World of Hyatt has just launched its newest global promotion, after opening registration a bit over a week ago. The program hasn’t had a global promotion since fall 2023, so I’m sure many people are happy to see the return of an offer. While this promotion is better than nothing, it’s also not the most exciting promotion we’ve seen from the program.

In this post:

World of Hyatt spring 2024 global promotion details

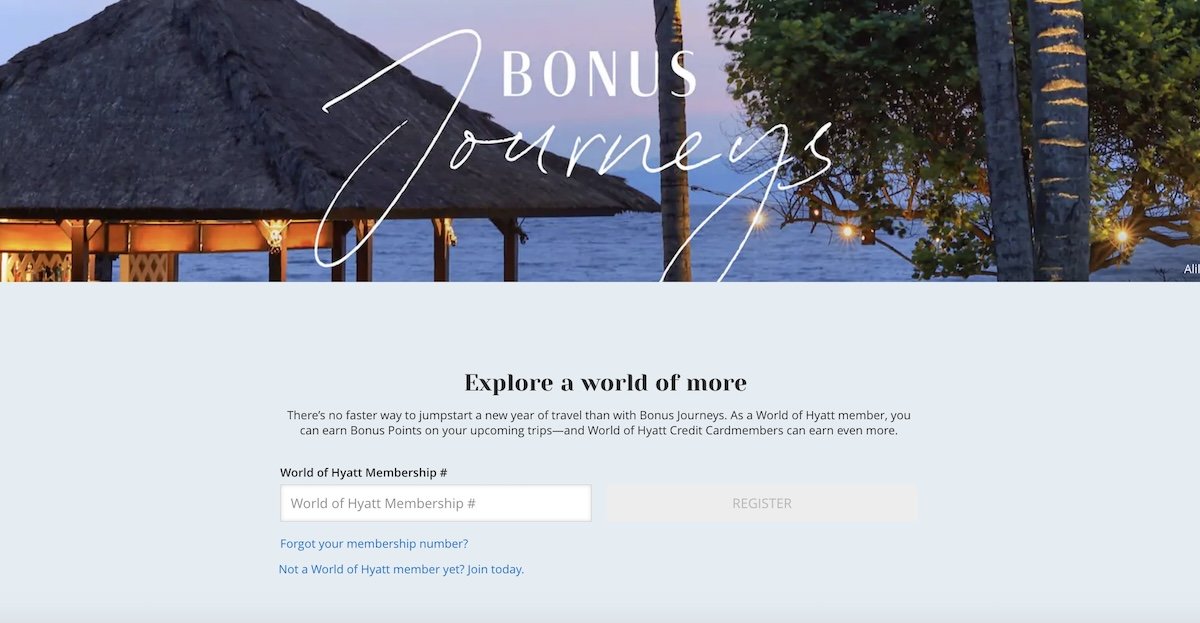

Registration is open for World of Hyatt’s Bonus Journeys promotion, which is now live. This offer is valid for stays globally between March 1 and April 30, 2024. With this offer:

- Earn 3,000 bonus points for every three qualifying nights, up to a total of 21,000 bonus points, at all properties globally

- Those with the World of Hyatt Credit Card (review) or World of Hyatt Business Credit Card (review) can earn an additional 1,000 bonus points for every three nights at properties in 18 participating destinations — Australia, Germany, Hong Kong, India, Indonesia, Japan, Mainland China, Macau, Malaysia, Mexico, New Zealand, South Korea, Spain, Taiwan, Thailand, United Arab Emirates, United Kingdom, and Vietnam

That means between those two aspects of the offer, you could earn up to 28,000 bonus points. There are some details to be aware of with this promotion:

- Registration is required prior to your first eligible stay, and between February 22 and April 15, 2024

- The promotion kicks in starting with your first stay; the nights requirements are cumulative, so you’re rewarded the same whether you make one stay of three nights or three stays of one night

- The main promotion is valid for stays at all Hyatt properties, plus Small Luxury Hotels of the World locations; meanwhile the credit card promotion only applies at properties in select destinations

