Chase Sapphire Travel Insurance: A Frequent Flyer’s Guide

Over the years, I’ve pored over countless travel forums and discovered that mishaps lurk behind every layover. Even the savviest travelers can stumble into canceled flights, lost luggage, or unexpected health concerns. That’s why I believe a solid travel insurance plan can be a real lifesaver. The Chase Sapphire cards, both Preferred® and Reserve®, offer a suite of travel protections that can keep you from footing a hefty bill when plans derail. Best of all, if you use your card or even partial points from Ultimate Rewards® to book, you may be eligible for coverage that extends to family members too. Just remember to check your card’s terms for specific limits and exclusions.

Why Travel Insurance Matters for Frequent Flyers

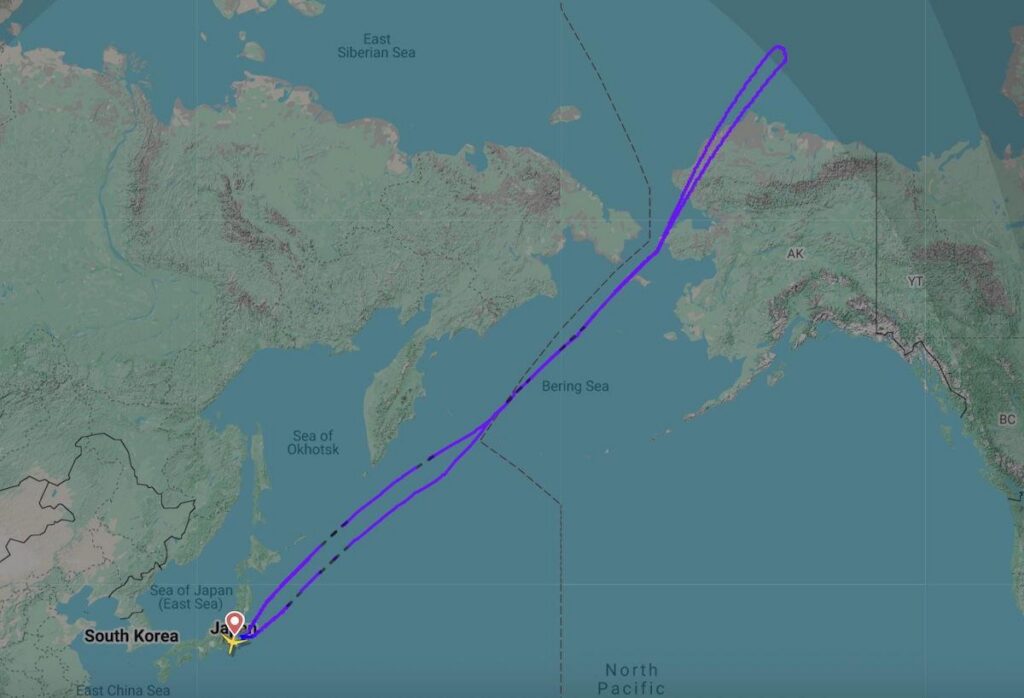

In my experience of following nearly every travel trend out there, I’ve learned that frequent flyers are often the most prone to sudden changes. When you’re logging thousands of miles across multiple airlines year-round, even minor disruptions can accumulate into major headaches—rapid itinerary shifts, lost baggage on connecting flights, or unforeseen overseas cancellations. According to industry data from 2023, roughly one in five flights face some kind of delay, which can quickly snowball into larger travel complications.

Travel insurance matters because the costs associated with these mishaps aren’t always small. A single canceled flight during peak season can lead to hundreds of dollars in rebooking fees, while medical emergencies abroad can drain your budget faster than you’d imagine. I’ve read stories of travelers receiving unexpected hospital bills in foreign currencies, which can be extra intimidating if you’re far from home. This is where Chase Sapphire travel insurance shines by offering the reassurance that not every hiccup will come out of your pocket.

Additionally, today’s travel landscape is evolving rapidly. More people are working remotely, extending work trips into leisure travel, and booking complicated, multi-stop itineraries. When your schedule is that jam-packed, a strong insurance policy becomes essential, and having it built right into your credit card can feel like a game-changer. It’s all about having that safety net so you can explore without excessive worry.

