Turn Your Rent into Free Flights with Bilt Rewards

Imagine transforming your largest monthly expense—rent—into a gateway to free travel. With Bilt Rewards, this isn’t just a possibility; it’s a reality. This innovative program allows renters to accumulate points on their rent payments and redeem them for incredible rewards, including free flights. In this comprehensive guide, we’ll delve deep into how you can leverage Bilt Rewards to turn your rent payments into unforgettable travel experiences, and we’ll share insider tips to maximize your earnings.

What Is Bilt Rewards?

Bilt Rewards is a groundbreaking loyalty program designed specifically for renters, offering them the unique opportunity to earn points on rent without any extra fees. Traditionally, renters have missed out on the reward opportunities that homeowners enjoy through mortgage-linked credit benefits. Bilt Rewards bridges this gap by partnering with major property management companies and offering a seamless platform for renters to earn valuable points.

The program is free to join and integrates smoothly with your existing rent payment methods. Whether you pay through an online portal, check, or even if your landlord doesn’t accept credit card payments, Bilt has you covered. By using the Bilt Mastercard, you can pay your rent and earn points without any transaction fees. This approach not only incentivizes timely payments but also adds significant value to your financial routine.

But Bilt Rewards doesn’t stop at rent payments. The program offers a diverse range of redemption options, from travel and fitness classes to home decor and even the option to use points towards a down payment on a house. As highlighted in our article on Creative Ways to Use Travel Rewards, diversifying your redemption options can lead to greater satisfaction and value.

One of the most compelling aspects of Bilt Rewards is its extensive network of partners. By understanding how to navigate and utilize these partnerships, renters can unlock a world of possibilities and make the most of every dollar spent on rent.

How to Earn Points Paying Rent

Accumulating Bilt points is a straightforward process, but maximizing your earnings requires a strategic approach. Here’s how you can earn points efficiently:

1. Paying Rent Through Bilt: Once you join Bilt Rewards, you can start earning points simply by paying your rent through their platform. If your landlord is part of the Bilt Rewards Alliance, you can link your rent payment directly. If not, you can use the Bilt Mastercard to pay rent, and Bilt will send a check to your landlord on your behalf. This method ensures you earn 1 point per dollar on rent payments without any fees.

2. Utilize the Bilt Mastercard for Everyday Spending: The Bilt Mastercard isn’t just for rent. You earn:

- 3X points on dining: Use your card at restaurants, coffee shops, and even food delivery services.

- 2X points on travel: Earn points on flights, hotels, car rentals, and transit.

- 1X points on other purchases: From groceries to utilities, every swipe counts.

Remember, to earn points on rent, you need to make at least five transactions per statement period on your Bilt Mastercard.

3. Take Advantage of Bilt’s Bonus Opportunities: Bilt frequently offers promotions that can significantly boost your point earnings. For example, on the first day of each month, known as Rent Day, members can participate in challenges and trivia to earn bonus points. Staying informed about these promotions is key to maximizing your rewards.

4. Engage with Bilt Partners: Bilt has partnerships with popular brands and services. Linking your Bilt account with partners like Lyft allows you to earn points on rideshares. Additionally, booking fitness classes through Bilt’s app with studios like SoulCycle can earn you extra points and exclusive perks.

Redeeming Bilt Points for Free Flights

Once you’ve accumulated points, redeeming them effectively is crucial to unlocking maximum value. Bilt Rewards shines in this aspect by offering a robust selection of travel partners and flexible redemption options.

