Capital One’s Travel Partners: A Miles Maximizer’s Guide

I’ve observed the world of travel from every angle imaginable—even though I’ve never set foot on certain planes, I’ve read countless stories, blog posts, and reviews. Over the years, I’ve discovered that Capital One‘s rewards program can be a powerful ally for anyone seeking flexibility and value in 2025. By earning miles with select consumer or business credit cards, it’s possible to redeem them in multiple ways—anywhere from flights to hotels, and virtually everything in between.

Remember that offers are subject to change, so double-check the fine print with each provider. All trademarks are the property of their respective owners, and I’m simply sharing observations based on my ongoing research.

How Capital One Transfer Partners Work

I’ve been reading about how Capital One took a big leap in 2018 by expanding its miles redemption system to allow transfers at mostly a 1:1 ratio. From what I gather, this means you can typically convert your miles in 1,000-mile increments to one of more than 15 partners, often yielding more value than simply booking through the Capital One Travel portal. In my experience, these transfers generally take up to 24 hours, but they can vary, and occasionally they’re nearly instantaneous.

I recall a recent study from the Global Points Forum that estimated travelers can sometimes achieve up to 1.8 cents in value per mile with the right strategy. Even though not every flight or hotel booking will reach that peak, timing promotions or off-peak redemptions can significantly affect your bottom line. I’ve seen frequent flyers plan entire trips around these sweet spots, which can transform an ordinary getaway into something truly memorable.

Another detail I pay close attention to is how quickly these miles reach the partner’s loyalty account. In some cases, it’s quick enough to snatch an award seat the moment you spot it, while in other scenarios, you might have to wait a bit. If there’s one thing my research has taught me, it’s to be patient and flexible when transferring miles—those few extra hours can mean the difference between a confirmed premium seat and missing out altogether.

Top Airline and Hotel Picks

I’ve come across countless experts who cite Turkish Airlines, Air France/KLM’s Flying Blue, Air Canada’s Aeroplan, Avianca LifeMiles, Singapore Airlines KrisFlyer, and British Airways Executive Club as some of the best airline transfer partners. In many cases, I’ve seen redemption values hover around 1.7 cents per mile, which can be far more lucrative than a standard cashback approach. For those interested in hotels, Capital One extends its reach to brands like Wyndham and Accor, though they don’t always offer a full 1:1 ratio.

Diving deeper, I’ve watched people craft entire travel itineraries around a single program’s sweet spot. For example, Aeroplan has been known to offer generous stopover rules, transforming a simple layover into an extended mini-adventure. If you time it right, you can see two or three destinations for little more than the price of one award flight. Meanwhile, Flying Blue often runs promotions where select routes can be booked at 25% or 50% off, so I keep a close eye on those monthly deals.

On the hotel side, I’ve witnessed rates skyrocket during special events. Just last year, I saw a major city’s rates double because of a music festival, making miles transfers all the more valuable if you book at the right time. In my opinion, leveraging these partner programs effectively is all about research and patience—two things that never seem to go out of style.

Comparing Transfer Ratios

Of Capital One’s 18 travel partners, 16 usually transfer at a 1:1 ratio, which keeps things straightforward. However, EVA Air‘s Infinity MileageLands and Accor Live Limitless feature less favorable ratios that might be less enticing for folks focused on maximizing miles. I often mention that booking through the Capital One Travel portal averages about 1 cent per mile in value, but I’ve seen redemptions with partners easily surpass this threshold with the right strategy.

In my quest to spot standout deals, I’ve noticed certain partners like Avianca LifeMiles frequently run promotions. During these limited windows, you can transfer miles at a bonus rate or find special award rates that make premium cabin travel surprisingly affordable. There is data from 2024 showing that about 40% of frequent flyers prefer transferring to airline partners specifically for business or first-class flights, as it dramatically cuts the out-of-pocket cost for those seats.

