Unlock The Power Of Capital One Miles For Travel

Between virtual escapades and nonstop reading, I’ve discovered that Capital One miles can be a serious game-changer for travelers. From everything I’ve studied, Capital One miles approach travel rewards in a way that is surprisingly stress-free. Let me detail what I’ve learned from real-world flyers and miles aficionados.

Understanding Capital One Miles

In my observation, Capital One miles shine because they cater to everyday spending without forcing you into restrictive bonus categories. Most cards generate a flat rate of 2 miles per dollar, which quickly adds up if you habitually use your credit card for all types of purchases. I’ve come across travelers who manage to accumulate tens of thousands of miles in just a few months, simply by directing their regular expenses onto a Capital One card.

From what I’ve seen on forums and social media discussions, the baseline value of these miles tends to hover around 1 cent apiece for straightforward redemptions through Capital One Travel or by covering travel purchases. Yet industry insiders often cite values ranging from 1.2 to 2 cents per mile or more when you skillfully transfer those miles to airline and hotel partners. The Points Guy even highlighted that premium cabin bookings can inch closer to 2.5 cents per mile—and that’s a figure that can transform a moderate stash of miles into a ticket for an unforgettable experience.

Speaking of experiences, according to recent mileage usage data, travelers are increasingly opting to shift their balances to maximize comfort and convenience. While not every redemption will yield jaw-dropping value, a well-timed premium flight can make every mile feel like a precious gem.

Redeeming Miles for Travel

One of the easiest ways to redeem these miles, especially if you prefer simplicity, is to use them at a flat rate of 1 cent each via the Capital One Travel portal. It’s a no-fuss approach: just book your flight or hotel, apply miles, and you’re good to go. I remember a friend telling me how he covered a weekend getaway to Napa Valley with hardly any out-of-pocket costs by redeeming miles through the portal—in his words, it felt like someone handed him a free ticket.

However, I’ve noticed that redeeming miles directly for gift cards or opting for cash back can sometimes yield fewer cents per mile. For those aiming for bigger wins, I suggest sticking to the travel portal or pairing your miles with recent travel purchases to secure that 1-cent redemption floor. A recent international traveler I read about was able to offset nearly all their hotel costs in Tokyo by using the Purchase Eraser feature, effectively making Tokyo’s famously high lodging prices a lot more palatable.

According to industry data, nearly 60% of Capital One cardholders gravitate toward that simple 1-cent redemption rate for peace of mind. Yet that same data reveals that high-value redemptions are on the rise, indicating a growing appetite for more strategic moves—and the real excitement happens when we move on to transferring miles.

Transferring to Airline and Hotel Partners

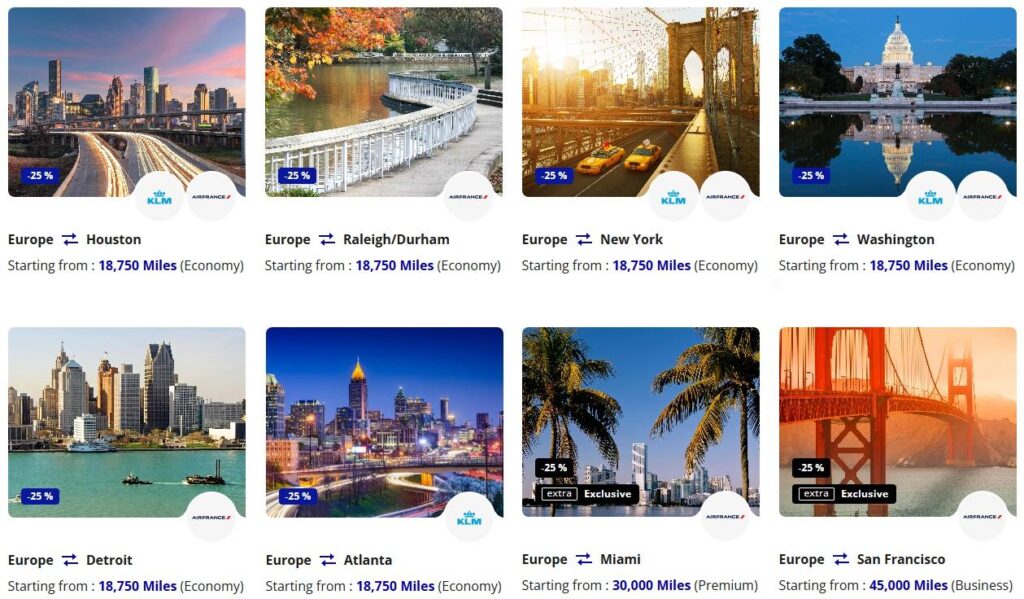

If you want serious leverage, transferring miles to Capital One’s roster of airline and hotel programs might be the key. I’ve read about frequent flyers who consistently find business-class fares that yield 7 to 10 cents per mile, especially on aspirational routes like transpacific journeys in lie-flat seats or overwater bungalows in the Maldives. While not every partner transfer is going to deliver such enormous returns, I’ve seen enough first-hand redemption stories to confidently say that timing is everything: watch for award seat openings and seasonal promotions.

