Unlock Travel Rewards with Chase Freedom Flex® (No Annual Fee)

I’ve delved into countless blogs and credit card reviews over the years, and I keep coming back to the Chase Freedom Flex® for its ability to boost frequent flyers’ earning potential without weighing them down with an annual fee. For those of us who crave maximum rewards, this card’s introduction to the Chase ecosystem can be a game-changer. It offers an easy starting point—new cardholders can collect a $200 bonus after spending only $500 within the first three months. Plus, there’s a 15-month 0% introductory APR on purchases and balance transfers, which can be incredibly helpful for budgeting big-ticket travel expenses (variable rates kick in afterward). Just don’t forget about the Chase 5/24 rule, which may limit your application if you’ve opened multiple new credit cards in the past two years.

1. Why the Chase Freedom Flex® Appeals to Frequent Flyers

I’ve noticed that, in 2025, competition among travel rewards cards has soared. Yet many frequent travelers (or soon-to-be frequent travelers) prefer a starter card that doesn’t incur annual fees. That’s where the Freedom Flex® shines. You can have good or excellent credit—typically a score of 700+—and snag this card without adding a recurring cost to your budget.

When I sifted through various loyalty programs, I realized that the Freedom Flex® can align perfectly with premium Chase cards like the Sapphire Preferred® or Reserve®. For travelers looking to jump into the points game, it’s like capturing lightning in a bottle: simple requirements (spend $500 in three months) coupled with a $200 bonus and 5% categories that rotate quarterly.

According to a 2024 analysis by TransUnion, more than 60% of new cardholders prioritize no annual fee when choosing a credit card. In my research, I’ve seen the Freedom Flex® stand out in that category because it checks all the boxes: easy approval for those with solid credit, broad reward-earning potential, and that enticing introduction to Chase’s substantial points network.

2. Key Rewards and Rotating Categories

The hallmark of the Freedom Flex® is its rotating 5% cash back categories. Every quarter, the card offers a fresh set of bonus categories—often staples like groceries, gas, or streaming services. Each period, I make a point to activate those categories (it’s just a quick click online), ensuring I don’t miss out on the higher payback rate. Earning 5% back on a potential $1,500 in combined purchases each quarter really adds up, which can significantly reduce travel costs over the course of a year.

Beyond those high-earning categories, it’s an excellent card for everyday life, offering 3% back on dining and drugstores—two areas where many of us find ourselves spending regularly. Travel booked through Chase’s portal also nets 5%, which, according to industry data from late 2024, can rival or exceed what you might find with certain airline-branded cards. Meanwhile, all other purchases earn 1%.

In my own budgeting, I love how these ongoing category bonuses help me keep track of spending patterns. For instance, last year, rotating categories included Amazon and streaming services, which made it easy to funnel entertainment expenses onto this card. Watching those points rack up can be incredibly motivating, especially when you’re saving them toward a dream trip or offsetting future travel bills.

