Holiday Travel Insurance: Why It’s Worth It This Season

The holiday season is upon us, bringing with it the excitement of festive celebrations and the anticipation of reuniting with loved ones. Whether you’re visiting family across the country, escaping to a snowy mountain retreat, or embarking on an exotic international adventure, the allure of holiday travel is undeniable. However, this peak season also comes with increased risks of travel disruptions, unforeseen expenses, and unpredictable challenges. In this comprehensive guide, we’ll delve into The Essential Reasons to Invest in Holiday Travel Insurance This Season, providing you with peace of mind and financial protection when you need it most.

Understanding the Rise in Holiday Travel Insurance Purchases

Holiday travel can be notoriously stressful, with potential disruptions such as flight cancellations, delays, and unexpected emergencies. According to a recent NerdWallet’s Holiday Travel Report, 21% of holiday travelers plan to purchase travel insurance, marking an increase from 16% the previous year. This uptick underscores a growing awareness of the value that travel insurance brings, especially as travel volumes near pre-pandemic levels but with fewer flights available. The limited number of flights amplifies the impact of any disruptions. A single cancellation or delay can cascade into significant travel headaches. It’s no wonder more travelers are considering the safety net that Comprehensive Holiday Travel Insurance Policies provide. From trip refunds to health coverage, understanding your travel insurance options is crucial. Whether leveraging protections offered by travel credit cards or purchasing standalone policies, being insured can make all the difference when the unexpected occurs. Experts emphasize the importance of Assessing Your Existing Travel Insurance Protections before buying additional coverage. Travel insurance typically falls into three main categories: coverage for your trip investment, belongings, and health. Purchasing insurance directly from reputable providers ensures comprehensive coverage tailored to your needs, unlike default options from airlines that may offer limited protection.

The Essential Benefits of Holiday Travel Insurance

Travel insurance serves as a financial safeguard against a myriad of potential issues that can arise during the holiday season. From severe weather disturbances to personal health emergencies, having the right coverage can save you from significant out-of-pocket expenses. Here are some key benefits:

1. Trip Cancellation and Interruption Coverage

The risk of trip cancellations increases during the holidays due to factors like sudden illnesses, family emergencies, or unpredictable weather conditions. Understanding Trip Cancellation and Interruption Insurance can be crucial. Travel insurance policies often reimburse non-refundable expenses if you need to cancel or cut short your trip for covered reasons. This protection ensures that your vacation investment is not lost and provides flexibility in rescheduling your plans.

