 Marriott points for 100,000 airline miles, which means you’re really paying the following number of points for seven nights at a hotel:

- 90,000 points for a Category 1-4 (ordinarily up to 25,000 points per night for standard pricing)

- 150,000 points for a Category 5 (ordinarily up to 35,000 points per night for standard pricing)

- 270,000 points for a Category 6 (ordinarily up to 50,000 points per night for standard pricing)

- 330,000 points for a Category 7 (ordinarily up to 60,000 points per night for standard pricing)

- 510,000 points for a Category 8 (ordinarily up to 85,000 points per night for standard pricing)

Let’s take a Category 7 as an example. That would ordinarily require 60,000 points per night, though you get a fifth night free. So seven nights would cost you 360,000 points, compared to 330,000 points with a Hotel + Air Package. So the savings are mild but not huge.

How will Marriott handle existing travel packages?

Marriott is actually being extremely unreasonable here.

On the most basic level, if you booked a Tier 3-5 certificate (the most expensive certificate possible) it won’t even be redeemable at Marriott’s most expensive properties come next year, when Category 8 hotels are introduced? How is that justifiable? At a minimum the most expensive certificate should be redeemable at the most expensive hotel going forward, no?

And then to map both Category 9 and Tier 1-3 certificates to Category 6 is unreasonable.

The further big issue is the expectations that Marriott has created here. By intentionally not publishing the chart in advance (and clearly it was intentional, because they published it the day the new program went into effect), this led people to the logical conclusion that they were planning on being generous.

Marriott has a lot of unhappy people right now, and if their plan was to convert the certificates in this way, why didn’t they just tell us the mapping in advance?

You’d think they’d want to launch the new program with happy members, but this doesn’t do a whole lot to create that.

Transfer directly to airlines

One of the strong points of the Starwood Preferred Guest program has long been that you can efficiently convert Starpoints into airline miles. They converted into dozens of currencies at a 1:1 ratio, and you even received a 5,000 point bonus for every 20,000 points transferred. In other words, each Starpoint was worth up to 1.25 airline miles, which is why the Starwood Amex Card has been so valuable for many. It was a card that basically earned you 1.25 flexible airline miles per dollar spent.

The good news is that with the new program, it will continue to be possible to efficiently convert Marriott points into airline miles. Specifically, Marriott points will convert into airline miles at a 3:1 ratio, with a 15,000 point (or 5,000 mile) bonus for every 60,000 Marriott points transferred. In other words, 60,000 Marriott points will convert into 25,000 airline miles.

This means that it’s more or less business as usual for SPG members, since 60,000 Marriott points is the equivalent of 20,000 Starpoints.

What airline programs you can transfer Marriott points to

Marriott’s website about the new program is surprisingly unhelpful when it comes to laying out the new airline transfer partners, so Tiffany put together a chart that shows the transfer partners and ratios under the new program, as well as the old partners for each program:

Combined Program Partners | Combined Program Transfer Ratios | Previous Marriott Transfer Partners | Previous SPG Transfer Partners |

|---|---|---|---|

Aegean Miles+Bonus | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred | |

Aeroflot Bonus | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | |

Aeromexico Club Premier | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Air Canada Aeroplan | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Air China PhoenixMiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Air France/KLM FlyingBlue | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Air New Zealand Airpoints | TBD transfer ratio | 65:1 transfer ratio, ~77 bonus Airpoints for every 20K points transferred | |

Alaska Airlines Mileage Plan | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Alitalia MilleMiglia | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

ANA Mileage Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

American Airlines AAdvantage | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Asiana Airlines Asiana Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Avianca Lifemiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

British Airways Executive Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Cathay Pacific Asia Miles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

China Eastern Airlines Eastern Miles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

China Southern Airlines Sky Pearl Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | ||

Copa Airlines ConnectMiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | |

Delta SkyMiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Emirates Skywards | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Etihad Guest | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Frontier Miles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | |

GOL Smiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Hainan Airlines Fortune Wings Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred | |

Hawaiian Airlines HawaiianMiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred | |

Japan Airlines JAL Mileage Bank | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Jet Airways JetPrivilege | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

TBD transfer ratio | Transfer ratio ranges from 5.6:1 to 10:1 | ||

Korean Air SkyPass | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

LATAM PASS | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred | |

Qantas Frequent Flyer | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | |

Qatar Airways Privilege Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Saudi Alfursan | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Singapore Airlines KrisFlyer | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

South African Airways Voyager | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | |

Southwest Airlines Rapid Rewards | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | |

TAP Miles&Go | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | |

Thai Airways Royal Orchid Plus | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred | |

Turkish Airlines Miles&Smiles | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 4:1 to 6.66:1 | |

United MileagePlus | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.24:1 to 4:1 | 2:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Virgin Atlantic Flying Club | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | Transfer ratio ranges from 2.8:1 to 5:1 | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

Virgin Australia Velocity | 3:1 transfer ratio, 5K bonus miles for every 60K points transferred | 1:1 transfer ratio, 5K bonus miles for every 20K points transferred |

We’re actually going to see more airline transfer partners than ever before, which is good news, though for certain partners (including United), the transfer ratio is worse for Marriott Rewards members than it was previously.

SPG Moments

Historically one unique way you can redeem Starpoints is through SPG Moments, which lets you redeem points for sold out concerts and other unique experiences. Fortunately Marriott adopted this concept shortly after taking over Starwood, and this will continue to be available going forward.

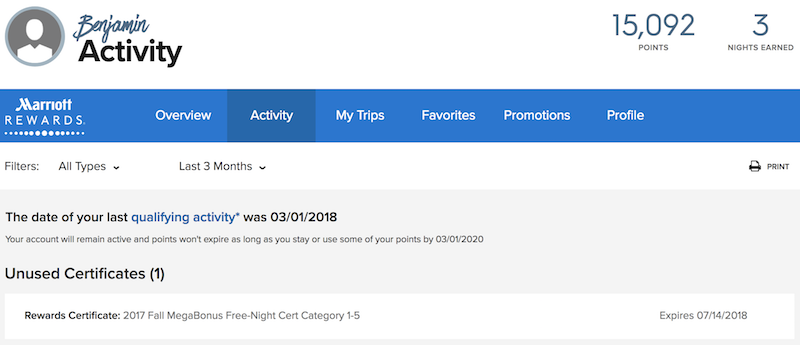

How to redeem Marriott award certificates

I redeemed my first Marriott free night certificate earlier this year (in the past I’ve only outright redeemed points). These are similar to the ones they offer through their co-branded credit card, so the redemption process should be identical in theory. In practice, the transition may make things complicated, so it may be more efficient to call Marriott Rewards at 1-801-468-4000 to redeem your free night award.

Anyway, to find your Marriott Rewards free night certificate, simply log into your Marriott Rewards account and click on the “Activity” tab, where you’ll see a section with “Unused Certificates,” assuming you have any to redeem.

That part is straightforward enough, though what tricked me was that there was nothing there to click on to go through the booking process, and I couldn’t get the website to display an option to redeem the certificate, at least not initially.

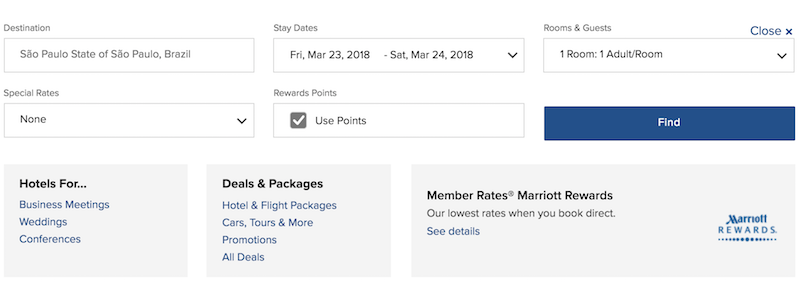

It took me a while to figure out the correct process, and then it was obvious. To redeem a Marriott free night certificate you just click “Use Points,” as you’d do if you were redeeming points for a stay.

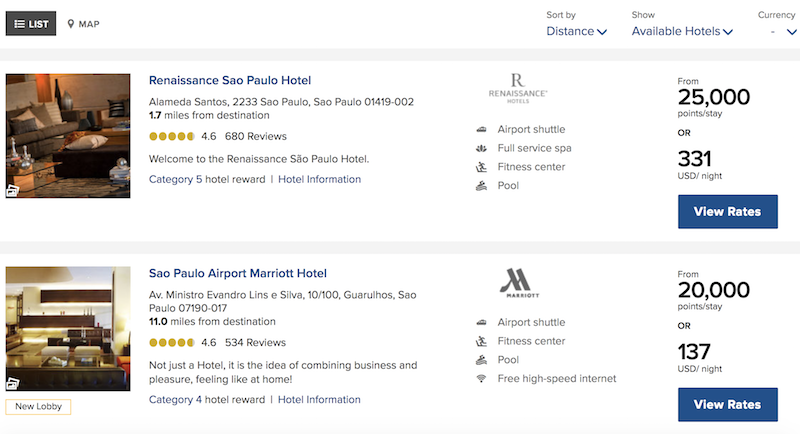

On the next page you’ll see all the options for redeeming points. In this case I didn’t even have enough points for a free night, so interestingly it only showed me hotels that were within the category range of my certificate. This page lists the category of each property, so you can easily verify that a property is in an eligible category.