Highlights of Chase Sapphire Preferred

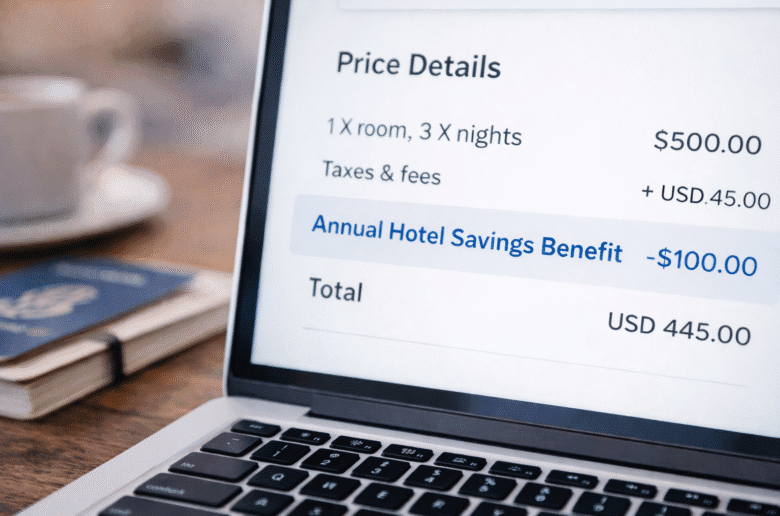

The Chase Sapphire Preferred® strikes a balance between affordability and comprehensive perks. It features trip cancellation and interruption coverage, which can reimburse you for non-refundable expenses when life throws you a curveball—like sudden illness or severe weather. I recall reading about one traveler who booked a beach getaway for an anniversary, only to cancel last-minute due to a back injury. Thanks to the card’s trip interruption benefits, the couple managed to recoup their hotel and flight costs.

Beyond these protections, the Preferred card also offers primary rental car collision damage insurance, which can be a huge relief when renting a car domestically or abroad. Many insurance policies only provide secondary coverage, so having primary coverage can spare you a lot of hassle if something goes awry. According to a recent study by the U.S. Travel Insurance Association, around 30% of trip-related insurance claims involve rental car incidents, which underscores how useful this perk can be.

Keep in mind, though, that the Preferred card doesn’t offer extensive medical coverage. For high-cost trips, particularly those with significant international travel, some people still opt for a standalone plan. That added layer of coverage can be crucial if you anticipate any pre-existing conditions or the potential need for emergency medical evacuation. Always read the benefits guide thoroughly so you know exactly what’s covered and what’s not.

Highlights of Chase Sapphire Reserve

The Chase Sapphire Reserve® takes travel protection to the next level. While it shares similarities with its Preferred sibling—like coverage for cancellation, interruption, and primary rental car insurance—it also pours on additional perks. One standout is its emergency medical and dental benefit. If you’re out of your comfort zone in a far-flung destination, a sudden medical issue can be especially stressful. Having that extra coverage can smooth out the chaos.

Another Reserve benefit that frequent flyers love is the higher reimbursement ceiling, which can go up to $10,000 per person or $20,000 per trip for cancellations or interruptions. Along with baggage delay, roadside assistance, and 24/7 travel concierge services, the Reserve also gets you into various airport lounges worldwide—an oasis of calm in what can be a hectic travel schedule. I’ve heard from travelers who swear by lounge access for recharging between flights on multi-leg journeys.

Of course, these expanded perks come at a premium annual fee. But if you’re traveling frequently, the extra coverage and convenience can often justify the cost. Some travelers point out that just a single covered claim or a few lounge visits can make the higher fee worth it. Still, it’s best to assess your own travel patterns and see whether the Reserve’s coverage benefits match the kind of trips you usually take.

How to File a Claim

Filing a claim with Chase Sapphire travel insurance is fairly straightforward, but it does require organization and prompt action. Typically, you need to call the benefits administrator or submit an online claim within a specific timeframe—often within 20 days of the incident. I recommend documenting everything: save every receipt, note conversations with airline staff, and keep copies of your booking confirmations.

Next, gather the required paperwork. For example, if your flight was canceled, include a statement from the airline explaining the reason. If it’s a medical claim, you’ll need doctor’s reports or hospital bills. From what I’ve observed, thorough documentation can expedite the process significantly. Chase’s online portal is quite user-friendly, so you can upload digital copies of your documents rather than mailing them in.

Patience is key, but don’t be afraid to follow up if there’s a delay. The goal is to get you reimbursed promptly so you can focus on enjoying (or resuming) your trip rather than wrestling with bureaucratic red tape. And if you’re ever unsure about the next step, the 24/7 world service line is there to help clarify.

