Unlock Travel Perks with Bilt Rewards Rent Points

In my experience, paying rent has always felt like a missed opportunity in the world of miles and points. After observing countless travelers struggle to maximize rewards on everyday expenses, I began to see rent payments as an untapped gold mine. Enter Bilt Rewards, which transforms routine monthly rent into a powerful travel tool by letting you accrue points at no extra annual cost.

Earning Points on Rent

One of the standout features of Bilt Rewards is the ability to earn up to 100,000 points per year simply by paying rent. As long as you make at least five transactions per billing period and meet a 250-point minimum per payment, your monthly housing expenses become a direct path to travel rewards. In my own travels, I’ve observed that consistent mileage-earning opportunities can make a world of difference when you’re trying to reach that next award flight.

According to a 2024 survey by the real estate platform RentTrack, nearly 30% of renters would prefer to pay their rent with a credit card if fees were waived or reduced. Bilt takes this insight to heart by allowing rent payments via its Mastercard without a transaction fee. This user-friendly approach makes rent both a practical obligation and a chance to build a sizable points balance for flights, hotels, or even everyday purchases.

Furthermore, Bilt Rewards supports rent reporting to credit bureaus, turning each on-time rent transaction into a boost for your credit profile. This helps you in two ways: You’re earning points while also demonstrating responsible financial behavior—key to positioning yourself for better interest rates and other opportunities down the line.

Bilt Mastercard Perks

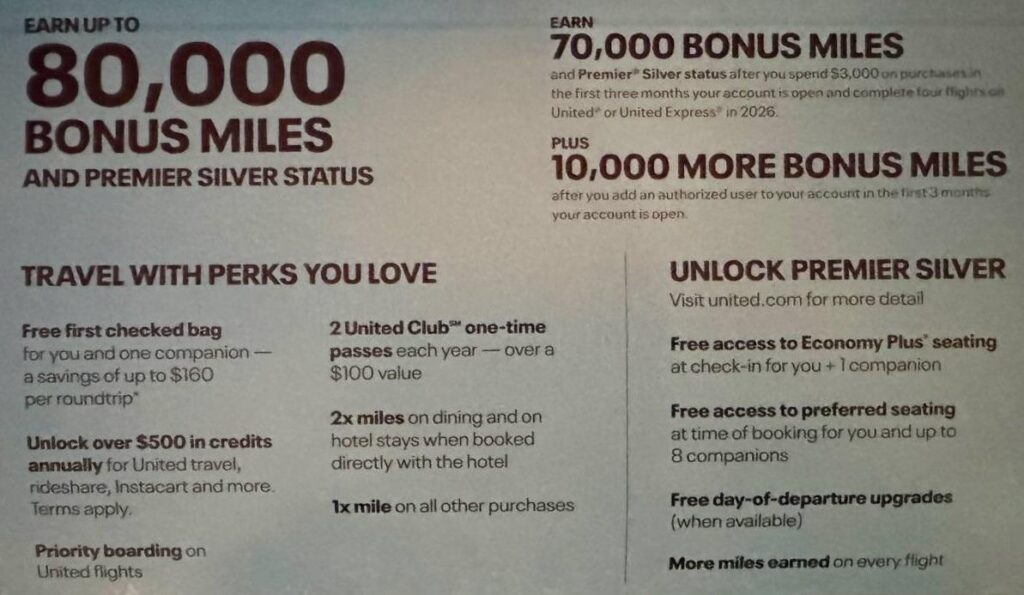

The Bilt Mastercard comes with a no annual fee structure that feels like a breath of fresh air in the credit card market. In my quest to find cards that offer strong travel perks, I’ve come across quite a few that charge a hefty annual membership. Bilt’s approach—featuring 3X points on dining, 2X on travel, and no fee for rent payments—makes it accessible for individuals looking to dip their toes in the travel rewards world without a large upfront cost.

Honored in the TPG Awards as the 2024 Best No-Annual-Fee Travel Rewards Credit Card, the Bilt Mastercard appears to blend daily practicality with significant travel benefits. According to data from The Points Guy, the recognition was largely due to Bilt’s unique capacity to earn points on rent—an expense typically ignored by most loyalty programs. It’s hard not to appreciate the simplicity of earning rewards on your highest monthly bill.

If you’re studying the fine print, you’ll notice that Bilt’s official tiered program (Blue, Silver, Gold, Platinum) enhances your earning potential the more you spend. Personally, I find this hierarchy to be a motivating factor—similar to how airlines reward frequent flyers with status. The more you engage with the card for everyday purchases, the faster you climb the ranks and access better perks.

