Making Travel Less Taxing: Introduction

Your Tax Home (Away from Home)

Airfare and Transportation

Lodging and Meals

Entertaining Clients

Car Expenses

The Nitty Gritty: Required Receipts and Tax Forms

Ask Scott!

Greetings, travelers and taxpayers! For the past seven weeks, I have covered the general parameters of tax law on travel and entertainment costs. Thanks so much to Ben for the chance to contribute to his blog and to you all for the feedback and questions posed along the way. In the tradition of Ben’s timely and helpful “Ask Lucky” series, we’ll conclude the series with my answering some of your questions left in the comments or in emails and tweets to me. If your question was not answered or if you have others in the future, feel free to leave them in the comments, and I’ll do my best to answer. Or, if you’d rather contact me directly, you may do so on my law firm website. Please also note the disclaimer that follows this post.

1. Deducting convenience fees paid for using a credit or debit card to pay taxes.

Blog reader UAPhil asks, “ I’m a passive rental property investor. If I pay the associated property taxes with a credit card, are there any problems deducting the Official Payments 2.5% (or equivalent) fee as a rental expense on Schedule E? (If that’s OK, net after tax cost to me is around 1.5%, which makes the fee well worth paying for Starwood Amex.)”

Fees paid for the ability to pay your income tax liability with a credit or debit card are deductible as a miscellaneous itemized deduction on Line 23 of Schedule A, Itemized Deductions, subject to a 2% of adjusted gross income threshold. If that concept sounds familiar from previous posts, it’s the same category of expenses where unreimbursed employee business expenses fall. So, if your income is $50,000, your first $1,000 (2% of $50,000) would not provide any tax benefit to you, but for items above that amount, you would be able to deduct the cost of such fees as long as you itemize deductions. Practically, what that means is that most taxpayers will not be able to get any reduction in their tax liability for paying convenience fees despite them being deductible in a technical sense.

To answer Phil’s direct question, some state and local governments permit the payment of real estate taxes or property taxes by credit card for a fee. Those convenience fees would not be deductible as a state and local income tax payment but would qualify as a miscellaneous itemized deduction subject to the 2% threshold. Thus, unless you have other miscellaneous itemized deductions, I would not adjust the after-tax cost of paying by credit card from the 2.5% fee you mentioned. For more on miscellaneous itemized deductions, check out this IRS publication.

2. Deducting travel costs incurred to check on an investment property.

Blog reader TheBeerHunter asks, “What deductions can be taken for a visit to an investment property in another state?” Blog reader Rich asks a similar question: “So if I fly back to AZ where I have a rental house in a LLC, can I deduct part or all of my expenses (air, hotel, food)?”

Yes, you can deduct travel costs related to your managing a rental property subject to the other restrictions covered in the airfare and lodging and meals posts. In brief, those restrictions are that the property must be away from your tax home, the expenses must be ordinary and necessary to managing your property, and the trip’s primary purpose must be business (for airfare) or you must allocate business and personal days (for lodging and meals). For example, if you took a trip to collect rent, make repairs, or market the property, you would deduct those on Schedule E as an expense of your rental property. If some of the days spent away from home were for personal vacation, you’d only deduct the meals and lodging for the days spent on business matters.

If the purpose of your trip is not to make repairs or find a tenant but is to make a substantial improvement to the property or build a new property, your travel costs would be capitalized along with the cost of the improvement or property and depreciated over the life of the rental (27.5 years for most rental properties). If your income is $150,000 or less, then you can deduct losses from rental properties of up to $25,000 against your other income. If your income is higher than $150K, you can only deduct your rental losses (what the IRS terms “passive activities”) to the extent you have income from rental properties.

If the property is not being rented but is instead a piece of property you bought to later sell, then your costs would be deducted on Schedule A as a miscellaneous itemized deduction subject to the 2% threshold.

Expenses incurred to travel to actively manage a rental property are deductible against rental income, while expenses incurred to purchase land for investment are considered miscellaneous itemized deductions.

