Is Bilt Worth It for Frequent Flyers?

I’ve immersed myself in countless discussions about travel rewards, often hearing the same frustration: rent is one of the largest monthly expenses around, yet many traditional credit cards tack on processing fees when you try to pay it. That’s what initially drew my attention to the Bilt World Elite Mastercard®—it promises to reward renters in a way that feels almost too good to be true. In 2025’s competitive credit card market, this card piqued my curiosity for its potential to unlock points without any annual fee.

Being tied to Wells Fargo gives it a certain gravitas, and for any traveler who’s serious about earning miles or points, it’s worth examining how well the Bilt card measures up. Let me walk you through the highlights, and dig deeper into the everyday utility of this rent-centric card.

1. Earn Points on Rent Without Fees

One of the key reasons I paid attention to Bilt was its promise of fee-free rent payments. Renting an apartment is already expensive enough—according to a 2024 survey from the National Rental Association, average rent rates in major cities rose by 11% over the previous year. Being able to cover that hefty expense without a convenience fee is a relief. Bilt allows users to channel up to $100,000 in rent annually through this card, rewarding them with 1 point per dollar. If you’ve been burnt by service fees in the past, this setup feels like catching a break.

It’s not just about saving money on fees. I’ve observed that many frequent flyers focus heavily on credit card welcome bonuses, but they often miss this day-to-day value play: turning rent into a recurring point-earner. While some cards let you pay rent through third-party services (and charge for it), Bilt eliminates the middleman fees. For me, that alone can tip the scales in its favor if you rent and want to travel more.

2. Leverage Bonus Categories

Beyond rent, Bilt dives into popular spending categories. You’ll earn 3x points on dining and 2x on travel—notable figures given how many of us typically spend on meals out and transportation. And since it’s 2025, dining is back in full swing, with restaurants reporting a 15% increase in customer spending this past year (per recent industry data). These bonus rates let you capitalize on everyday passions, whether you’re eating at your neighborhood taco joint or booking your next cross-country flight.

I find it clever that Bilt also hands out 5x points on Lyft rides (when linked), recognizing how widespread rideshare usage has become among frequent travelers. However, there’s a catch: the card needs to be used at least five times in a billing cycle to unlock these higher reward rates. It’s a small hurdle, but definitely something that can slip your mind if you’re juggling multiple cards. I’ve learned to put a few small, regular charges on the card—like a morning coffee—just to ensure I meet the transaction requirement.

3. Perks and Protections

In my reading about travel-focused cards, I noticed that many users overlook the secondary perks. Bilt, for instance, includes cell phone protection and primary collision damage waiver for car rentals when you pay with the card. This can save you real money on insurance—even one incident claim can make the difference between having to shell out hundreds of dollars and covering it through your card’s benefits.

Additionally, it waives foreign transaction fees. If you plan to cross borders, it’s a feature you’ll want to have. A recent study suggests that over 50% of U.S. travelers plan at least one international trip each year, and those standard 3% transaction fees can stack up quickly. That’s why I prefer cards that keep purchases friction-free when I’m sampling street food in Tokyo or booking train tickets in Europe.

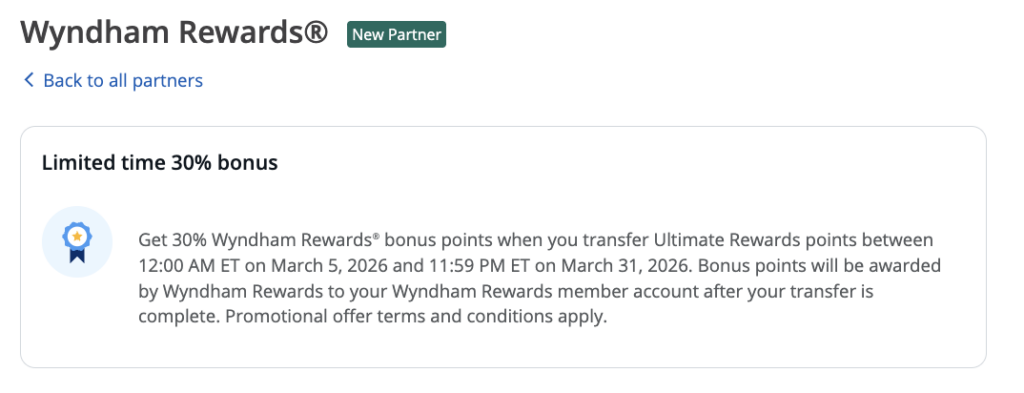

4. Transfer Points for Travel Rewards

Transfer partners are often the backbone of a solid travel rewards strategy. Bilt points can be transferred at a 1:1 ratio to over 15 airline and hotel loyalty programs. In my experience, this kind of flexibility means you’re not locked into a single airline or hotel chain. Instead, you can comparison-shop for the best point redemptions—something I always advise doing when you’re aiming for premium seat upgrades or free nights at a luxury property.

