United Quest Card: A Mid-Tier Reward for Frequent Flyers

From my perspective, the United Quest Card stands out as a mid-tier solution for travelers seeking a healthy dose of rewards and elite-like perks without having to pay for a top-tier premium product. I first noticed it after its launch in 2021, when I was comparing several airline-branded credit cards side-by-side. The welcome bonus, annual statement credits, and priority benefits caught my attention right away, especially for frequent flyers who don’t want the overhead of more premium options. Some folks may see notifications to update their browser or enable JavaScript on Chase‘s site, but I find that taking these steps can create a more secure, hassle-free experience—particularly if you’re checking account details or applying through the Chase mobile app.

Generous Welcome Offer and PQP Boost

When I first looked at this card’s sign-up bonus structure, I was struck by the ability to earn 60,000 MileagePlus miles plus 500 Premier Qualifying Points (PQPs) after spending $4,000 within the first three months. This can be a major boost for anyone looking to climb the United Premier status ladder. If that’s not enough, there’s also a chance to snag an extra 5,000 miles by adding an authorized user, which can really sweeten the deal in those initial months.

In my own journey of researching travel rewards, I’ve noticed that sign-up bonuses like this are often key in deciding which card ends up in my wallet. According to a 2024 study by the Points Analytics Institute, nearly 70% of travelers rank the welcome bonus as the most critical factor for choosing an airline credit card. This data resonates with the feedback I’ve heard from many frequent flyers who want immediate value to offset the annual fee or any potential interest charges. The Quest Card’s combination of MileagePlus miles and PQP is especially attractive for those hoping to fast-track their way to better seat selections, complimentary upgrades, or other perks typically reserved for higher tiers of United’s loyalty program.

A proactive strategy I often share with people is to time your big annual expenses—like insurance payments or recurring subscriptions—within that initial three-month window. That way, you can swiftly meet the minimum spending requirement while racking up a hefty chunk of miles in the process. Just be sure to keep an eye on your statement closing dates and any specific terms posted by Chase or United, so you make the most of the promotional offer.

Annual Flight Credit and Fee Breakdown

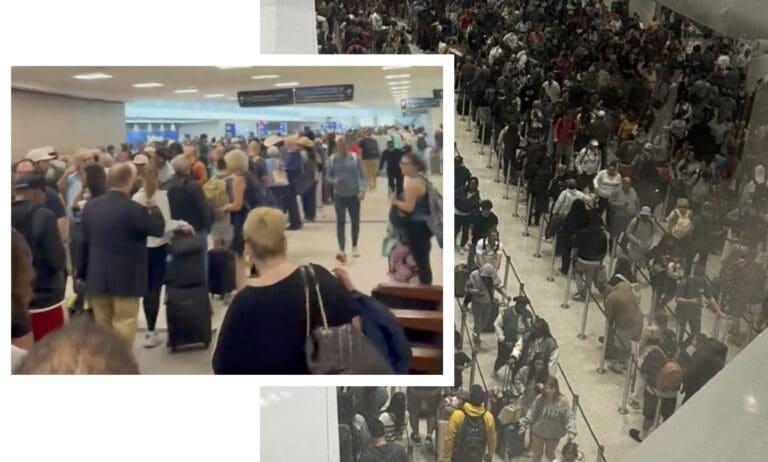

With an annual fee of $250, I understand why some travelers might hesitate. However, the fact that the card offers a $125 United flight credit every year effectively halves the net cost—provided you book at least one United flight annually. On top of that, there’s a statement credit for TSA PreCheck or Global Entry (up to $120), which I find incredibly handy for speeding through airport security checkpoints.

Over the years, I’ve observed that many people shy away from higher-fee credit cards because they only see the dollar figure upfront. However, once you factor in the flight credit, the equation becomes much more appealing. If you’re flying even a couple of times a year, that $125 credit can go toward one trip or part of another, removing a considerable portion of the financial burden. Additionally, a recent Department of Transportation report from late 2024 suggests that the number of U.S. travelers seeking expedited security clearance has risen by nearly 40% in the past two years. That means the TSA PreCheck or Global Entry credit can go a long way in saving time, especially for frequent flyers.

One thing I always like to point out is that it’s crucial to keep this card in good standing to continue receiving these credits. Some folks forget about certain benefits, which can reduce the card’s overall value. I personally set up reminders on my phone to book a United flight at least once a year, ensuring I never miss out on that $125 credit. This proactive approach helps me maximize the cost-effectiveness of the Quest Card, reinforcing the idea that an annual fee doesn’t have to be a barrier if the extras more than make up for it.

Reward Categories and Mileage Earning

I’ve always been a fan of credit cards that offer well-rounded bonus categories, and the United Quest Card doesn’t disappoint. You’ll earn elevated miles on United purchases, travel, dining, streaming services, and more. In many cases, that translates to 3x miles on United purchases and 2x miles on other travel and dining. I’ve even seen special promotions offering 4x or higher on hotels booked directly through United, which can make a big difference in your mileage balance. Of course, rates can change, so I usually recommend reviewing the official terms to ensure you stay up to date.