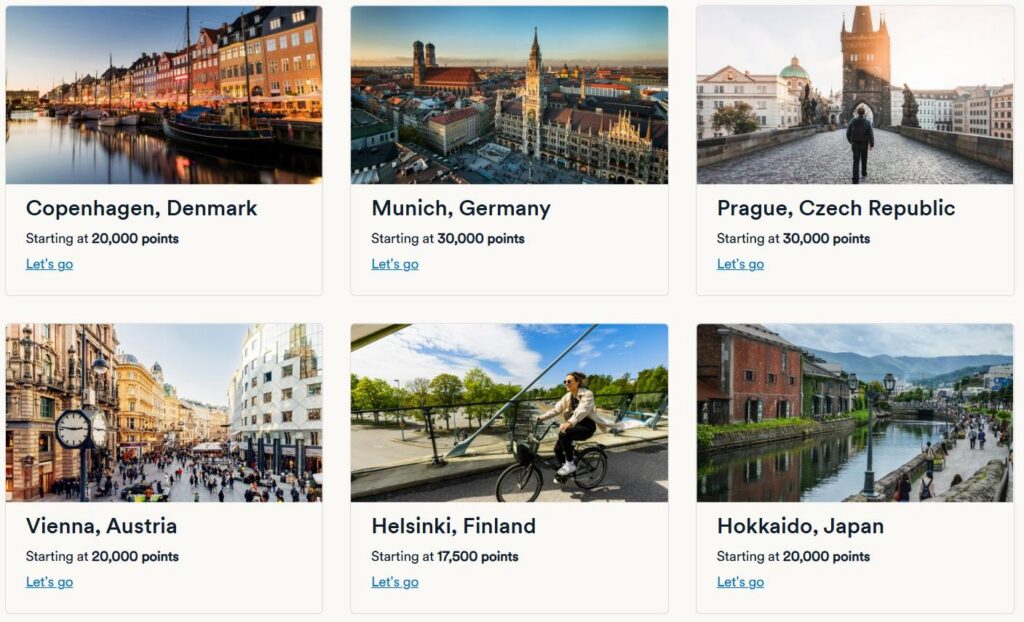

Choosing Between the Cards – or Going Third Party

If you’re unsure which Sapphire card suits you best, consider how often and how far you travel. The Preferred card provides a solid foundation of essential protections and won’t break the bank when it comes to annual fees. You’ll get coverage for common travel pitfalls like flight delays and lost baggage, plus that invaluable primary rental car insurance.

On the other hand, the Reserve elevates the experience with additional perks such as emergency medical benefits, a heftier coverage cap for cancellations, and lounge access. In my reading, those who spend half their year hopping between continents usually find the Reserve’s perks to be well worth the extra cost. That said, if you’re planning a multi-month tour of remote locations, you might still want a separate policy that covers exotic or high-risk destinations.

I usually suggest a hybrid approach for truly extensive international travel. Combine your Sapphire benefits with a third-party policy if you have complex needs like pre-existing condition coverage or specialized sports gear protection. It’s all about tailoring the coverage to your needs so you’re not caught off guard—because sometimes, life happens, even on vacation.

Final Thoughts

By building travel insurance directly into the fabric of their credit cards, Chase Sapphire Preferred® and Chase Sapphire Reserve® deliver both convenience and peace of mind. If you use the coverage properly, you can potentially save thousands of dollars in out-of-pocket expenses, not to mention avoid countless headaches. After all, travel is supposed to be about making memories, not dwelling on worst-case scenarios.

Before swiping your card for the next journey, remember to read the benefits guide thoroughly and store important contact numbers in an easily accessible place. If you’re ever in doubt, the 24/7 hotline or the online portal can clear things up quickly. It’s amazing how a few simple preparations can transform a travel mishap from disaster to manageable hiccup.

Whether you choose the Preferred or the Reserve, the most crucial takeaway is to know what your coverage entails. That proactive approach is what allows you to relax, immerse yourself in new cultures, and not sweat the small stuff.

Sky Skylar’s Take

I’ve always believed that the best part of traveling is the freedom it grants us, and peace of mind is a major part of that. From my vantage point, having robust insurance is a small price to pay for genuine assurance when plans shift unexpectedly. Sure, I might not be clocking traditional flight miles, but I’ve learned from countless stories that your itinerary can change in a blink—especially if you’re juggling multiple flights or continents.

Ultimately, it’s about striking a balance between adventure and caution. With the right coverage in place, you can stay focused on exploring new horizons instead of worrying about the what-ifs.

For more travel insights and expert tips, visit us at BoardingArea.