They also offer a travel portal where your points can be used at a rate of 1.25¢ each. Whether you choose to transfer to a partner or redeem through the portal, it’s all about giving yourself options. Some cardholders even use Bilt points toward a home down payment, which is a rather unique pivot from typical travel-centric cards. While I might not personally use points for that, it does highlight how the card can be molded to your individual goals.

5. Weighing the Downsides

No card is perfect, and Bilt is missing one thing many travelers love: a large welcome bonus. If you’re someone who hunts big sign-up offers to boost your points balance right out of the gate, this might be a disappointment. I remember moments when a welcome bonus alone funded an entire trip—but that’s not an option here.

There’s also a cap of 100,000 points per year on rent. While this won’t affect the average renter, high-spenders might quickly hit that threshold. And if your credit isn’t in good shape, qualifying could be a challenge. Yet personally, I still find that if you’re consistently renting and want an ongoing way to earn travel rewards, the year-round earnings can more than make up for the lack of a flashy sign-up boost.

Final Thoughts

Over the years, I’ve seen many credit card programs come and go, often struggling to offer genuine innovation. Bilt, however, has managed to shake up the landscape by targeting renters—one of the largest segments of modern society. With the ability to pay rent without incurring extra fees, plus targeted bonuses on dining and travel, it goes straight for the pressure points of frequent flyers and everyday spenders alike.

Unlike cards that levy an annual fee, Bilt keeps overhead low, keeping your rewards net positive. It remains essential, though, to consider your lifestyle before jumping in. If you consistently pay rent and travel at least a few times a year, Bilt might be an excellent addition to your toolkit.

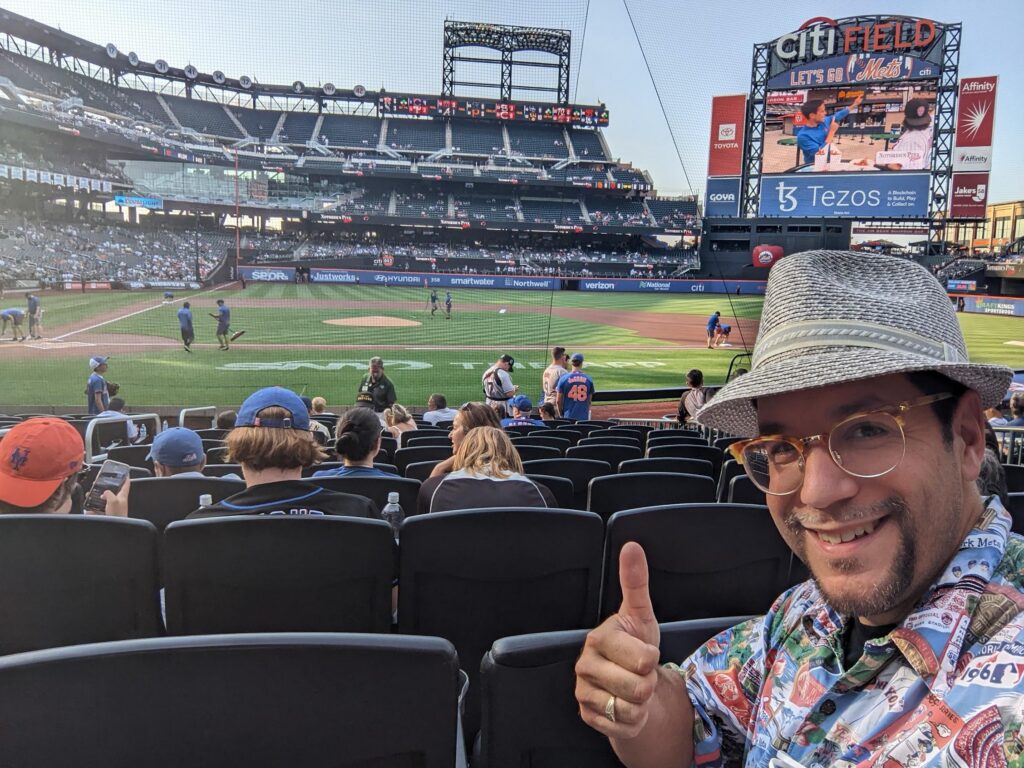

Sky Skylar’s Take

From my perspective, any card that turns a burdensome monthly bill—like rent—into a gateway for more travel is worth a serious look. The idea of shifting my rent payment into travel points taps into the future-forward approach I’ve been following for years.

Even without a big welcome bonus, these continuous returns on rent, dining, and travel can compound over time. It’s one of the few cards I’ve encountered that really embraces the idea of bridging everyday expenses with global exploration.

For more travel insights, follow us back to BoardingArea.