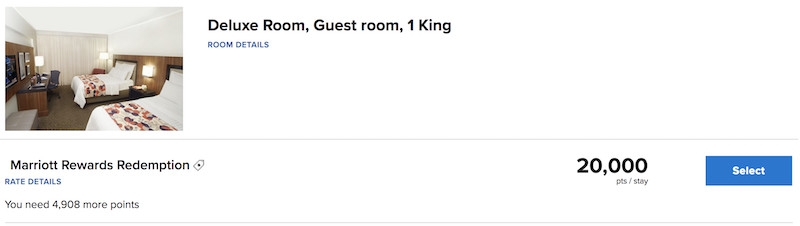

On the next page you’ll see the price in points, so you’ll want to select the base room. It let me select this even though I didn’t even have enough points in my account for the room I wanted.

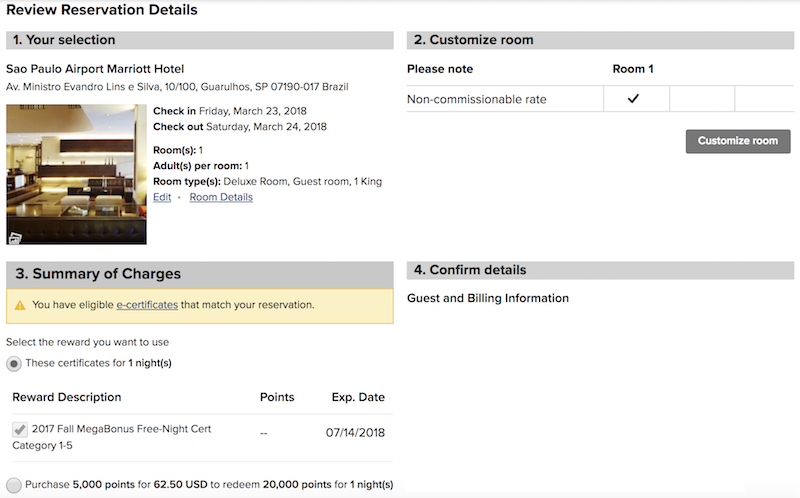

Finally the last page before you confirm the reservation shows your e-certificates as a payment method option. Since I didn’t have enough points, I had the option of paying $62.50 to buy 5,000 points, or the option of redeeming a certificate.

So just go through the process of making a points booking (even if you don’t have enough points), and then the last page before confirming the booking, select the eligible e-certificate that you want to use for the booking.

Other partnerships

Marriott and Starwood both offer some unique partnerships, and in many cases these are incompatible, so we are seeing some partnership changes.

RewardsPlus (United)

The RewardsPlus partnership between Marriott and United is sticking around. If you are a Marriott Platinum Premier member you’ll receive United MileagePlus Premier Silver status, and United MileagePlus Gold members and above will continue to receive Marriott Gold status. Furthermore, when booking a Hotel + Air Package, members will continue to receive a 10% United bonus.

Crossover Rewards (Delta)

The Crossover Rewards program, which launched in 2013 as a way for Delta and SPG members to earn reciprocal benefits, has been terminated as of July 15th, 2018. I’m guessing this is due to Marriott’s close relationship with United.

It hasn’t been announced whether Marriott or Delta will have any sort of a partnership going forward.

Your World Rewards (Emirates)

Starwood has partnerships with both Emirates and China Eastern to offer reciprocal benefits and points earning opportunities for elite members. These partnerships continue to be available as of now, though it hasn’t been announced what will happen with them in the future.

Eastern Explorer Rewards (China Eastern)

If you’ve already registered for the Eastern Explorer Rewards program, you’ll continue to receive your benefits for now, though the program isn’t currently open to new registrations.

SPG/Uber

Unfortunately, the partnership between SPG and Uber was discontinued as of late 2017, so it’s no longer possible to earn Starpoints for Uber rides.

