United is devaluing its award chart effective February 1.

And thinking about United’s really high pricing for international premium cabin awards, and international first class awards in particular, the more and more I’m liking international frequent flyer programs more and more, including international programs that add fuel surcharges onto award tickets.

Don’t get me wrong, fuel surcharges are bogus fees and they unfairly tax frequent flyers’ accumulated balances. For the most part they don’t really affect paid tickets, among other things they are a convenient mechanism for raising or lowering all fares in a given market. They serve as an excuse for airlines to take cash from members, claiming the miles pay for the base fare only and not any of the taxes or surcharges.

But when choosing a frequent flyer program to use, one that adds fuel surcharges to award tickets can make sense given the mileage savings involved. Think of fuel surcharges as cash and points awards. Depending on the price they can be very good or very poor values.

British Airways charges more and more miles for longer and longer flights, and charges additional miles for each flight segment. Los Angeles – Sydney roundtrip in first class is going to be 300,000 miles and nearly $1000 in taxes and fees. Add on Sydney – Auckland and it costs you even more. Gulp.

But it’s not always extortionate. Let’s take a look at American Express Membership Rewards transfer partner All Nippon.

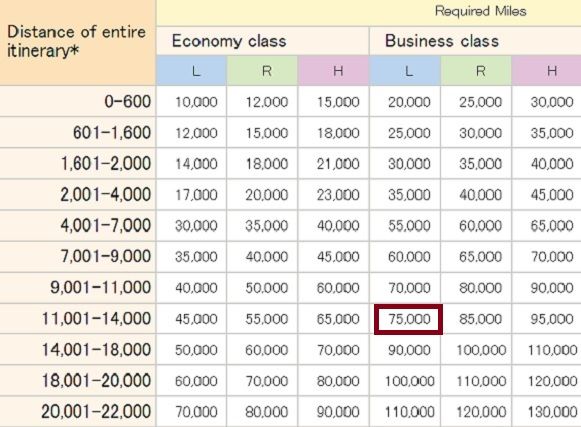

They have a distance-based award chart. They have a separate award chart for flying only their own flights, and pricing is seasonal.

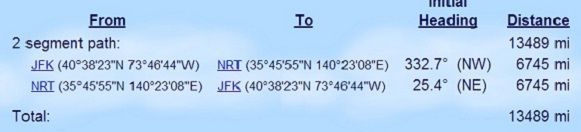

New York – Tokyo is 13,489 miles roundtrip.

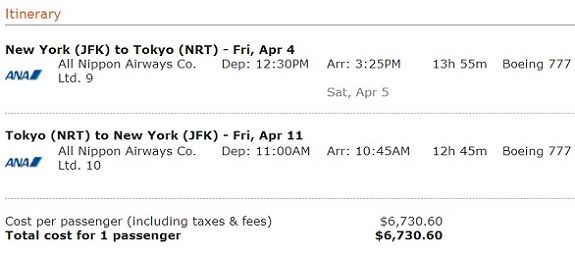

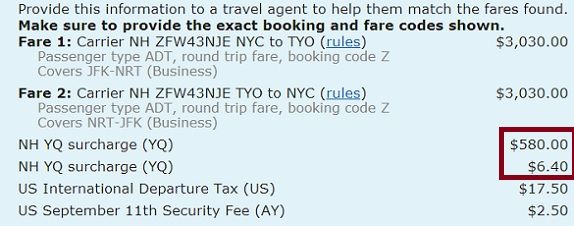

Here’s an itinerary in April, it costs $6731 in business class.

Fuel surcharges are $586. That’s how much more cash you’ll pay ANA to redeem these flights than you would if you were redeeming with United miles.

The roundtrip mileage cost of this award in April is 75,000 miles.

United’s new chart on the other hand will charge you 150,000 miles for this new itinerary. (130,000 if you stick to United flights, e.g. Newark – Tokyo.)

You’re still going to get a pretty decent return on your United miles, even with their new pricing, for this itinerary.

