In this hobby, one of the main ways banks entice new customers to apply for a credit card is through an attractive sign-up bonus (SUB). Failing to hit the required minimum spend in the allotted time is a major mistake. But how do you know how much more spend you need to put on a card and how much more time do you have to do it? You could keep track of all of your expenses, or you could call customer service and ask them to verify, but fortunately Chase has an easier option to answer both questions.

Inside the Chase mobile app, but not currently on a web browser, you can easily see both the remaining required spend to reach the SUB threshold and how much time you have left to complete it. The timing is particularly nice to see because you should have more than 90 days from the date of the application to hit the required minimum spend. However, I have called Chase back-to-back to ask this question as a test and received different answers from different phone agents so having something in writing is reassuring.

How to Check Using the Chase Mobile App

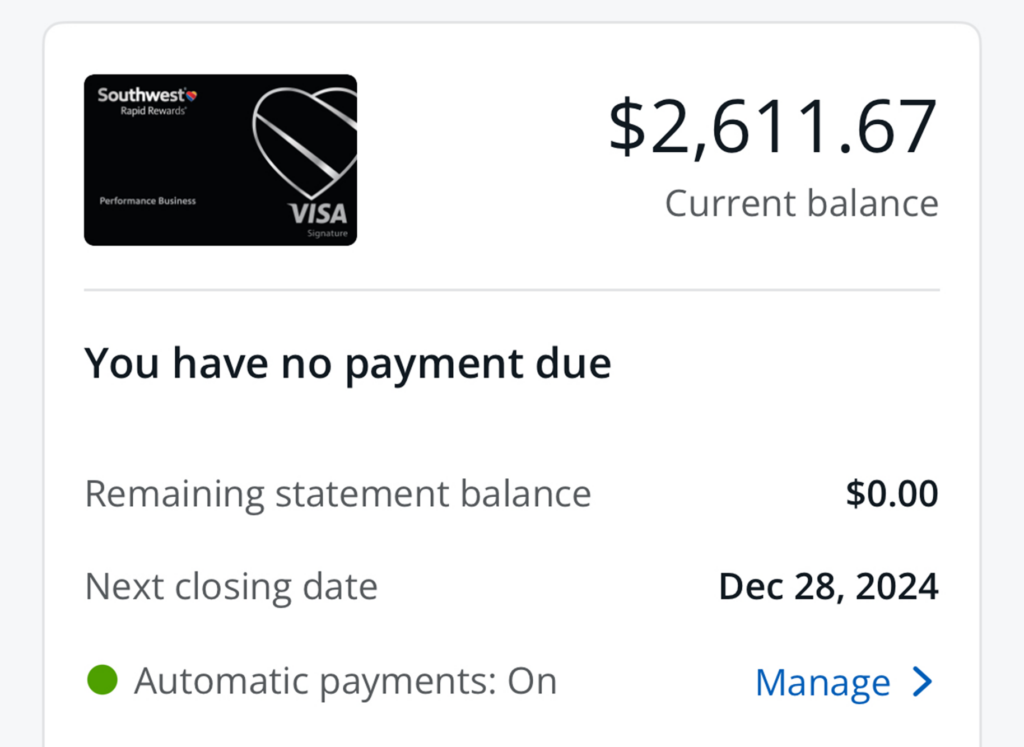

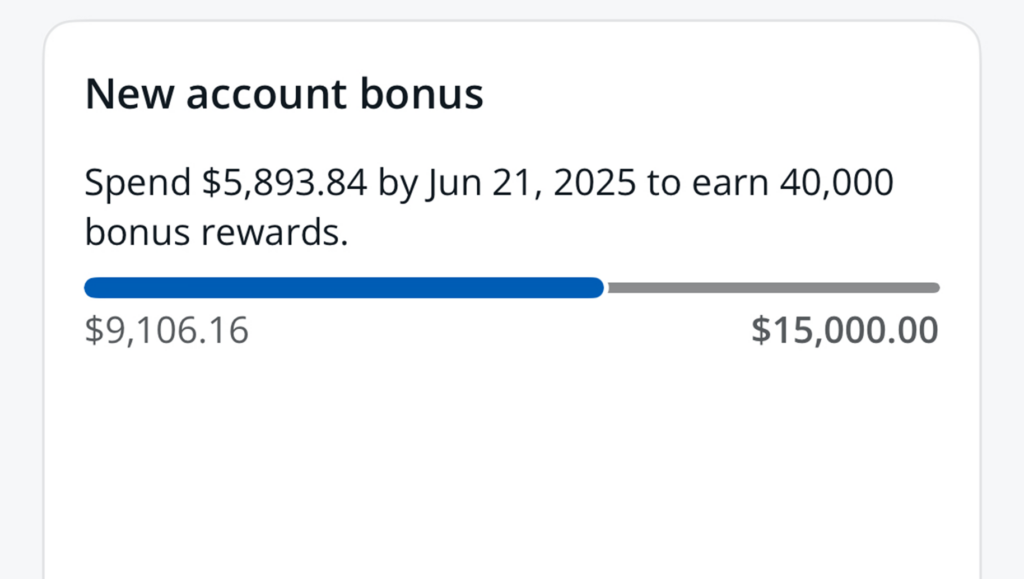

Simply open the Chase mobile app and login to the account of interest. From there you select the card of interest and scroll down to the section called New account bonus. This will show you progress towards meeting the minimum spend requirement and also the date you must complete it by.

In this example, I had a 2-tiered SUB offer on the Chase Southwest Performance Business card of 80,000 points after $5k spend in 3 months and an additional 40,000 points after a total of $15k spend in 9 months. Wanting all of my points to post as early in 2025 as possible to get a nearly-two-year Southwest Companion Pass I quickly hit the first $5k threshold as soon as my November 2024 statement had closed. In this case I had until June 21st to complete the remaining spend, but I completed it as quickly as possible in early 2025.

TL;DR: Don’t miss a sign-up bonus on your new Chase card. Easily track your minimum spend progress and remaining time to hit it in the Chase mobile app.

But is this only updated after each month when the statement closes? It’s not real time is it? At least that’s what I was told.

I believe it updates when new charges move from pending to posted. I haven’t worked on a new card minimum spend for a few months now so I am not 100% sure, but when I was checking this one I believe it updated often.