If you are like me, and looking to signup for credit card offers in April, you’re likely evaluating potential offers to apply to in the coming weeks. In total, I narrowed it down to 4 cards from many and will have the chance to earn 200,000 points, two free weekend night certificates at select Hilton properties and complimentary gold status at Hilton just from credit card applications.

What I Ruled Out

The first cards I ruled out were the Delta Reserve Card from American Express (already have it), Platinum Delta SkyMiles® Credit Card from American Express (have the business version), and the Gold Delta SkyMiles® Credit Card from American Express (can’t get it due to the reserve card I have). So that was an easy choice for me.

The next card was a little more tough to pass up. The SimplyCash® Business Card from American Express card offers 5% at U.S. office supply stores & on wireless telephone services purchased directly from U.S. service providers, 3% on the category of your choice and 1% on other purchases. I do currently have the Chase Ink Plus, but am considering downgrading that card and picking up this one in the future for the cash back category bonuses.

Then there is the Citi Executive® / AAdvantage® World EliteTM MasterCard® 100,000 American Airlines mile offer. I’ve heard rumors that you can signup for multiple cards and receive the credit card bonus, but I already earned the easiest 100,000 American Airlines I’ve ever earned through this card, and with the latest unannounced changes from American, I’m going to let the merger play-out before I go on a binge of earning more American Airlines miles.

Credit Card Strategy

1. Personal And Business Starwood Preferred® Guest Cards

- Starwood Preferred Guest® Credit Card from American Express

- Starwood Preferred Guest® Business Credit Card

I’m focused on both the Starwood Preferred Guest® Credit Card from American Express and the Starwood Preferred Guest® Business Credit Card due to the welcome bonus. I can earn up to 25,000 bonus points with EACH card by earning 10,000 Starpoints after my first purchase on the Card and an additional 15,000 Starpoints after I make $5,000 in purchases within the first 6 months. So I could net 50,000 points if I sign up for the personal card and the business card offers.

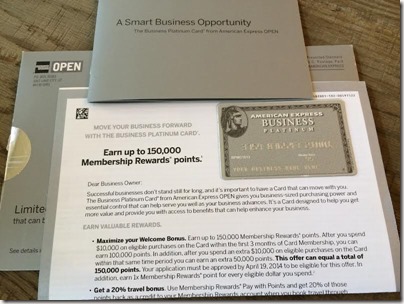

2. TARGETED OFFER: Business Platinum Card® from American Express

Limited Time (Targeted) Offer valid through April 19, 2014 for select members who receive this offer. This one was sent directly to me in the mail and I couldn’t have been happier. I can’t pass this one up, so I”ll need to apply before my personal offer expires on April 19, 2014. Not everyone can apply for this offer, but you can click here to see my tips on how to increase the likelihood of receiving offers from American Express.

-

- Earn up to 150,000 Membership Rewards points

- Earn 100,000 points after spending $10,000 on eligible purchases in the first 3 months of card membership

- Earn additional 50,000 points after spending another $10,000 on eligible purchases in the same period

3. Citi® Hilton HHonors™ Reserve Card

With the Citi® Hilton HHonors™ Reserve Card I’ll earn TWO WEEKEND NIGHT certificates, each good for one weekend night after I meet minimum spending requirements for the offer. The card also comes with complimentary upgrades, so I can enjoy complimentary space available upgrades and welcome amenity (which can include free breakfast at certain Hilton hotel types – like main Hilton hotels).

So with my credit card application strategy in April, I’ll apply for two personal cards and two business cards for a total available points to be earned of 200,000 points, two free weekend night certificates at select Hilton properties and complimentary gold status at Hilton.

- Starwood Preferred Guest® Credit Card from American Express

- Starwood Preferred Guest® Business Credit Card

- TARGETED OFFER: Business Platinum Card® from American Express

- Citi® Hilton HHonors™ Reserve Card

Bottom Line

I think there are several good credit card offers out there that meet my needs at this time, but I’m focusing on the ones above for the reasons mentioned.

If you are thinking about applying for a credit card in April, make sure you share your strategy for a chance to win a $100 gift card. You can enter by clicking this link and following the instructions in the post to enter.

Related Posts

- My April Credit Card Strategy + Win $100 For Sharing Yours?

- Free Hilton Gold Status for Cardholders

- How To Transfer American Express Membership Rewards To Travel Programs

- How To Link Travel Programs To American Express Membership Rewards Program

Sign up for Email || Twitter || Facebook || Tips & Tricks

Hotel Offers || Airline Offers || Bank Offers || Cash Back Offers

Points, Miles & Martinis will earn a referral credit for successful applications through the links in this post. We appreciate any support for Points, Miles & Martinis by using our affiliate links.

So really the Amex Platinum is 150k for $10k in 3 months, they just worded it weird. Correct?

Rookie mistake…..Hilton is so so dead………..

@PainCorp, nope it’s $20K to get all 150K MR

Hilton is still a great value for me anyway. Trip to HNL at Hilton Hawiian Village using 40000 points per nite and got upgraded from standard resort to rainbow ocean front with wifi and executive lounge, over $1,200 value. Breakfast for 4, water, snacks and apps, will save over $500.

Can you apply for the SPG personal card and still get the 25,000 offer if you have any AMEX card? Every time I try to get the offer, it identifies me as a current AMEX card holder, and no longer gives me the 25,000 point offer.

Hi Anky – that is because you have your cookies being picked up on your internet browser. If you clear your history / cache you can see the offer.

With respect to the Amex SPG personal card you really should mention there that supposedly as of May 1st, Amex will no longer allow you to get a bonus for a second time on the same card. Currently, you only have to allow 366 days to elapse after cancelling to get the bonus again when you re-apply. So there are good reasons to do an Amex application now (check the T&Cs on the ones you apply for though) since within a few weeks you may not qualify for the bonus anymore.

Hi Glenn – Good point. That is why I’m doing my April card applications. I’ve already had the SPG Amex, so if I get it now I should get the bonus, but if I wait, I will likely be disqualified based on what I’m hearing.