For comparison purposes, let’s use lower United itinerary price that MileagePlus is going to chart of 130,000 miles. That’s 65,000 miles more that ANA is going to charge for the itinerary on its own flights and it saves you $586. That’s a value of less than a penny a mile, the fuel surcharge from ANA means you’re buying back miles on the cheap by redeeming through the ANA Mileage Club program.

Fuel surcharges – when incurred with a program that has really reasonable mileage pricing or really fantastic award availability (such that you could compare their award chart almost to ‘Anytime’ awards or at least a three-tiered chart’s ‘medium’ level), can probably be thought of as offering cash and points awards.

- You can join the 30,000+ people who see these deals and analysis every day — sign up to receive posts by email (just one e-mail per day) or subscribe to the RSS feed. It’s free. You can also follow me on Twitter for the latest deals. Don’t miss out!

Yep this is why I switched my spending from chase ink to Amex and Starwood. North Asia in C is only 90k miles on Ana vs. 160k for UA! Much better deal.

I fly home to BOS from Japan often, so I’m looking for another program that works.

For the past 2 years, I’ve used the CSP exclusively because it is a Visa (Amex isn’t as widely accepted in Japan), it has an EMV chip, and no foreign transaction fees. I can’t think of another card that offers transferrable points that fits these requirements of being an expat. The closest thing is the Amex Platinum, but again, acceptance is spotty (and far less in other parts of Asia).

“That’s 65,000 miles more that ANA is going to charge for the itinerary on its own flights and it saves you $586. ”

This sentence needs to be fixed.

I use the Barclays Arrival points to pay for these high fee tickets. Works out great.

Indeed, with the UA devaluation the value of Amex points have imcreased relative to Chase. I agree with above posters. I now use my Amex cards preferentially within the UA but still use visa and MA while over seas. Wonder how Chase vuew UA’s devaluation of their program, and potential impacts to their revenue base?

Interesting thought experiment, but the comparison is lacking to me in a couple ways. For hotels, points+cash is an alternative within a program to a straight points award. Here that’s only true if you have points that transfer to both types of programs, but obviously not to points that are stranded, where the airlines makes the choice for you. Also, many (most?) hotels let you earn stay credit on points+cash awards, right (although some do on award stays generally)? I can’t see airlines doing that anytime soon.

While I recognize the logic in this analogy–and can acknowledge that paying points + cash is better than pure cash–I still find the whole ideally of paying such large sums to use my miles offputting, and I’d hate to see the practice spread.

I’d just take it a step further and convert the YQ to miles. In your example, say you valued Amex MR points at 1.5¢ each – the award would cost you 75000 + 586/.015 = 114000 MR points.

Interesting thought and comparison… Do you have any other examples/programs where this also would apply?

For the big – around the world or aspirational trips – don’t forget to originate your ANA award ticket in Brazil where the YQ goes away completely. Use Alaska, American, United, or other partners for a one-way flight to Brazil to start your itinerary

Great great article! Not that I ever expect anything less from you 🙂

We often find ourselves saying similar things to our clients when they tell us they want to avoid fuel surcharges. At the end of the day, they are often less severe than paying double or triple the number of miles! That said, for some – particularly those with millions of miles – all that matters is not paying cash out of pocket. For them, perhaps higher award rates seem to be the better deal.

Regardless – thank you for putting this in an easy-to-understand form. GREAT INFO!

Rather than “points and cash”, I look at these fuel surcharge airlines as “We never really have rewards,but you may get some discount” ticket purveyors. Except for specific niches useful to me without fuel surcharges (Avios in the Western Hemisphere, for example), I have no interest in those programs. In legitimate points and cash programs I know of, you can get the same product for just points. I have never figured out why the deceptive practice is even legal. More countries should follow Brazil’s example and make the airlines deal honestly with their customers.

Gary – does ANA charge YQ on UA metal? Is there a difference btw domestic and international?

@Paul – YQ is charged on United where United paid fares have a YQ. Domestic fares do not.