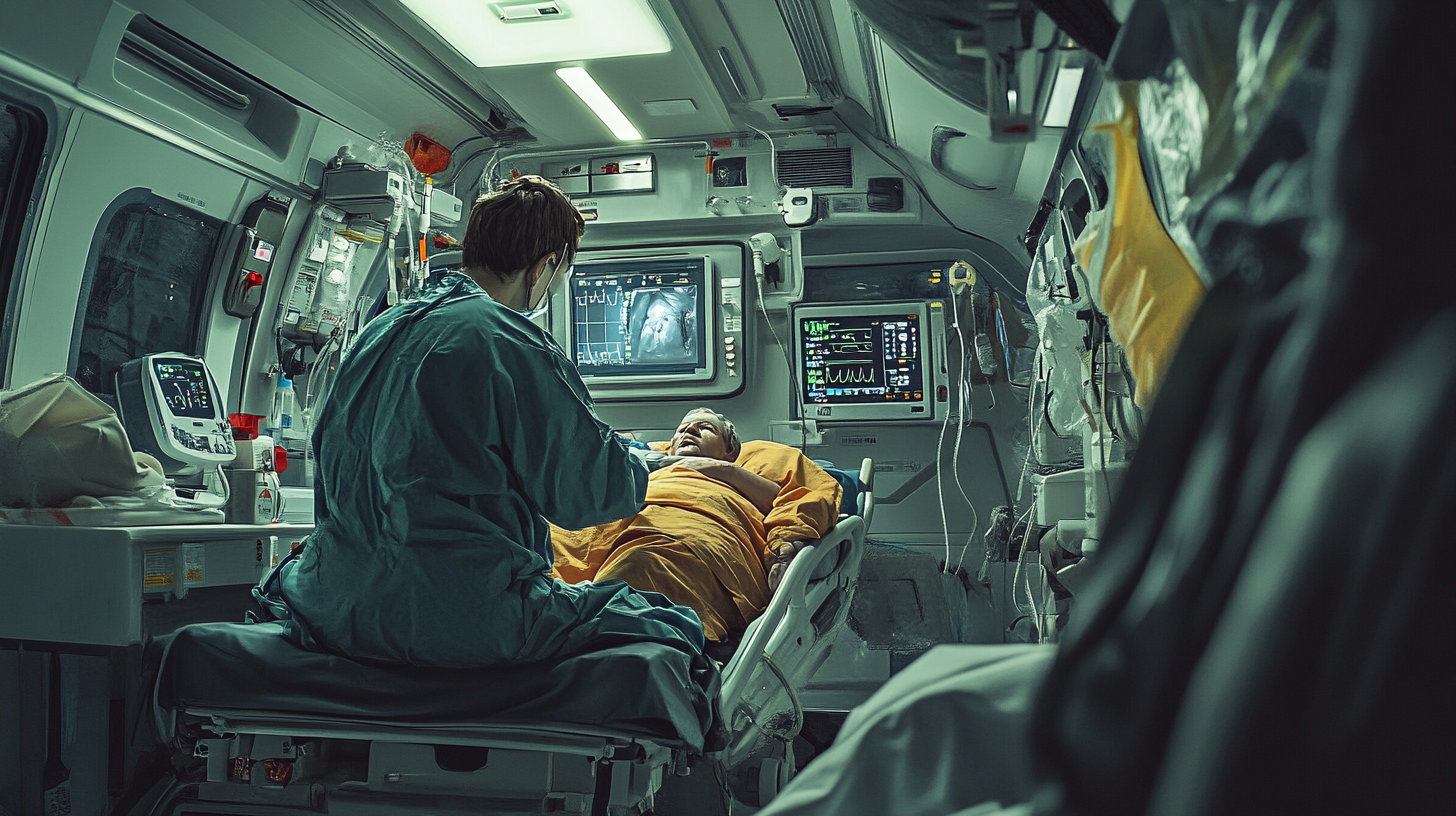

2. Medical and Emergency Assistance

Medical emergencies can be particularly daunting when you’re away from home, especially if you’re traveling internationally. Many domestic health insurance plans offer limited or no coverage abroad. Travel insurance bridges this gap by covering emergency medical expenses, hospitalizations, and even medical evacuations if necessary. This coverage is crucial for destinations where healthcare costs are exorbitant. Consider exploring Travel Medical Insurance for International Travelers to understand your options.

3. Baggage Loss and Delay Protection

Lost, delayed, or damaged baggage can disrupt your holiday plans and lead to unexpected costs for essential items. Travel insurance policies typically provide compensation for baggage issues, allowing you to replace necessary belongings and continue your journey with minimal inconvenience. For more on this, see How Baggage Protection Insurance Can Save Your Trip.

4. Travel Delay Reimbursement

During the holiday season, airports are busier, and the chances of delays increase. Travel delay coverage reimburses additional expenses incurred due to significant delays, such as accommodation, meals, and transportation. This benefit ensures you’re not financially strained while waiting to reach your destination. Learn more at The Benefits of Travel Delay Coverage During Holidays.

Factors to Consider When Choosing Travel Insurance

Selecting the right travel insurance involves evaluating your specific needs and understanding the policy details. Here are some factors to consider:

1. Destination and Duration

Your travel destination plays a significant role in determining the type of coverage you need. International trips, especially to countries with high medical costs or limited healthcare facilities, may require more comprehensive medical coverage. Additionally, longer trips may increase the likelihood of encountering issues, making insurance even more vital. Check out Choosing the Right Travel Insurance Based on Destination for detailed insights.

2. Trip Cost and Non-Refundable Expenses

If you’ve invested significantly in non-refundable trip components—such as flights, accommodations, or tours—travel insurance protects you from losing that investment. The cost of insurance is often a small percentage of your total trip cost, providing valuable security. For tips on calculating your coverage needs, visit Assessing Trip Costs for Travel Insurance Coverage.

3. Pre-Existing Medical Conditions

If you have pre-existing health conditions, ensure the policy covers related medical expenses. Some insurers offer waivers for pre-existing conditions if the policy is purchased within a specific time frame after making the initial trip deposit. Learn more at Travel Insurance Options for Pre-Existing Conditions.

4. Adventure Activities and Sports

Engaging in adventure sports or activities like skiing, snowboarding, or scuba diving requires specialized coverage. Standard policies may exclude these activities, so look for add-ons or policies that cater to your planned activities. Explore Adventure Sports Coverage in Travel Insurance for more information.

Expert Tips for Maximizing Your Travel Insurance Benefits

Navigating the world of travel insurance can be complex. Here are some expert tips to help you make informed decisions:

1. Compare Policies Early

Start researching travel insurance options as soon as you begin planning your trip. This allows you to compare different providers and policies to find the best fit for your needs and budget. Websites like Squaremouth’s Travel Insurance Comparison Tool and TravelInsurance.com’s Plan Comparison offer comparisons of various plans and insurers.