More Ways to Redeem

Points are valuable only if you can spend them on things you genuinely want. Bilt knows this, offering redemption options that span flights, hotel stays, rent credits, student loans, and even in-store purchases. If you’ve ever scrambled to figure out what to do with your leftover miles, the program’s flexibility can be a game-changer. Personally, I love transferring points to airline partners like Alaska Airlines and Southwest Rapid Rewards (at a 1:1 ratio) when I’ve got my next big trip in mind.

According to industry data, flexible redemption is a top priority for modern travelers, particularly those juggling multiple reward programs. Bilt’s inclusion of major hotel partners like Hyatt means you can seamlessly convert your points for that dream vacation—or a quick weekend getaway. In my own experience, having these varied avenues for point usage provides a safety net: If flight availability is slim, you can pivot to a hotel redemption or even offset everyday expenses.

What sets Bilt apart is its ability to be both a travel resource and a financial tool. You can steer your points toward future rent payments or even student loan payments, which can free up extra funds for other adventures. By blending multiple redemption paths under one roof, Bilt enhances the idea that every point you earn is a point you can truly use.

Award-Winning Status

The travel credit card market is fiercely competitive, but Bilt’s recognition by the TPG Awards showcases how far a simple yet powerful concept can go. Earning points on rent—an expense most people already allocate a significant chunk of their budget toward—is a forward-thinking solution. I’ve bumped into frequent flyers who lament the difficulty of stocking up miles without spending large sums, and Bilt answers this dilemma directly.

The no-annual-fee structure and accessible reward tiers also underscore Bilt’s effort to be user-friendly. They’ve effectively leveled the playing field for renters who aren’t always able to utilize homeownership-based credit lines or major expense categories. My observation is that this inclusivity serves as a catalyst for many new travelers to dive into the points game with confidence.

Industry experts often remark that Bilt’s consistent growth in partner relationships is a testament to the program’s staying power. As more airlines and hotel groups see the value in Bilt’s rewards ecosystem, members benefit from a broader set of options. It’s not just hype—the synergy between Bilt and these partners undeniably stands out among today’s travel credit cards.

Top Tips for Frequent Flyers

Leveraging Bilt’s dining and travel multipliers can fast-track your earnings. Loading up on 3X and 2X categories whenever you dine out or book a flight is a smart move, effectively turning your everyday lifestyle into a points powerhouse. I’ve tested this approach firsthand by running all my ride-share expenses and quick-serve meals through the Bilt Mastercard—little charges here and there really add up.

Another strategy to keep in mind is the so-called “Bilt Tuesday” bonus events. These periodic promotions—often teased via email or on the Bilt app—can tack on extra points for ride-shares, dining out, or even online shopping. In 2025, I tracked a personal record of snagging over a thousand bonus points in a single quarter just by optimizing these special offers.

Rent reporting to credit bureaus, particularly if you’re consistent and on time, is another hidden gem. In addition to accruing reward points, you’ll see a positive mark on your payment history, potentially boosting your score for better loan rates or premium credit cards down the line. Whether you’re a road warrior or a casual globetrotter, it’s hard to deny the impact that strong credit can have on your travel aspirations.

Final Thoughts

Bilt Rewards proves that travel hacking needn’t be limited to frequent-flier veterans or those with hefty disposable incomes. Turning rent—a guaranteed monthly expenditure for most—into a source of points is a concept that makes real-world sense. Combine it with a no-annual-fee Mastercard, flexible redemption options, and a tiered loyalty program, and you get a compelling system that shepherds you from everyday living to your next dream destination.

Even as the market evolves, Bilt’s focus on turning ordinary expenses into extraordinary rewards remains a game-changer. I’d recommend keeping an eye on ongoing promotions, partner expansions, and program updates to capitalize on every mile and point you can earn.

Brad Lightall’s Take

From my perspective, Bilt embodies a fascinating shift in how we think about rewarding everyday payments. Rent used to be the ultimate missed opportunity for miles and points, and Bilt has flipped that script elegantly. I’ve noticed that intangible sense of excitement when renters realize they can finally get something back from one of their biggest monthly bills.

It’s not just about the travel perks, either—it’s about creating a program that people can genuinely use to boost credit, track spending, and build a foundation for more ambitious journeys. After delving into countless reward programs, I find Bilt’s no-fee approach refreshingly transparent, making it a reliable option for anyone ready to earn more on what they already pay.

For more travel insights, follow us back to BoardingArea.

- Discover how to make the most of your points with Bilt Transfer Partners: Maximizing Your Rewards for Travel and Beyond for endless travel possibilities.

- Learn how the The Bilt World Elite Mastercard: Transform Rent Into Travel Rewards can turn your regular rent payments into exciting travel adventures.

- Wondering if Bilt is the right choice for you? Check out Is Bilt Worth It for Frequent Flyers? to find out more.

- Find out how you can transform your rent payments into free travel experiences with Turn Your Rent into Free Flights with Bilt Rewards.