3. The audit risk of making multiple estimated tax payments throughout the year.

Blog reader, fellow lawyer, and prolific tweeter Mark @palmerlaw asks, “I’m curious what Scott says regarding estimated tax payments. Any pitfalls? Audit triggers?”

Mark, presumably, you are asking the question because you’re interested in using a points earning card to make payments through online payment companies approved by the IRS that impose limits on how much can be paid in one transaction. So, rather than sending in four quarterly checks to the IRS for estimated tax payments, you may choose to pay smaller amounts much more frequently. By doing so, you end up paying the same total amount of taxes, but you do so with many smaller transactions that earn you miles and points.

The crediting to your tax account of those payments is automated, and I have no knowledge of any audit triggers or specific audit programs in place at the IRS that would target frequent payers. As you may expect, the Service tends to target those who do not pay more closely than those who do. 🙂 That said, as discussed last week, the IRS may target your return based on specific items in your return or on a completely random basis. If you choose to make frequent payments, make sure you keep careful track of your payments made by registering for an account at EFTPS so you can accurately report them on your return.

4. The threshold for reporting income earned out of state.

Blog reader Lark asks, “At what threshold am I required to pay taxes in a state that I spend a lot of my time working in?”

Lark, every state is different. I would google “(state name) department of revenue” for the state that you are working in and find the instructions for individual income tax returns for that state. Then, search the instructions to determine the state’s rules; many states have income thresholds below which no return need be filed.

In many cases, what happens is that your employer withholds taxes in that second state, so it’s in your best interest to file a non-resident or part-year resident return to have those withheld taxes refunded to you. Otherwise, there is no way to recapture those taxes.

5. Foreign tax credits for taxes paid while working abroad.

Blog reader Matt says, “I have a foreign tax credit that I’m carrying forward and it’s pretty complicated.” In addition, an email question from a reader in Switzerland asks, “how do I report my foreign paid taxes on my U.S. return?”

The U.S. taxes its citizens on worldwide income regardless of where the income is earned. Even if you no longer live in the U.S., unless you renounce citizenship, you must file a U.S. tax return to report income earned abroad. In theory, you could be paying tax on the foreign income to the foreign government and then again to the IRS. Practically, few taxpayers pay tax on income twice, though, because payments made to a foreign government (whether the foreign federal government or a foreign state or municipality) are deductible as a tax credit on your U.S. return on Form 1116. The administration of the credit may be country-specific due to individual tax treaties that the U.S. has with specific countries. But, in general, most western European countries have higher tax rates than the U.S., so taxpayers who work abroad almost always get a tax credit for foreign taxes paid that more than covers their U.S. liability.

For more information on what foreign taxes qualify, check out this IRS page. In short, taxes based on income are eligible for the credit, but no deduction or credit is allowed for social security taxes paid or accrued to a foreign country with which the United States has a social security agreement.

For taxpayers working abroad, taxes paid to a foreign government are deductible as a credit against their U.S. tax liability.

6. Deducting the purchase of luggage.

Blog reader Segments asks “would the purchase of a carry-on bag be considered a deductible travel expense?”

Tax law generally does not permit the deduction of personal items. Tangible personal property items, such as clothing, jewelry, luggage, furniture, and guns are typically not deductible. Certainly there are exceptions (e.g., airline uniforms worn by crew members or guns purchased by a farmer to manage wildlife), but a standard carry-on bag does not immediately come to mind as such an exception. I could concoct a scenario wherein you perhaps had to buy a particular carry-on bag for business reasons (laptop carrying case?) that if used for business purposes could be deductible, but in general, a traditional roll aboard bag that you are using for personal travel is not deductible.

7. Difference between marginal rate and effective tax rate.

Twitter follower @mark_shoffner asks, “what’s the difference between my marginal income rate and my effective tax rate?”