If you want to earn points for ridesharing, Delta’s partnership with Lyft is worth considering, as you can earn one SkyMile per dollar spent.

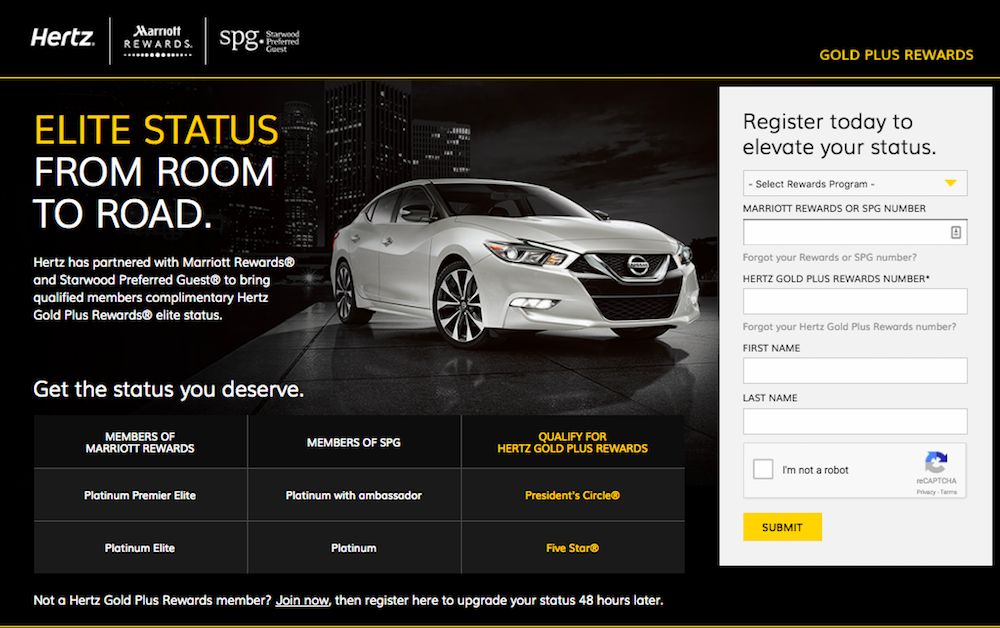

Marriott/Hertz

Last November, some minor changes were announced to the Marriott Rewards and Starwood Preferred Guest programs for 2018. Among these changes was that Starwood and Hertz would be introducing a new partnership, and the existing partnership between Marriott and Hertz would be expanded.

As part of this expanded partnership:

- All SPG members can now access discounted rates and earn 200 Starpoints for their Hertz rentals; to earn Starpoints, SPG members must add their SPG account number to their car rental reservations for rentals picked up at any airport or off-airport location

- Members are also eligible for status matches — Marriott Rewards and SPG Platinum members receive Hertz Gold Plus Rewards Five Star status, and Marriott Platinum Premier and SPG Platinum Ambassador members receive President’s Circle status

In order to take advantage of this you’ll need to register on this page. Here’s what you can expect in terms of Five Star and President’s Circle elite benefits:

Caesar’s/Total Rewards partnership

Starwood had a unique partnership with Caesar’s a few years back, though that ended as of December 31, 2016. Wyndham Rewards has since announced a partnership with Caesar’s, so don’t expect anything from Marriott on this front.

Other program details

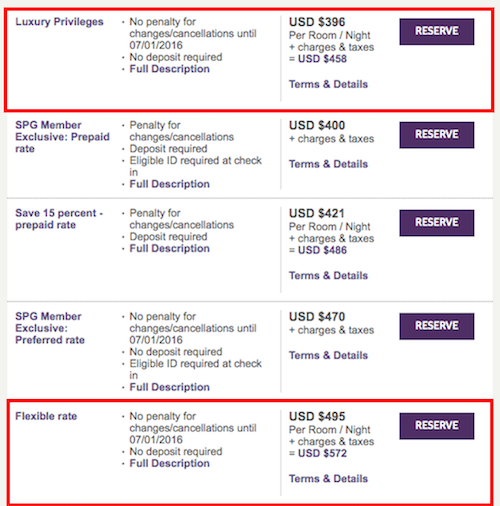

Luxury Privileges

Luxury Privileges is Starwood’s own preferred partner program, similar to Virtuoso and American Express Fine Hotels & Resorts, both of which offer great perks like resort credits, room upgrades, and complimentary daily breakfast. The difference is Luxury Privileges is Starwood’s proprietary, in-house program designed to reward and increase loyalty among travelers.