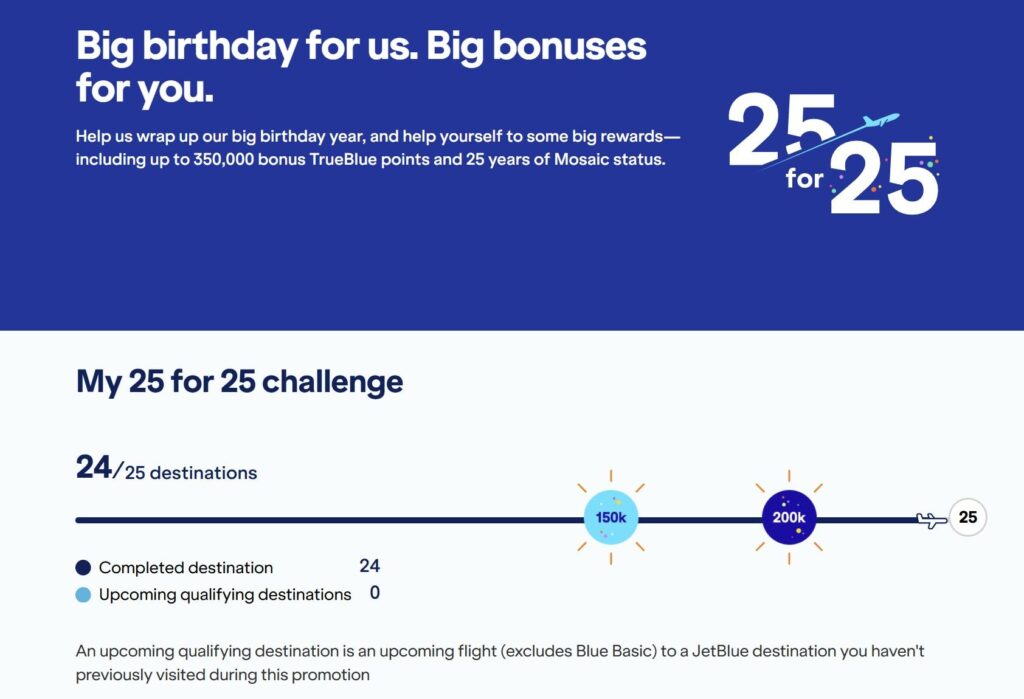

1. Transfer Partners: Bilt allows you to transfer your points 1:1 to over a dozen leading airline and hotel loyalty programs, including:

- American Airlines AAdvantage

- United MileagePlus

- Frontier Miles

- JetBlue TrueBlue

- World of Hyatt

- Hilton Honors

Transferring points to these partners can unlock award flights and hotel stays around the globe. For instance, transferring 60,000 Bilt points to World of Hyatt could get you two nights at a luxury property worth over $1,000.

2. Bilt Travel Portal: Alternatively, you can book travel directly through the Bilt Travel Portal. This option allows you to use points to book flights, hotels, and car rentals without worrying about blackout dates or award availability. Each point is typically worth 1.25 cents when redeemed this way, which can be a good value for certain bookings.

3. Maximize Transfer Bonuses: Occasionally, Bilt offers transfer bonuses to specific partners. For example, a 25% bonus when transferring to American Airlines means your points go further. Keep an eye on Bilt communications to take advantage of these limited-time offers.

4. Combine with Other Points: If you’re enrolled in other loyalty programs, you can combine points from different sources to book that dream flight. This strategy is especially useful if you’re just shy of the points needed for an award.

Maximizing Your Bilt Rewards

To truly make the most of Bilt Rewards, consider implementing these advanced strategies:

1. Pay Attention to Spending Caps: While you can earn unlimited points on non-rent spending, there’s a cap of 100,000 points per year on rent payments. If your rent is particularly high, plan your spending to maximize earnings without hitting the cap prematurely.

2. Leverage Rent Day Promotions: Participate in Bilt’s monthly Rent Day promotions. These can include earning double points on non-rent spend or winning bonus points through games and challenges. For detailed strategies on making the most of these promotions, refer to our guide on Rent Day Rewards Strategy.

3. Optimize Dining and Travel Spend: Since the Bilt Mastercard offers higher earning rates on dining and travel, use it for these categories. If you dine out frequently or travel often for work or leisure, this can significantly boost your point balance.

4. Stack Rewards with Partner Programs: Link your Bilt account with partners like Lyft and fitness studios. This not only earns you Bilt points but also rewards within the partner’s loyalty program, effectively double-dipping on rewards.

5. Monitor Credit Score Impact: Bilt offers free rent reporting to the credit bureaus, which can help build your credit history. Ensure timely payments to positively impact your credit score, opening up more financial opportunities. For more on how rent payments affect credit, see our article on Rent Payments and Your Credit Score.

Benefits Beyond Free Flights

While turning rent into free flights is a headline benefit, Bilt Rewards offers a suite of other advantages:

1. Homeownership Opportunities: You can redeem Bilt points towards a future home down payment. Every 100,000 points is equivalent to $1,250 towards a down payment, providing a unique bridge from renting to owning.