2. Understand Policy Exclusions

Carefully read the fine print to understand what is and isn’t covered. Common exclusions may include certain natural disasters, epidemics, or incidents arising from high-risk activities. Being aware of these exclusions helps avoid surprises during the claims process. For a detailed explanation, see Common Travel Insurance Exclusions Explained.

3. Keep Documentation Accessible

Maintain organized records of all travel-related documents, including receipts, itineraries, medical records, and correspondence with service providers. Having this information readily available simplifies the claims process if you need to file one. Learn organizational tips at How to Organize Travel Documents for Insurance Claims.

4. Leverage Credit Card Benefits

Some travel credit cards offer built-in insurance benefits such as trip cancellation, baggage loss, and rental car coverage. Review your card’s benefits guide to see what is included and determine if you need additional coverage. For more details, visit Understanding Travel Insurance Benefits on Credit Cards.

The Affordability and Value of Travel Insurance

One common misconception is that travel insurance is costly. In reality, policies typically cost between 4% to 10% of the total trip cost. Considering the potential financial losses from trip disruptions or medical emergencies, the investment in a travel insurance policy offers significant value. Allstate Agent Brian Green notes that “the cost is often a small investment compared to potential losses.” For frequent travelers, annual multi-trip policies can be a cost-effective option, providing coverage throughout the year for multiple trips. Explore options at Annual Multi-Trip Travel Insurance Plans to see if this is right for you.

Holiday Travel Insurance: A Necessity in Uncertain Times

The holiday season brings joy and togetherness but also heightened travel risks due to increased traffic, unpredictable weather, and ongoing health concerns like COVID-19. Travel insurance addresses these uncertainties by offering comprehensive protection.

Weather-Related Disruptions

Winter weather can cause significant travel delays and cancellations. Insurance policies with weather-related coverage can reimburse non-refundable expenses and provide compensation for accommodations and necessities during delays. For more on protecting against weather issues, see Travel Insurance for Weather-Related Cancellations.

Health and Safety Concerns

Traveling amidst global health concerns increases the risk of illness. Policies that include COVID-19 considerations ensure you are covered for medical expenses or trip interruptions due to the virus. Read more at COVID-19 Coverage in Travel Insurance Policies.

Luggage and Personal Belongings

With higher volumes of travelers, the likelihood of lost or mishandled luggage increases. Baggage protection coverage compensates for lost, damaged, or delayed luggage, allowing you to replace essential items promptly. Learn how to safeguard your belongings at Maximizing Baggage Insurance Benefits.

Final Thoughts: Peace of Mind for Your Holiday Travels

Ultimately, travel insurance offers unmatched peace of mind. It’s about safeguarding your investment and ensuring that unforeseen events don’t derail your holiday plans. As Allianz Global Assistance’s Guide to Travel Insurance highlights, “travel insurance is a smart financial safeguard,” providing support when you need it most. Before embarking on your holiday journey, consider the potential risks and weigh them against the benefits of being insured. By choosing the right policy, you can focus on creating cherished memories, knowing that you’re protected against the unexpected.

FAQs About Holiday Travel Insurance

Is Travel Insurance Worth It for Domestic Trips?

While international travel poses more significant risks, domestic travelers can still benefit from travel insurance—especially if they have substantial non-refundable expenses or are engaging in activities with higher risks. For more information, visit Benefits of Travel Insurance for Domestic Travel.

How Do I Choose the Right Travel Insurance Policy?

Assess your needs based on trip cost, destination, activities, and personal health. Compare policies from reputable providers, read the fine print, and consider consulting with an insurance agent for personalized advice. See Step-by-Step Guide to Choosing Travel Insurance for detailed assistance.

Does Travel Insurance Cover COVID-19 Related Issues?

Many insurers now offer coverage for COVID-19-related medical expenses and trip interruptions. Verify with the provider that such coverage is included and understand any specific conditions or exclusions. For the latest updates, check out Travel Insurance Policies Covering COVID-19.

Can I Rely on Credit Card Travel Insurance?

Credit card insurance benefits can be valuable but may offer limited coverage compared to standalone policies. Review your credit card’s terms and consider supplementing with additional insurance if necessary. Learn more at Comparing Credit Card Travel Insurance and Standalone Policies.

Take the Next Step

Don’t let unforeseen events disrupt your holiday joy. Protect your travels by investing in a comprehensive travel insurance policy tailored to your needs. For personalized quotes and policy options, visit Get a Personalized Travel Insurance Quote Today.

For those interested in further enhancing their travel plans with expert tips and industry news, visit us at BoardingArea for a wealth of resources tailored to travelers worldwide.

Safe travels, and happy holidays!