Below Ford has put together a list of frequently asked questions he’s received from clients, in hopes of clarifying and explaining the program so you can best take advantage of it.

Which Starwood properties take part in Luxury Privileges?

- St. Regis properties

- W properties

- Luxury Collection properties

- Select Westin properties

The above properties that aren’t a part of Virtuoso or Amex Fine Hotels & Resorts still participate in Luxury Privileges, and participation with Virtuoso or Amex doesn’t preclude membership in Luxury Privileges. You can find a list of Luxury Privileges hotels and their amenities here.

Many W Hotels in particular aren’t a part of Virtuoso, which is an added perk since W properties are a popular choice for travelers looking for a trendy, high-end experience without an absurd nightly rate (at least in most cases). For example, the W Seattle is a part of Luxury Privileges, but not part of any other major program. By booking through Luxury Privileges you get free breakfast, a $100 food & beverage credit, etc.

The W Seattle participates in Starwood Luxury Privileges

What are the typical perks available through Luxury Privileges?

- Upgrade on arrival, early check-in, late checkout, all subject to availability

- Daily breakfast for two

- Complimentary in-room internet access (though all SPG & Marriott members now receive free internet)

- A hotel specific perk, once per stay (typically ~100 USD food and beverage, property, or spa credit, though it varies)

- 4th night free at select properties

Breakfast is included when booking through Starwood Luxury Privileges

Do Luxury Privileges rates cost more?

The Luxury Privileges rate is almost always the same as the best available rate, known as the “flexible rate” at Starwood properties. It is not available with discounted prepaid rates and is not combinable with other promotions and rates offered by Starwood.

There are even cases where the Luxury Privileges rate is significantly better than the flexible rate. For example, at The Chatwal, an SPG Category 7 hotel and Luxury Collection property in NYC, the Luxury Privileges rate is in many cases significantly less than the flexible rate, and in some cases even less than the pre-paid rate.

Do Luxury Privileges rates earn points?

Absolutely. Luxury Privileges rates count the same as any other stay booked directly with Starwood. You’ll earn Starpoints, along with elite qualifying stay and night credits.

Can I combine Luxury Privileges with other programs and promotions?

Nope. Luxury Privileges isn’t combinable with Virtuoso or Amex FHR, nor is it bookable through the Citi Prestige fourth night free benefit. When a property participates in both Virtuoso and Luxury Privileges, for example, you have to compare the perks and rates and decide which is a better value.

It’s also important to note you cannot book a Luxury Privileges rate with points or any combination of cash and points. It’s only available on revenue bookings.

The Westin Palace Madrid is a part of Starwood Luxury Privileges

How do I book Luxury Privileges?

Luxury Privileges has to be booked through a Travel Advisor with access to the program, and rates for the program aren’t publicly available to those outside the travel industry.

If you are interested in booking a Luxury Privileges rate at a Starwood property, Ford is always happy to help and can be reached via email at [email protected] (if you’re also a Travel Advisor who has access to the program, feel free to leave your contact info below as well, so others can contact you). As I said, in a vast majority of instances, rates tend to be the same as the flexible rate.

Cancellation policy

Most of the major hotel chains adjusted their cancellation policy for flexible rates in 2017. Marriott’s current cancellation policy will continue to apply across all brands.

Flexible rates need to be canceled at least 48-hours prior to arrival to avoid a fee. However, the policy does vary at properties, including resorts, so you’ll want to check the policy for the specific hotel you’re booking.

Best Rate Guarantee

In an effort to get consumers to book direct, most of the major hotel chains offer some sort of a “best rate guarantee.” Both Marriott and Starwood offer these, and going forward Marriott’s best rate guarantee will continue to apply.

In the event that you find a lower rate through a third party than what Marriott is charging directly, they’ll match the rate and give you 25% off. Terms and conditions apply.

What other questions can I answer about the new Marriott Rewards program?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Starwood Preferred Guest® Credit Card from American Express (Rates & Fees), and Marriott Bonvoy Business® American Express® Card (Rates & Fees).

The great merger

Bonvoy-age SPG...

Can you update the list to reflect Titanium & Ambassador benefits specifically for Breakfast benefit ?

Spoke with Marriott agent today. Points transfer time to airlines is no longer a few days. SHOCKED to hear Marriott has changed it to 2.5 MONTHS!!!!! (10-15 weeks). Doesn't this deserve riotous response from the avgeek community? Did I miss something?