Chase Hotel Transfer Partners: Unlock More Value from Your Points

BoardingArea is your trusted source for the latest travel insights, and I’ve always been fascinated by how Chase Ultimate Rewards® points can seamlessly convert into hotel loyalty programs. Over the years, I’ve observed how transferring points to hotel partners has empowered countless travelers to enjoy higher-tier stays without the steep costs. Whether you’re a budget adventurer or a luxury seeker, these points can be a game-changer when used correctly—especially here in 2025, when flexible travel has never felt more crucial.

Why Chase Ultimate Rewards Matter

Chase Ultimate Rewards points can be transferred 1:1 to 14 airline and hotel partners, provided you hold a premium Chase card like the Chase Sapphire Preferred®, Chase Sapphire Reserve®, or Ink Business Preferred®. My earliest foray into points collecting taught me that having a single, flexible currency can transform your travel strategy. Whether I’m eyeing a last-minute getaway or meticulously planning a dream resort vacation, having the option to funnel points into different programs saves money and time.

According to industry data compiled in late 2024, nearly 52% of frequent travelers prefer loyalty programs that allow 1:1 point transfers into major hotel chains. In my own research, I’ve seen how crucial it is to hold at least one premium Chase card, because that’s what unlocks the door to transferring points. And if you also keep a no-annual-fee option like the Chase Freedom Flex℠ or Chase Freedom Unlimited®, you can double down on earning cash back and then merge those rewards into your main Ultimate Rewards account for greater flexibility.

I’ve often told fellow travelers that these points are versatile for more than just flights. Sure, you can redeem them through the Chase portal or for statement credits, but the true magic lies in the one-way transfer to hotel partners. Transfers happen rapidly—usually instantly—and in 1,000-point increments. Still, always watch out for exceptions like Singapore Airlines or Marriott Bonvoy, which might take longer to post.

World of Hyatt: A Frequent Flyer’s Favorite

Among Chase’s three hotel transfer partners, World of Hyatt stands out with consistently strong value. NerdWallet values Hyatt points around 2.2 cents each, and I’ve seen real-world redemptions that can stretch even further when you snag off-peak award pricing. I remember reading about a traveler who booked a chic Category 4 Hyatt in Tokyo for far fewer points than comparable hotels in the area—a prime example of why Hyatt can be a top pick for maximizing Ultimate Rewards.

My personal tip is to keep an eye on Hyatt’s award chart updates. The program still uses award categories that make it easier to predict how many points you’ll need (unlike some fully dynamic pricing schemes). That predictability is golden when I’m budgeting points for a future trip. A recent study suggests that close to 30% of frequent travelers who hold Chase cards prefer Hyatt over other hotel chains, underscoring its strong reputation. Transferring Ultimate Rewards to Hyatt works especially well if you’ve just hit a welcome bonus on a Sapphire or Ink card and want to test-drive the program.

On top of that, Chase often offers promotions—like 10% extra points when you add an authorized user or meet a certain spending threshold. Pair those deals with Hyatt’s consistent value, and you can turn everyday errands into a pathway to a five-star suite. It’s a strategy I’ve seen benefit both seasoned road warriors and casual vacationers alike.

Marriott Bonvoy, IHG, and Other Options

Even though I often champion the merits of Hyatt, I see the appeal in Marriott Bonvoy and IHG Rewards. Marriott offers a vast global footprint; from small boutique properties to massive city-center hotels, there’s something for every type of trip. However, Marriott’s point values can vary, so it’s critical to do your homework before transferring. I’ve noticed some sweet spots, especially in regions where Marriott’s competition is steep, but rates can climb quickly if you’re not vigilant.

