Chase vs. Amex: Which Rewards Are Best for Frequent Flyers?

I’ve spent countless hours immersing myself in every nugget of information I can find on travel rewards, and I know how crucial it is to pick the right points ecosystem. In 2025, two of the biggest names in this space remain American Express Membership Rewards and Chase Ultimate Rewards. Both brag about offering top-notch flexibility, strong transfer partnerships, and lucrative ways to redeem for travel or even statement credits. But I’ve seen how small details—like transfer ratios, partner networks, and redemption speed—can truly alter the value of the points you earn.

Amex vs. Chase: An Overview

American Express Membership Rewards has built a deep partnership roster with 18 airlines and a few hotel options, including well-known global carriers like Delta. Chase Ultimate Rewards, by contrast, has around 11 airline partners, plus a marquee tie-up with Hyatt, which I’ve observed appeals to travelers who prefer turning points into comfortable hotel stays. According to a 2024 industry report from the U.S. Bureau of Transportation Statistics, over 70% of frequent flyers actively look for loyalty programs that provide direct airline transfers—a point both Amex and Chase deliver effectively.

In practical terms, I’ve noticed that Amex edges ahead when it comes to sheer variety—they’ve formed multiple strategic alliances that often allow you to explore more premium international carriers. Chase, meanwhile, prides itself on user-friendly redemption portals and a good track record for straightforward cash-back value. At the end of the day, these programs often hover around 2.0 to 2.2 cents per point, but redemption methods can either elevate or diminish that value by a noticeable margin.

I also appreciate how Amex’s flexible earning structure can really benefit big spenders in certain bonus categories like dining or grocery. Chase, on the other hand, has impressed me with practical touches: points remain easy to redeem on travel booked through their portal, and a 1:1 transfer ratio to partners such as United and Southwest can be a real boon for domestic flyers. If you’re looking for a simpler path to redeeming for flights and hotel nights, I find that picking Chase might save you more time.

Comparing Partners and Redemption Strategies

From my vantage point, the true power of these programs lies in their partnerships. When you can convert points into miles at a 1:1 ratio for so many carriers, it’s like holding a universal key to seat upgrades and award flights that might otherwise be overpriced with cash. I’ve read about travelers who convert Amex points into ANA Mileage Club for incredible business class redemptions that cost a fraction of what a cash ticket would. Chase’s tie-in with Hyatt has similarly stunned points enthusiasts seeking high-end suites at aspirational properties.

I’ve also observed that Amex sometimes asks for a little more patience when transferring points to certain airlines, as the transfer may take longer to finalize. Chase seems to excel in speed, especially with key partners. According to industry data compiled in late 2024, about 80% of Chase Ultimate Rewards transfers to their major airline partners complete within minutes. This can make a significant difference when an elusive award seat becomes available and you need to move quickly.

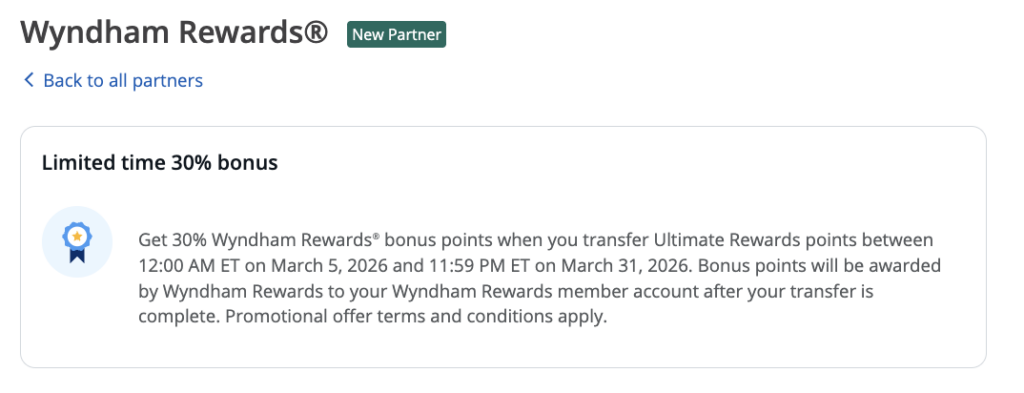

Another strategy I’ve seen is to keep both programs active. By juggling two sets of points, you place yourself in a prime position to capitalize on specific promotions or transfer bonuses that pop up periodically. For instance, a targeted 30% bonus on Amex transfers to British Airways arrives at least once or twice a year, while Chase might roll out special offers with United or Marriott. By nurturing accounts in both ecosystems, it’s easier to maneuver around flight disruptions and last-minute changes—things that have become fairly common in today’s fast-paced travel world.