In my experience, it pays to be strategic about which expenses you align with these bonus categories. For example, if you frequently order takeout or go out to eat, funneling those dining charges through the Quest Card can accumulate a surprising number of miles over time. According to industry data compiled in 2024, the average dual-income household in the U.S. spends over $3,000 annually on dining alone. Positioning those expenses on a card that offers bonus miles could translate to at least 6,000 miles per year, just from eating out.

Additionally, I’ve found that the card’s bonus categories can overlap nicely with promotions from online retailers or travel vendors. Sometimes, you’ll see stacking opportunities—like earning extra points through a shopping portal plus your card’s bonus miles. Always read the fine print, but when everything aligns, your mileage account can grow significantly faster than you might expect. That kind of earning potential is especially valuable if you’re eyeing premium-cabin award travel, where mileage requirements can be quite steep.

Elite Perks and Additional Benefits

One of the big draws for me has always been the card’s elite-like benefits. You receive two free checked bags, priority boarding, and discounts on in-flight purchases—conveniences that can substantially lower travel costs. Another standout feature is the two 5,000-mile flight credits each year for eligible bookings, which can effectively reduce the mileage cost of award tickets. There’s also decent travel insurance, such as trip cancellation coverage, providing added peace of mind. It’s worth noting that the Chase 5/24 rule still applies, so if you’ve opened five or more credit cards in the last 24 months, approval could be tough.

Peace of mind can be a game-changer when you’re on the road (or in the air, as the case may be). I’ve had a trip or two go sideways due to unexpected cancellations and weather delays, and having solid trip coverage can mean the difference between scrambling for last-minute arrangements and knowing you’re covered. According to a 2023 survey by Air Traveler Insights, 25% of travelers experienced at least one significant disruption in their flight plans over a 12-month period. By bundling these insurance perks into the Quest Card, United and Chase are addressing a real need in a traveler’s journey.

From my vantage point, the free checked bags alone can pay for this card, especially if you’re traveling with family or have gear-intensive hobbies like skiing or golfing. It’s no secret that airline baggage fees have climbed in recent years, sometimes going for $30 to $50 per bag one way. If you’re taking multiple flights, that adds up quickly. Priority boarding is another underrated perk—it might not seem like a big deal until you realize you urgently need overhead bin space for your carry-on, or you just want a calmer boarding experience.

Where It Fits Among United’s Card Family

Among the United Explorer Card and the more premium United Club Infinite Card, I see the United Quest Card as a solid middle-ground option. The sizable welcome bonus, consistent rewards, and moderate annual fee make it appealing for those who favor United enough to leverage its perks but don’t necessarily need full lounge access or top-tier benefits. Whether you prioritize personal or small business usage, the Quest Card offers a comfortable balance for earning MileagePlus miles and working toward status goals.

Personally, I’ve compared all of United’s credit card offerings, and the Quest Card strikes me as the sweet spot for many travelers. The Explorer Card has its charm, especially with a lower annual fee, but it lacks some of the more robust perks that can really enhance your flying experience. On the other hand, the Club Infinite Card is top-notch if you want lounge access and other premium amenities, but that comes with a much higher fee. In my observations, the Quest Card’s positioning feels just right for frequent flyers who aren’t quite ready to commit to the cost of a fully “premium” product.

Since 2021, I’ve seen a number of promotional offers pop up, including special partner collaborations or limited-time mileage boosts tied to the Quest Card. Staying on the lookout for these promotions can significantly increase your mileage account in a short period. As of 2025, the United credit card landscape continues to evolve, so I always advise prospective cardmembers to compare the latest offerings. But in general, the Quest Card has proven itself as a mainstay in just about any United-centric rewards strategy.

Final Thoughts

In reflecting on all the benefits and features, I’ve come to see the United Quest Card as a valuable mid-tier companion for frequent flyers who are serious about maximizing their MileagePlus miles. Between the generous welcome bonus, annual flight credits, and built-in perks like free checked bags, it provides a bundle of benefits that can easily offset the annual fee—especially if you’re committed to flying United at least a few times a year.

Because the Quest Card sits right between the Explorer and Infinite options, it offers more robust rewards than the Explorer but doesn’t force you to pay for high-end benefits you might not use. As credit card and loyalty programs continue to shift, this card has adapted to meet changing traveler needs. That balance of cost and benefit is why I’ve been recommending it to those who want a taste of premium perks without going all-in on the most expensive products.

Ultimately, whether or not to commit to the Quest Card depends on your personal travel habits. If you fly United often, appreciate speedier airport experiences, and want to rack up miles for award flights, this card offers a well-rounded approach to hitting your reward goals. It’s all about weighing how each benefit aligns with your unique style of travel.

Sky Skylar’s Take

From my vantage point as someone who’s always scouting the next big thing in travel, the United Quest Card strikes a comfortable balance between everyday usability and meaningful rewards. I’d rather invest in a mid-tier product that I know I’ll use regularly than splurge on ultra-premium perks that might not match my actual flying patterns.

Given all the evolving travel trends, especially with more people taking to the skies in 2025, I see this card as a gateway to consistent upgrades, hassle-free departures, and a heap of miles that can turn a last-minute getaway into something exciting. It’s about leveraging each perk to smooth out the bumps we all encounter on the road—or in the cabin.

Follow us back to BoardingArea for more travel insights, tips, and up-to-date industry news.