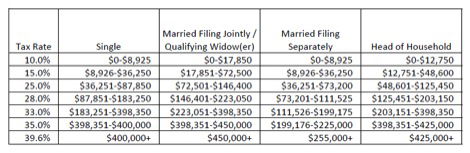

Mark, the 2013 tax rate schedule is as follows:

When someone mentions their marginal tax rate, they are referring to the rate at which marginal or additional dollars are being taxed. Thus, if someone is in the 25% tax bracket, each additional dollar of taxable income that is earned will be taxed at 25%. However, a taxpayer’s average tax rate (also known as the effective or overall tax rate) is a blended rate that considers the fact that some income is taxed at lower rates. A frequent concern of many clients after relaying the initial good news of a bonus or raise is, “will this put me in a new tax bracket?” The short answer may be yes, but the more accurate answer is that only those dollars which exceed the previous income tax strata will be taxed at the higher rate; it’s a progression, not a cliff.

To calculate your effective tax rate, take your total tax (line 61 of page 2 of Form1040) and divide it by your taxable income (line 43 of page 2 of Form 1040).

Have more questions? Leave them in the comments, or send me a tweet @ScottTaxLaw or an email on my website.

Although this is the last post in the series, you can’t fly away from tax liabilities; feel free to stay in touch with future questions.

Disclaimer: While I hope the information I provide will be helpful (and hopefully even humorous at times), none of this information should be construed as offering legal advice or creating an attorney-client relationship between the reader and my law firm. You should not act or refrain from acting based on this advice and should consult your own attorney or CPA regarding your specific tax matters. IRS Circular 230 Notice: Nothing in these communication is intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

Can a contractor (not employed) working out of state, take the per diem amount for lodging as a tax deduction? Or, must actual lodging expenses be used?

@Tim - If a hypothetical travel blogger were to view online reviews of airfare and food products as an integral part of his or her business, then I think perhaps such expenses could be considered ordinary and necessary in the course of their business and therefore deductible.

Lest anyone want to start a random blog to deduct all their travel costs, remember that the IRS presumes any activity in which you don't earn a...

@Tim - If a hypothetical travel blogger were to view online reviews of airfare and food products as an integral part of his or her business, then I think perhaps such expenses could be considered ordinary and necessary in the course of their business and therefore deductible.

Lest anyone want to start a random blog to deduct all their travel costs, remember that the IRS presumes any activity in which you don't earn a profit inf or 2 out of 5 years to be a hobby and non-deductible.

Scott @HackMyTrip also responded to this question in the post "Your Tax Home (Away from Home) as follows:

February 19th, 2013 at 10:43 am

Scottrick said,

@johnnycakes – I know some travel bloggers deduct every penny of their travel expenses. I’m not comfortable going that far. A fair amount of mine involves visiting family with absolutely no relation to the blog.

@RV - Expenses for the production of income, such as investment advisory fees, are deductible subject to the 2% limit. Travel expenses related to the production of income, though, are not specifically mentioned. I think deducting travel costs to meet with an investment adviser who is managing paper securities (that is, not real property, but intangible property such as a stocks or mutual funds) would be aggressive. On audit, the IRS agent would likely question...

@RV - Expenses for the production of income, such as investment advisory fees, are deductible subject to the 2% limit. Travel expenses related to the production of income, though, are not specifically mentioned. I think deducting travel costs to meet with an investment adviser who is managing paper securities (that is, not real property, but intangible property such as a stocks or mutual funds) would be aggressive. On audit, the IRS agent would likely question the necessity of travel versus a phone conference. Compare a rental property where you may need to physically be there, and you can see the argument the IRS is likely to make.

Given that most taxpayers won't get to deduct such costs due to the 2% limit, this isn't a frequently litigated matter; thus, I know of no case on point, so I would rely on your CPA or tax attorney to make the best decision for you based on the level of risk you are comfortable.

If you were to take a deduction for the trip, the allocation is based on the purpose of the trip and the time spent on business and personal matters. If the primary purpose of the trip was business, then you can deduct all of the airfare cost, and you should allocate meals and lodging based on whether it's a business or personal day. For more info, check out my earlier posts on airfare and meals and lodging.

How would deductions work for a travel blogger? Can they deduct airfare/hotel/food as a business expense because they post a review of the product?

Thanks Scott - situation is similar to #2, but I'm curious about expenses to visit out of state investment advisor - I believe these would also be subject to 2% AGI with some allocation if trip is extended for personal time - Am I missing anything? Any suggestions how to do the allocation?