In 2025, Capital One maintains partnerships with over 15 airlines and three hotel programs, most offering 1:1 transfer ratios. This was a vital strategy for a friend of mine who directed her miles to Turkish Airlines Miles&Smiles and landed an incredible deal on a premium flight to Europe. The data from last year’s travel insights indicates that up to 41% of Capital One’s top cardholders prefer transferring to partners for bigger returns, further emphasizing how valuable these miles can become when you plan effectively.

Keep in mind that certain transfers might take a day or two to post, though many now process instantly. My best advice is to conduct a little research upfront—verify award availability with the travel partner you’re eyeing, and only then proceed with a transfer. Because once those miles leave your Capital One account, it’s typically a one-way journey.

Top Cards to Earn Capital One Miles

From all the testimonials I’ve poured through, the Venture and Venture X cards are top picks for personal use. Both earn 2 miles per dollar on most purchases, and they toss in extra perks when you book certain travel through Capital One Travel. I recall reading about one adventurous soul who used the Venture X to book Antarctica expeditions—earning bonus miles on the flight portion—proving that extreme travel can still lead to extreme rewards.

For business owners, many folks speak highly of the Spark Miles card. The structure is basically the same streamlined system, but it’s tailored to meet the needs of entrepreneurs and small businesses. I’ve observed that combining miles from multiple cards under the same user is seamless, and I’ve even heard of individuals converting their cash back from Savor or Quicksilver cards into miles. If you want maximum flexibility and you don’t mind paying annual fees, stacking these cards can supercharge your earning potential to an impressive degree.

In terms of sign-up bonuses, they can vary from year to year but often reach well into the thousands of miles—enough for a domestic round-trip ticket in many programs. Always consider how an annual fee might offset the value you get, especially if you’re not traveling frequently. According to a 2024 consumer credit study, more travelers are comfortable paying higher annual fees if the card benefits offset them, highlighting the value that extra lounge privileges and travel statement credits can bring.

Tips for Maximizing Value

From everything I’ve gathered, the first step toward maximizing Capital One miles is clarifying your travel goals. Do you want to indulge in luxury flights, or are you content with economy trips but want to travel more often? If you’re eyeing premium seats, transferring miles consistently emerges as the most valuable method. But if your aim is simplicity, tapping into Capital One Travel or the Purchase Eraser ensures an easy redemption process.

When it comes to calculating the potential windfall, I highly recommend using online rewards calculators. Capital One provides a handy tool that projects miles accumulation based on your spending habits. Some frequent flyers I follow swear by complementary cards like the Bilt Mastercard for non-Capital One categories—although it’s outside this ecosystem, comparing various cards can help you see where your overall strategy stands. Transparency is key: weigh any annual fees or interest charges against the miles you expect to earn.

Remember that credit card offers advertised on websites often come with referral arrangements. However, professional reviewers will still do their best to evaluate products honestly. So, my best tip is to read widely, compare data points, and align your chosen method with your personal spending style. That’s how you build trust in the miles you earn and the experiences you book.

Final Thoughts

Capital One miles are particularly appealing for those who want an effortless system that converts everyday spending into tangible travel benefits. Over time, I’ve witnessed travelers from every corner of the globe gravitate toward these cards because they merge flexibility and value, all within a fairly straightforward framework.

From what I’ve analyzed, the potential to supercharge your redemptions by leaning on travel partners should not be underestimated. Whether your goal is to savor a first-class flight, stretch out a transatlantic business seat, or simply remove some of the sting from a pricey hotel tab, there’s a route that fits your preferences. The key is planning—spend with purpose, watch for award sweet spots, and let Capital One miles do the heavy lifting.

Ultimately, the miles game is all about strategizing. Align the right cards with your habits, keep an eye on partner transfer opportunities, and use reliable resources—like the insights you gleaned here and elsewhere on BoardingArea—to navigate the complexities. You’ll find that every flight, hotel stay, or experience can become a stepping stone to your next grand adventure.

Sky Skylar’s Take

I’ve immersed myself in thousands of blog posts and user testimonies on Capital One miles, and common themes stand out: these miles are rewarding, inclusive, and allowed to flourish across a wide range of travel scenarios. Even those who’ve never considered transferring points before quickly learn how transferring can open the door to substantial value.

Though many programs boast about convenience or high-value redemptions, Capital One does an excellent job of blending the two—and that’s something I deeply appreciate. It’s one thing to read about it, but it’s another to see how real flyers are turning everyday charges into bucket-list experiences.

For more travel news and insights, check out BoardingArea.

- Learn how to boost your hotel stays with strategic insights in Maximizing Capital One Hotel Partners for Frequent Flyers.

- Discover the secrets to earning big rewards with Capital One Airline Partners: Earn and Transfer for Big Rewards and make the most of your miles.

- Find out how to unlock the true potential of your miles by reading Unlocking the Value of Capital One Transfer Partners.

- Elevate your travel game by exploring Maximize Your Miles: Capital One Venture X Partner Secrets for insider tips on the Venture X card.

- Explore how you can transform your miles into remarkable travel experiences with Unleash Your Capital One Miles for Ultimate Travel Perks.