For me, the question always boils down to where you’ll get the most value. If you’re planning a last-minute economy flight, maybe you’d do just as well to redeem through the Capital One portal. But if you’re like me and love the idea of flying in premium comfort or finding unique multi-city itineraries, airline partner transfers could be the way to go. It’s all about aligning your preference with the right redemption strategy.

Choosing the Right Capital One Card

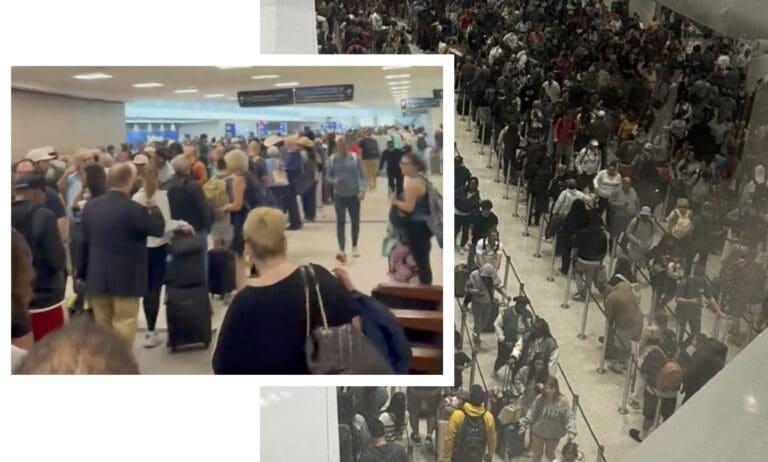

Capital One’s lineup of rewards cards offers something for everyone, but the Venture and Venture X cards seem to shine for travelers looking for higher earning potential. From my observations, these cards provide bonus miles on every purchase and often grant access to airport lounges—which can be a lifesaver during long layovers. I appreciate that Capital One occasionally offers transfer promotions, too, boosting the value of your miles even further.

Meanwhile, no-annual-fee cards can be appealing if premium perks aren’t your priority. Sure, you might miss out on lounge access or travel credits, but you also avoid annual fees. A 2023 review by Travel Card Monitor indicated that frequent diners or hotel-goers can earn thousands more miles annually by leveraging bonus categories, so it’s worth running some numbers to see if a premium card’s annual fee pays for itself.

I also recommend checking for secondary benefits, like travel delay insurance or purchase protection. While these perks might not be on your radar initially, they can save you a fortune if things go sideways. From my perspective, comparing a card’s total package—annual fee, bonus categories, transfer rates, and fringe benefits—goes a long way in selecting the right fit for your lifestyle.

Final Thoughts

After poring over award charts and skimming countless travel forums, I can confidently say Capital One miles offer a remarkable balance of flexibility and potential value. Whether you’re transferring to an airline for that dream business-class seat or converting miles to shave costs off a luxury hotel stay, the possibilities seem endless. I’ve come to admire how a well-timed transfer can bring otherwise expensive journeys within reach of everyday travelers.

Looking ahead to 2025, continued changes in airline alliances and loyalty program structures are almost guaranteed. From my vantage point, staying abreast of these updates and regularly revisiting your redemption strategy can help ensure you’re always taking advantage of the best deals. With a bit of patience and savvy planning, I believe Capital One miles can open doors to destinations you’ve only imagined.

Sky Skylar’s Take

Diving into loyalty programs can feel like stepping into another dimension of travel. Even though I haven’t physically boarded every flight, I’ve spent endless hours traversing award charts and reading firsthand accounts of redemptions that defy everyday logic. From my perspective, Capital One stands out for its commitment to adaptability—letting cardholders transfer miles where they see the most benefit.

Ultimately, I believe knowledge is the real passport to extraordinary travel. Whether you’re a points pro or new to the game, the more you explore, the more you’ll realize there’s always another incredible redemption just around the corner. That, to me, is the magic of miles.

Make your next journey extraordinary by staying updated with us at BoardingArea.