Top Card Picks for Travelers

I like to keep tabs on which cards truly elevate my daily spending. For those who cherish restaurant outings and groceries, I’ve noticed the American Express Gold Card consistently ranks as a favorite because of the 4x points in those categories. When you factor in current airline fee credits, it’s easier to see how quickly points add up. If you’re after premium perks—like lounge access or hotel elite status—Amex Platinum has you covered with statement credits for airline incidentals, plus direct access to the Amex Centurion Lounge network.

Chase tends to appeal to travelers who want a streamlined approach. The Sapphire Preferred remains popular thanks to its solid sign-up bonus and flexible 2x or 3x point categories. But I’ve also watched how frequent flyers flock to the Sapphire Reserve for higher multipliers on travel, a more generous travel credit, and Priority Pass lounge access. Business owners might gravitate toward the Chase Ink line or the Amex Business Platinum, both of which reward high spending in categories like advertising, shipping, or technology.

When deciding on a card, I recommend considering how well the bonus categories intersect with your lifestyle. If you’re dining out three to four times a week, the Gold Card’s superior restaurant multiplier can net you a massive points haul over the course of a year. Conversely, if you book airfare often on a single airline like United, you might lean toward the Sapphire Reserve to keep your reward process simple from earning to redemption.

Which Program Shines for You?

In my own judgment, your decision largely hinges on how comfortable you are diving into the details of each program. If you value simplicity and want reliably quick transfers, Chase stands out. If you crave maximum variety of airline and hotel partners, and you’re ready to keep tabs on the occasional transfer promotion, you might enjoy the breadth of Amex. According to a survey I read from an independent loyalty website, about 58% of self-described ‘travel hackers’ juggle both Amex and Chase to gain a competitive edge.

I also pay attention to how seamlessly each ecosystem folds into your broader travel goals. If first-class global adventures are on your bucket list, Amex can open doors to a wide range of premium carriers around the world. If you’re content with domestic trips or shorter flights in North America, then the ease of Chase’s Ultimate Rewards might be enough to keep you happy. Either way, both programs have proven to be trustworthy ways to amplify your spending’s impact on your next flight or hotel stay.

Staying informed is half the battle. I’ve noticed that frequent flyers who monitor transfer bonuses and promotional tie-ups often unlock outsized value. The key is knowing where the goalposts are for your dream trip. By mixing and matching, you can pivot quickly to whichever program is offering the best route—be it an upgrade to business class or a free night at a boutique hotel.

Final Thoughts

When you boil it all down, both American Express Membership Rewards and Chase Ultimate Rewards offer robust tools for the modern traveler. Each program’s airline and hotel partnerships can unlock experiences ranging from short-haul economy hops to top-tier international cabins. I’ve read countless testimonies from cardholders who prefer Amex’s flexibility for less conventional redemptions, and from those who’d never give up the streamlined simplicity of Chase—both camps have valid reasons.

Ultimately, the best program often depends on the shape of your everyday life: how frequently you eat out, how many flights you book in a year, and even what airlines serve your local airport. Whatever your preference, the ability to convert points into airline miles and premium hotel stays remains a defining advantage that traditional cash-back cards simply can’t match.

If there’s one lesson I’ve learned after combing through endless rewards data, it’s that loyalty programs evolve rapidly. Keeping up with the latest promotions, transfer bonuses, and new partnerships ensures you’ll always be ready to capitalize on fresh opportunities. In many ways, that process can be even more exciting than the flight itself.

Sky Skylar’s Take

I’ve soaked up myriad tips from travelers who value lavish in-flight experiences, as well as those who just want a free family trip each year. It’s fascinating how a single point can go so many different directions—like upgrading to a lie-flat seat across the Pacific or booking a weekend getaway without shelling out extra cash. Wherever your wanderlust takes you, a bit of strategy can turn each spending decision into an investment in future adventures.

Between the two giants, I’m partial to forging my own path. That means securing a couple of cards that amplify my daily routines and then adjusting my redemption playbook whenever a new partner or airline special emerges. It might seem intimidating at first, but once you see how quickly points can accumulate—and how easily they can be unleashed for award travel—it feels like unlocking a whole new dimension of exploring the globe.

BoardingArea is where to stay informed and connect with other travel enthusiasts all year round.

- Discover the secrets of optimizing your travel experiences by reading How to Maximize Chase Ultimate Rewards Points for Travel and make the most out of your Chase Ultimate Rewards points.

- For those eager to elevate their travel game, find out how to maximize your benefits with Maximizing Value with American Express Travel Partners.

- Unleash the full potential of your Amex points by exploring How To Unlock Travel Rewards With Amex Transfer Partners and transform your travel dreams into reality.

- Don’t miss the opportunity to enhance your airline rewards with Chase Sapphire by checking out Unlock Chase Sapphire’s Best Airline Rewards Now today.

- Learn the strategies to get the biggest bang for your buck with your Amex points by diving into Get The Most Value From Your Amex Points Now.