Maximizing Capital One Hotel Partners for Frequent Flyers

What Are Capital One Hotel Partners?

I’ve been keeping a close eye on credit card rewards for quite some time, and I’ve noticed how Capital One’s addition of hotel transfer partners has truly broadened the playing field. While many folks tend to focus on airline redemptions—particularly well-known carriers like Turkish Airlines Miles & Smiles or British Airways Avios—I’ve found that the hotel side can be equally valuable. Accor Live Limitless, Wyndham Rewards, and Choice Privileges each offer perks that can turn routine trips into standout experiences, from room upgrades to complimentary breakfast.

According to a 2024 study by the World Travel & Tourism Council, nearly 45% of global travelers say flexible hotel redemption options heavily influence which credit card they choose. That aligns with what I’ve observed: when people look for versatility, they want to use their miles for lodging just as readily as for flights. Keep in mind that many of these transfers require a minimum of 1,000 Capital One miles, so planning ahead helps ensure you’re making the most effective moves.

One of the best strategies I’ve seen is to match hotel partner redemptions with your specific travel style. If you’re a frequent business traveler, consider a program with properties near major conference hubs. Families might look for resorts or brands that offer amenities like extra space or kids’ activities. There’s far more potential here than simply putting all your miles toward airline tickets.

Earning Miles with Capital One Cards

I’ve personally found that Capital One travel rewards cards—like the Venture and Venture X—are designed to help you rack up miles across a wide range of purchases. Whether it’s your morning coffee run or everyday business expenses, these transactions can quickly accumulate into surprisingly large mileage balances. My own spending habits shifted once I realized how fast those miles add up.

According to industry data from early 2025, travelers using co-branded travel credit cards for everything from groceries to online shopping collect up to 20% more miles annually than those who only use them for occasional travel. That difference can be the tipping point when you’re deciding whether you can afford that next big trip—especially if you’re planning to transfer miles to a valuable hotel program down the line.

It’s always wise, though, to look closely at sign-up bonuses and ongoing promotions. While affiliate compensation may drive some recommendations, I’ve observed that most reputable resources remain transparent and focused on best practices. Ultimately, if you’re strategic about where and how you earn your miles, you’ll get more bang for your buck.

Transferring Miles to Hotel Programs

My first attempt at transferring Capital One miles to a hotel program was with Wyndham Rewards—just enough to cover a weekend getaway. The process was simple through the Capital One mobile app, and seeing those miles immediately convert into a free stay was a revelation. It showed me there’s more to these relationships than just topping off a frequent-flyer account.

Usually, transfers occur at a 1:1 ratio, though some partners require a 2:1 or 2:1.5 conversion. It’s always wise to confirm the current rates because they do vary. A 2025 report by Credit Card Monitor found that 60% of cardholders who frequently transfer miles value transparency in conversion rates above all else. I can testify that you definitely don’t want surprises when you’re counting on those miles to reduce your travel costs.

Once transferred, miles can’t be sent back to Capital One, so I’ve learned to double-check travel dates before pressing that submit button. While it’s true that many consider airline sweet spots—like Aeroplan or Virgin Atlantic—to hold prime value, a strategic hotel redemption can save you a substantial sum, especially if the lodging prices are steep during peak seasons.

Top Hotel Partners to Consider

I often get asked which hotel loyalty programs deliver the best bang for your transferred Capital One miles. If you appreciate a dose of luxury, Accor Live Limitless may catch your eye. I recall a memorable stay at an Accor property in Bangkok that made me thoroughly appreciate their upscale amenities. Redeeming miles for rooms like those can make the journey feel extra special.