- Any stay booked directly with Hyatt qualifies toward the promotion, including stays booked prior to the start of the promotion, as well as award stays

- The check-out dates must fall within the promotion period, so in order for a stay to be eligible, you must check-out between March 1 and April 30, 2024

- You can earn up to 28,000 World of Hyatt bonus points with this promotion, and you’d accrue that after spending 21 nights at eligible hotels

- Only one room can qualify toward this promotion; so while you can earn points for multiple rooms, you would only earn the bonus based on one room

Crunching the numbers on Hyatt’s promotion

How lucrative is World of Hyatt’s Bonus Journeys promotion? For context, I value World of Hyatt points at ~1.5 cents each:

- With the main part of this promotion, you’re earning 1,000 bonus points per night in the right increments, which is a ~$15 return per night

- With the credit card portion of the promotion, you’re earning 333 bonus points per night in the right increments (but only at some properties), which is ~$5 per night

So for your first 21 nights, you’d earn anywhere from 1,000 to 1,333 bonus points per night. I’d say that’s not bad if you’re staying at an inexpensive property (especially if redeeming points), while it’s not going to move the needle much for a stay at an expensive property.

Just to recap World of Hyatt’s regular points earning rates:

- World of Hyatt members ordinarily earn 5x base points per dollar spent at Hyatt properties

- Elite members receive further bonuses — Discoverists earn an extra 0.5x points per dollar spent, Explorists earn an extra 1.0x points per dollar spent, and Globalists earn an extra 1.5x points per dollar spent

- If you pay with the World of Hyatt Credit Card (review) or World of Hyatt Business Credit Card (review) you earn an extra 4x points per dollar spent

As a Globalist member paying with a co-branded credit card, I’m ordinarily earning 10.5x points per dollar spent, which is a 15.75% return. Then eligible stays with this promotion would earn me 1,000-1,333 bonus points per night.

Other World of Hyatt offers to take advantage of

In addition to the new World of Hyatt promotion, keep in mind the other ongoing offers from World of Hyatt:

- You can earn 500 bonus points when you stay at a new Hyatt hotel

- You can earn a free Category 1-4 free night when you stay at new Hyatt brands with the Brand Explorer promotion

- American AAdvantage and World of Hyatt have a partnership, allowing elite AAdvantage members to earn bonus American miles for Hyatt stays

- You can maximize value with Hyatt stays by booking through the Hyatt Privé program

Other ways to earn World of Hyatt points

If you’re looking to earn more World of Hyatt points, the good news is that Hyatt points are pretty easy to come by. In addition to being able to earn World of Hyatt points with the World of Hyatt Credit Card (review) or World of Hyatt Business Credit Card (review), you can also transfer over points from Ultimate Rewards. This is one of my favorite uses of Chase points.

- Earn 4x Points at Hyatt Properties

- Free Night Every Year

- Complimentary Discoverist Status

- $95

- Earn 4x Points at Hyatt Properties

- Complimentary Discoverist Status

- Gift Discoverist Status up to 5 Employees

- $199

- 5x total points on travel purchased through Chase Travel

- 3x points on dining

- 2x points on travel purchases

- $95

- 3x points on Travel after the $300 Annual Travel Credit

- 3x points on Dining

- $300 Travel Credit

- $550

- Earn 3x points on travel

- Earn 3x points on shipping purchases

- Cell Phone Protection

- $95

- Earn unlimited 1.5% cash back on all purchases

- Car Rental Coverage

- Extended Warranty Protection

- $0

- Earn 5% Cash Back at office supply stores

- Earn 5% Cash Back on internet, cable TV, mobile phones, and landlines

- Car Rental Coverage

- $0

- Earn 3% Cash Back on Dining

- Earn 3% Cash Back at Drugstores

- Earn 1.5% Cash Back On All Other Purchases

- $0

See this post for everything you need to know about earning Hyatt points with credit cards. On top of that, World of Hyatt frequently sells points at a discount.