2. Fitness Perks: Bilt’s partnerships with fitness studios like SoulCycle, Y7 Studio, and Rumble Boxing offer members exclusive class credits and amenities. By booking classes through the Bilt app, you earn points and enjoy perks like complimentary shoe rentals and water.

3. Rent Protection: Bilt offers up to $5,000 in reimbursement coverage for eligible new purchases made with your Bilt Mastercard, adding a layer of security to your spending.

4. Access to Special Events: Members receive invitations to exclusive events such as concerts, art shows, and dining experiences. These opportunities enhance your lifestyle and provide unique experiences that go beyond typical rewards.

5. No Foreign Transaction Fees: For travelers, the Bilt Mastercard doesn’t charge foreign transaction fees, making it an ideal companion for international trips.

Potential Caveats and Considerations

While Bilt Rewards is highly advantageous, it’s important to be aware of certain considerations:

1. Credit Card Usage: The Bilt Mastercard requires responsible use. Carrying a balance and accruing interest can negate the value of the rewards earned. Always aim to pay off your balance in full each month.

2. Activity Requirements: To earn points on rent, you must make at least five transactions per statement period. Plan your spending to meet this requirement without making unnecessary purchases.

3. Point Valuation: While Bilt points are valuable, ensure you’re redeeming them for rewards that provide good value. Transferring to travel partners often yields the highest return, especially for premium cabin flights.

4. Landlord Participation: Not all landlords or property management companies may be familiar with Bilt. If using the Bilt Mastercard to pay rent, ensure your landlord accepts checks sent on your behalf or work with Bilt to facilitate the payment process.

5. Rewards Cap on Rent: Remember the annual cap of 100,000 points on rent payments. If your rent is high, you may reach this cap before year-end, so plan your points strategy accordingly.

Success Stories: Renters Who’ve Flown for Free

Many renters have successfully turned their rent payments into memorable travel experiences. Take Sarah, a New York City renter who used Bilt Rewards to earn enough points for a round-trip business class flight to Europe. By paying her $2,500 monthly rent through Bilt and using the Bilt Mastercard for dining and travel, she accumulated over 100,000 points in a year. Transferring her points to American Airlines during a transfer bonus promotion amplified her balance, allowing her to book a flight worth over $3,000.

Another example is Mark and Lisa, a couple in San Francisco. They combined their Bilt points to book a luxurious hotel stay in Hawaii for their anniversary. By maximizing dining and travel spend on their Bilt Mastercard and participating in Rent Day promotions, they elevated their vacation without extra out-of-pocket costs.

These stories illustrate the tangible benefits of leveraging Bilt Rewards effectively. For more inspiration, read our collection of Reward Redemption Stories from savvy travelers.

Getting Started with Bilt Rewards

Ready to turn your rent into a rewarding travel experience? Here’s how to begin:

1. Sign Up for Bilt Rewards: Visit the Bilt Rewards website and create an account. The process is quick and free.

2. Apply for the Bilt Mastercard: To maximize your earning potential, apply for the Bilt Mastercard. Remember, there’s no annual fee, and it enhances your ability to earn points on rent and other spending.

3. Set Up Rent Payments: Link your rent payment to Bilt. If your landlord is part of the Bilt Rewards Alliance, the integration is seamless. If not, set up payments through the Bilt app or use the Bilt Mastercard.

4. Strategize Your Spending: Plan your monthly expenses to meet the five-transaction minimum and maximize earnings in bonus categories.

5. Stay Informed: Keep an eye on Bilt communications for promotions, transfer bonuses, and new partner announcements. Subscribing to our newsletter at BoardingArea can help you stay ahead of the curve.

Conclusion: Start Your Journey Today

Transforming your rent payments into free flights is an innovative way to make your money work harder for you. Bilt Rewards offers a unique opportunity for renters to reap benefits traditionally reserved for homeowners or frequent flyers. By understanding the program’s nuances, strategically earning and redeeming points, and staying engaged with promotions, you can unlock a world of travel and lifestyle rewards.

Don’t let your rent be just another bill. Make it a stepping stone to your next adventure. Join Bilt Rewards today and take the first step towards turning everyday expenses into extraordinary experiences. For more expert advice on maximizing travel rewards, explore our comprehensive guides on Maximizing Travel Rewards and Guide to Points Transfer Strategies. Or, hop back to our homepage at BoardingArea for more insights and tips.

Happy earning, and see you in the skies!