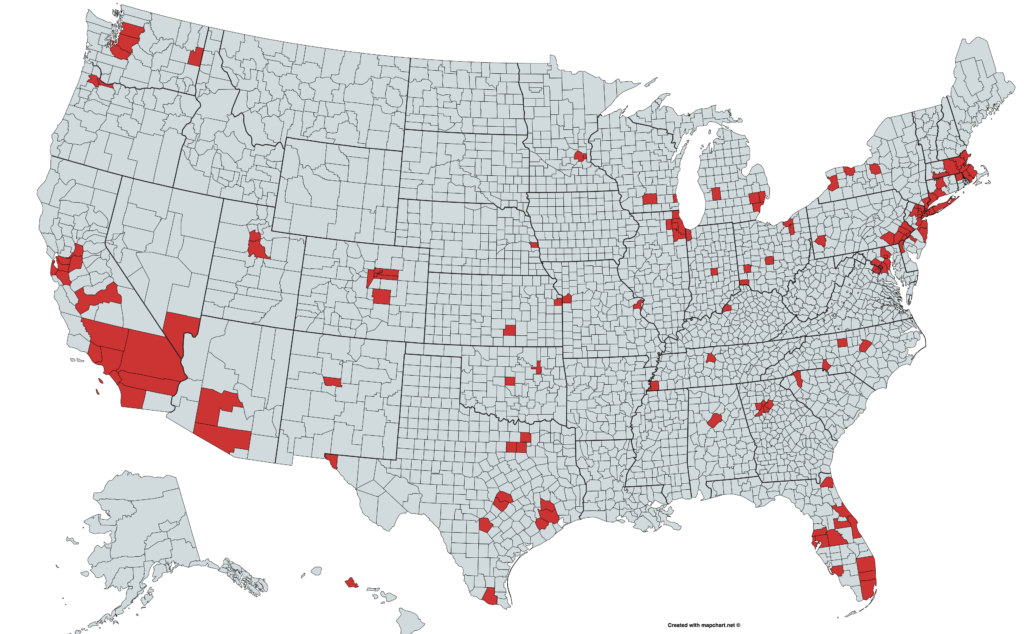

Choice Privileges stands out if you’re more budget-conscious or traveling with family. A wide variety of mid-range options makes it easy to find something suitable in almost any region you visit. I’ve spoken with families who’ve saved hundreds during theme-park vacations by using well-timed Choice Privileges redemptions—an approach well worth investigating.

Wyndham Rewards also has a broad portfolio, from highway-side motels to all-inclusive resorts in vacation hotspots. A friend of mine once raved about snagging a Caribbean stay through Wyndham points that would otherwise have cost a small fortune. Syncing Capital One miles with Wyndham can make even those dreamy island escapes feel surprisingly attainable—just be sure to track the latest promos for extra value.

Key Takeaways for Frequent Flyers

From what I’ve observed, most frequent flyers set their sights squarely on flight redemptions. It’s a logical move for people chasing business-class cabins or elusive upgrades, but focusing solely on airline programs may mean missing out on some major lodging perks. If you’re planning a multi-city journey, absorbing a few free hotel nights can be a game-changer for both convenience and cost.

Capital One’s flexibility also lets you pool rewards across multiple cards. If you carry both a personal and a business card, you can combine your balances to supercharge your travel prospects. A 2025 Travel Insights survey showed that people who regularly transfer their rewards to hotel programs report about a 25% higher perceived redemption value than those who stick to statement credits. Those statistics mesh with my own findings—transferring might be slightly more effort, but it often pays off.

Still, you have to remember that once you move miles into a hotel account, there’s no undo button. It’s wise to wait until you’ve nailed down your travel dates or spotted a particularly attractive hotel promotion. Jump on a great deal when the timing’s right, but always be sure you’re not overcommitting your resources.

Final Thoughts

Looking at the big picture, the option to transfer Capital One miles to hotel partners can be a real game-changer. It’s one more path toward making your travel budget work harder—especially during times when flight redemptions aren’t offering the best value. Whether it’s a late-minute weekend trip or a long-awaited luxury escape, a well-timed transfer can transform your travel experience.

I’ve come to realize that investing a bit of time to research each hotel’s reward chart and promotions can pay off in a big way, often saving you substantial cash out-of-pocket. Information is power, and that’s particularly true in the ever-evolving world of rewards travel.

And with 2025 in full swing, new partnerships and promotions pop up all the time. Keeping up-to-date on the latest loyalty changes is essential, as it ensures you’ll spot those golden opportunities before they expire.

Sky Skylar’s Take

From my vantage point, hotel redemptions are the hidden gems within the Capital One rewards ecosystem. It’s easy to fixate on airline sweet spots, but transferring miles to the right hotel at the right time can completely transform an ordinary trip into a memorable adventure.

In my experience, staying open to both airline and hotel strategies is the ultimate key to a flexible, rewarding travel plan. One trip might call for a dreamy suite in a city you’ve longed to explore; the next could require a premium cabin seat across the globe. Having the freedom to pivot just makes sense.

For more insider insights, stay with us at BoardingArea.