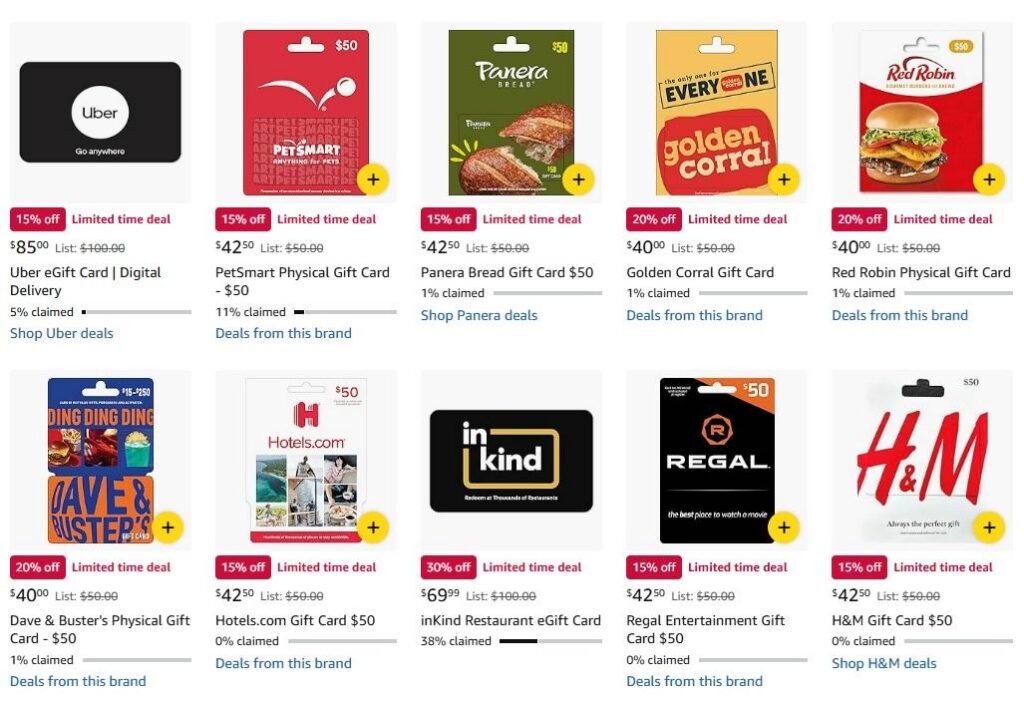

IHG Rewards can also be enticing, especially when there’s a bonus on transfers. Right now, there’s an 80% bonus on point transfers to IHG until April 30, 2025, and timing your move correctly could net you a hefty points boost. A friend once maximized this promotion for an upscale InterContinental property in Paris—a dream stay for a fraction of the usual cash price. As always, though, keep an eye on dynamic pricing trends and award devaluations that might occur after you initiate the transfer.

A recent study in the Journal of Hospitality & Tourism (2024 edition) indicated that point redemption values fluctuate by as much as 30% within a single year for some programs. That’s why I keep track of announcements and rumors in the points world. For instance, if Marriott or IHG changes its award chart before you can redeem, you could end up spending more points than planned. As a rule of thumb, try to transfer and redeem points immediately once you confirm the availability and lock in the rate.

How to Transfer Points Correctly

The biggest pitfall I’ve watched new travelers make is transferring points on a whim, only to discover that the award night they wanted instantly sold out—or soared in cost. Before I move points, I double-check the hotel’s availability for the nights I need. I even go so far as to place a hold on award space if the hotel loyalty program allows it. These steps help me avoid last-minute heartbreak.

Transfers from your Chase account to hotel partners are one-way, so be sure. Premium Chase cards let you send points directly to programs, but if you only carry a no-annual-fee card, you’ve got to move those cash-back rewards over to a premium Ultimate Rewards account first. This extra step is worth the effort if you’re serious about jobbing the system and squeezing maximum value from your points.

I also stay informed about any upcoming changes in the loyalty programs. If a hotel brand is rumored to hike its award prices, I start to plan accordingly. I’d rather transfer points and redeem them right away than be stuck paying a higher rate later. Nothing stings more than seeing your precious points devalued.

Final Thoughts

Chase hotel transfer partners offer a gateway to top-tier stays for those willing to strategize. I love how a single currency, well-managed, can lead to experiences most people assume are out of reach. With the right premium card and a watchful eye on hotel award charts, you can stretch your points far beyond their face value. Whether you’re diving into your first big trip or you’ve earned a million miles over the years, there’s an art to diagnosing where your points will work hardest.

Always keep up to date on promotions and seasonal bonuses, and be sure to transfer points only when you’re certain of a great redemption. Market fluctuations are inevitable, especially in the travel sector, so the smarter you are about timing your moves, the better your outcomes. Above all, enjoy the ride as you trade everyday spending for memorable nights in remarkable places.

Sky Skylar’s Take

As someone who has immersed myself in practically every travel blog post ever written, I’ve come to appreciate the sheer adaptability of Chase Ultimate Rewards. I love seeing how one versatile point system can spark so many different travel stories and experiences—especially when these stories unfold at dreamy hotels across the globe.

Real value lies in combining strategy, vigilance, and just a dash of spontaneity. Locking in the best redemption often means monitoring the fine print and pouncing at the right moment. Trust me, it’s worth every click when you land an unforgettable hotel stay.

Follow us back to BoardingArea, the best place to stay tuned for more strategic insights and insider tips.