UPDATE: This card is a corporate card and available to companies with revenue in excess of $4,000,000 USD. For those with business revenue under that threshold, likely small business cards would be a better fit.

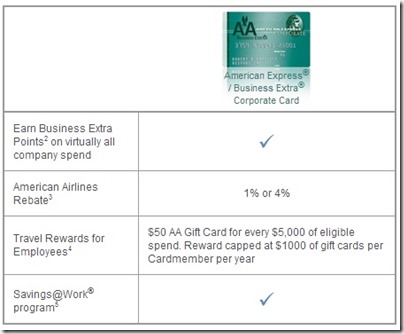

I’ve been thinking about this card for a while and trying to determine if it makes sense to add to my wallet. Here is a quick rundown of the American Express / Business Extra Corporate Card benefits:

- 2,500 Business Extra bonus points

- 1% to 3% rebate on American Airlines

- $50 gift card for every $5,000 in spend (up to $1,000 in gift cards)

- Earn Business Extra Points on virtually all company spend

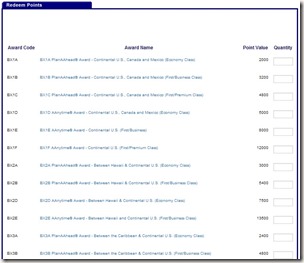

The Business Extra redemption chart is mighty intriguing with some great redemptions like:

- BXP5 Special Services Award – AAdvantage Gold® Status – 2,400 points

AAdvantage Gold appointments issued January 1st through June 30th of each year are valid through February 28th of the following year (i.e. Feb. 28, 2013).

AAdvantage Gold appointments issued July 1st through December 31st of each year are valid through February 28th of the next calendar year (i.e. Feb. 28, 2014).

- BXP1 Upgrade – Within North America or between North America & Hawaii or Caribbean (One Segment) – 650 points

Within North America,or between North America and Hawaii or the Caribbean. One-Segment Cabin Upgrade (Fare basis codes starting with N, O, Q or S are not eligible for this upgrade.)

- BX1A PlanAAhead® Award – Continental U.S., Canada and Mexico (Economy Class) – 2,000 points

- BXP8 Special Services Award – Admirals Club® Membership – 3,000 points

This one seems good, although, I already have Admirals Club Membership thanks to my Citi Executive Club card I picked up with the 100,000 bonus.

And many more awards look like an interesting value.

Bottom Line

The 2,500 bonus points after signing up for the card are enough for the Gold status award. This gets you status with American Airlines so you can enjoy the great benefits of Gold status.

However, since it is a corporate card, and my business doesn’t meet the criteria, I’ll have to forgo this card in my next application which I will consider the new Amex Everyday card and the Marriott 70,000 bonus offer card.

What do you think about this card? Is it worth considering?

Related Posts

- New 70,000 Marriott Rewards Premier Credit Card Offer

- Wow – 100,000 Citi Card Comes In Slick Package And High Spending Threshold Presents Challenge

- American Airlines – Upgrade policy, how even a gold can get one

- Mrs. Weekly Flyer’s Latest Application(s)–Cash Back, New Points, And A Must Have For Every Wallet

- First Time Reloading Bluebird – Mrs. Weekly Flyer’s First Time Using Vanilla Reloadable Cards

- Arrived: 100,000 American Airlines Card Offer Package Today

- American Airlines – Easy way to find AA record locator when booking through BA.com

- American Airlines – Free award ticket change during Scotland Golf trip

- American Airlines – Earn more miles with dining at your favorite restaurants

- American Airlines – Where to find in flight power outlets

- American Airlines – Earn 1,200 AA miles with Bose headsets

- American Airlines – Using American Airlines miles for unique experiences

- Get 100,000 Miles For Only $250 Plus $10,000 In Spending With American Airlines Credit Card Offer

- Family Time Turns Into 95,000 Points, Automated Point Tracking And More

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Here’s full details of the card:

http://boardingarea.com/viewfromthewing/2013/01/14/finally-full-details-on-the-business-extraa-american-express-corporate-card/

It’s a corporate card, not a small business card. You cannot apply online.

You earn 1% cash back plus 1 business extra point per $20 spend. The 4% cash back on American spend (note, not 1-3% as mentioned above) is stackable with the 1% on all spend – so it’s really 5% cash back on American.

How many BusinessExtrAA points does this earn per dollar spent?

Is there an annual fee?

I’ve actually answered those questions but included a link, so my comment above is in the moderation queue. So I’ll answer. It’s a $395 annual fee card (or at least it was a year ago, haven’t updated my familiarity with it) and it earns 1 Business ExtrAA point per $20 spent in addition to the cash rebate.

According to an earlier post by Pizza in Motion, the A/F is $395. Some FTers say that your business needs $4 million in revenues to apply. Not sure which of the above applies today.

http://pizzainmotion.com/2013/01/14/answers-to-the-remaining-questions-on-the-american-express-businessextraa-platinumcard/

http://www.flyertalk.com/forum/american-express-membership-rewards/1424343-aa-s-business-extraa-american-express-card-via-viewfromthewing.html

Don’t see any mention of annual fee. Is it waived first year or there actually is no annual fee?

It says on the Amex website that the corporate card is for businesses with a turnover in excess of $4m, so probably a bit more difficult to get.

Yeah, I think it should be pointed out that this card is a CORPORATE card. Individuals and small businesses are not eligible, lest Amex trend on Citi’s exclusive domain.

We’re currently restructuring our corporate cards and have been looking for a card that makes sense on this level in terms of travel rewards vs just a minimal cash back. This card does seem to offer more than our current AMEX corporate platinum that just gives us mr that we can’t transfer out. We’re NE based so AA merging with US would help the value of this card for us. If you guys have a corp Visa/MC corp alternative other than BofA products (which we currently use…and really don’t get a lot out of) for travel rewards/reimbursement on a corporate level I’d certainly appreciate the input.

While some of the FTers run businesses with $4 million in turnover, most by design are nonprofit with no tax returns. What documents should the more enterprising MS folk show to the banksters should they go for the gold?

SO much appreciated… thanks for the sharing your best views. all are so much nice…