Bottom line

World of Hyatt has launched its first Bonus Journeys promotion of 2024, so be sure that you register. Between March 1 and April 30, members can earn 3,000 bonus points after every three nights at all properties globally, and those with a co-branded Hyatt card can earn 1,000 bonus points after every three nights at select properties. Between the two offers, you can earn a total of up to 28,000 bonus points.

What do you make of the spring 2024 World of Hyatt Bonus Journeys promotion?

So, promotions exist to modify customer actions. (e.g. - I would spend money on Hyatt that I wouldn't have otherwise, because I feel points are valuable.)

Given Hyatt's annual devaluation of categories and plummeting value of their points currency, this will modify 0 of my behavioral patterns.

What is the math on even bothering with this? Why do they have promotions?

Does the 3 nights have to be at the same Hyatt property or can it be 1 night x 3 at different Hyatt hotels?

One of the worst hotel cards; more and more, it is impossible to find a decent category 4 hotels; cancelling my card this year.

Agreed, their annual category nerfs are getting tiresome. I'm also cheesed about "oh you want a category 8 certificate? Spend 150 nights with us!"

Hard no. I don't professionally live in hotels.

Tried to register & it tells me that i am ineligible. I bought points during the error sale a few days ago, I wonder if the two are related.

No, the support said there is an issue w/ registering online right now and to try again later.

Tried to sign up and got a response "Sorry, you are not eligible for this promotion".

Huh? What eligibility criteria are there other than being a WOH member?

Hopefully it is a glitch that will clear itself up in the next few days

Hyatt just discriminates non-US members who have no way of getting the Chase card or can transfer points from any other credit card to WOH. Even for us in Canada. The only way for us to earn points is thru stays. Points for stays have not budged for years. Still 30% for Globalist since Gold Passport days, and we lost the 1000 welcome bonus points for elite members after programme changed to WOH.

The level of entitlement and delusion has gone through the roof these days.

This is not discrimination. Discrimination is when you are denied rights to something you are entitled to have, like the right to free speech, etc.

A hotel rewards program is not discrimination. Not everything is equal in life. Suck it up and move on.

If I check in on 22 Feb to 10 Mar, do I get 10 qualifying nights or 17 qualifying nights?

You get 3K points for every night of your stay. How are coming up with 10 nights? The promo is to the end of April.

Sorry I couldn't edit my previous comment. After I reread your question.

Your stay counts only from 1st March.

No that is incorrect. Jason will earn all 17 qualifying nights.

How did the last (Fall 2023) promotion work? Anyone have a link to it or story about it?

If my stay begins Feb 28th and my checkout is on March 4th (5 nights), will any or all of this stay be counted towards the promotion?

The promo will start counting from 1st March.

Thank you for the follow-up and helpful answer!

Not to beat a dead horse, but the verbiage is a little confusing. The exact verbiage of the promotion says “Only Eligible Nights completed after registration and between March 1 and April 30, 2024, (“Promotion Period”) will count towards this promotion.”

I have a stay booked from 2/29-3/3. I would be “completing” the 2/29 night on 3/1 (would still be in the hotel even if I was checking out that day).

But if...

Not to beat a dead horse, but the verbiage is a little confusing. The exact verbiage of the promotion says “Only Eligible Nights completed after registration and between March 1 and April 30, 2024, (“Promotion Period”) will count towards this promotion.”

I have a stay booked from 2/29-3/3. I would be “completing” the 2/29 night on 3/1 (would still be in the hotel even if I was checking out that day).

But if I understand what you are saying the 2/29 night would not count because it goes by the night stayed (vs completed)? Bummer…. Thanks

Ok they added more FAQs to address my exact question. Doesn’t count 2/29. :(

9. I have registered for the promotion and have a stay on February 29 with a checkout on March 1, 2024. Will the night count towards the promotion?

No, only Eligible Nights completed between March 1 and April 30, 2024, count toward the promotion.

Do you know if award stays qualify?

They typically do

Okay, so most US-based folks can safely just ignore the cardmember bonus part of this. Functionally, it's a 21k point bonus (still not bad), not 28k point, for us.

Exacly, especially given that their international footprint is even smaller than their already small presence here in the US.