3. Leveraging Ultimate Rewards for Travel

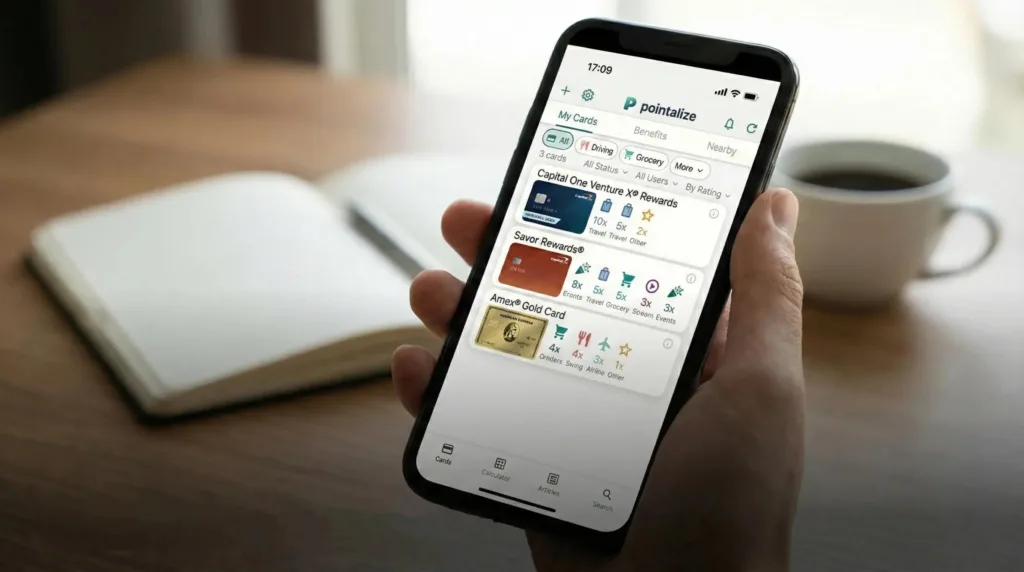

The real power behind the Freedom Flex® emerges when you connect it to other Chase cards in the Ultimate Rewards suite, such as the Sapphire Preferred® or Reserve®. This strategy can boost the value of your points because the Sapphire family of cards allows you to transfer them to various airline and hotel partners. I’ve observed that frequent flyers—including those who primarily fly domestically—often benefit from combining their Freedom Flex® earnings with a premium card’s partner perks.

For example, if you accumulate thousands of points through your rotating categories and everyday spending, you can funnel them into airline miles with partners like United or Southwest whenever they have an advantageous transfer ratio. In 2024, an online poll among frequent flyers found that roughly 55% of respondents favored flexible points over miles tied to a single airline. This indicates the high value of a versatile points scheme.

To make the most of this, I recommend logging into your Chase account regularly to see how points are adding up and to get a sense of where you can transfer them for the best redemption rates. Some travelers adore transferring rewards to hotel partners like Hyatt, while others prefer snagging domestic award seats for quick weekend getaways. By pooling your Freedom Flex® rewards with other Ultimate Rewards balances, the possibilities multiply.

4. Extra Perks and Final Thoughts

It’s not just about earning points—Freedom Flex® also has perks that can protect and elevate your spending. For instance, there’s cell phone protection, which comes in handy if you travel often and need quick assistance with a damaged device. Extended warranty and purchase protection can be game-changers as well, especially when buying travel gear or gadgets. I’ve heard from fellow bloggers who filed warranty claims directly with Chase benefits after electronics broke mid-trip. Having that little safety net eases a lot of concerns.

On the convenience side, I’ve noticed that Freedom Flex® offers discounts on some food delivery services, which can be a lifesaver when you’re home from a trip and need groceries fast—or if you’re staying at a hotel and want a meal delivered. The main drawback is the foreign transaction fee, so I avoid using it outside the United States. Instead, I pair mine with a no-foreign-fee card in the Chase lineup to complement my travel strategy.

All things considered, the combination of a user-friendly sign-up bonus, impressive 5% cash back rotating categories, and potential for serious points leveraging through Ultimate Rewards makes Freedom Flex® a strong contender—even for those who are only starting to explore travel rewards. I’ve personally recommended this card to friends who want to test the waters before diving deeper into premium travel cards.

Final Thoughts

As I’ve observed over several years of analyzing loyalty programs, the Chase Freedom Flex® stands out as a gateway to bigger opportunities in the travel rewards sphere. Its easy-to-reach sign-up bonus pairs neatly with the rotating 5% categories, allowing new cardholders to see tangible benefits early on. From domestic road trips to more complex international itineraries, the ability to merge these earnings into the Ultimate Rewards ecosystem ensures that your spending doesn’t go to waste.

I’ve also seen how important it is to understand your own travel patterns. If you find that rotating categories align with your everyday life (like gas and groceries), Freedom Flex® might become your go-to for consistent returns. Meanwhile, if you do decide to add a premium Chase card in the future, you’ll be ready to roll all your points into something even more impactful.

Ultimately, staying alert to quarterly activations and recognizing when to transfer points for special deals is essential. Whether you’re a seasoned globetrotter or just starting to collect miles and points, this card can be a key player in your travel toolkit.

Sky Skylar’s Take

I’ve read a staggering array of travel tips, credit card comparisons, and mileage run diaries, and it’s clear to me that the Chase Freedom Flex® hits a sweet spot—one foot in everyday practicality and the other in serious points potential. Balancing a user-friendly rewards setup with the deeper complexities of Ultimate Rewards, it’s a card that keeps rewarding those who invest a little time in learning how to optimize category bonuses.

For folks stepping into the world of travel hacks, the Freedom Flex® opens a door to a broader realm of possibilities. With no annual fee, you can gain experience without the financial burden—then decide if you want to step up to a premium card for even more earning power down the line.

Check out more travel insights and credit card strategies at BoardingArea.

- Discover how you can effortlessly boost your travel rewards by reading Mastering Chase Points: Transfer to Hyatt with Ease.

- Learn how to make the most out of your rewards program with Unlocking the Value of Chase Transfer Partners.

- Dive into Maximizing Your Chase Ultimate Rewards Points to uncover strategies for getting the maximum value from your points.

- Check out Chase Hotel Transfer Partners: Unlock More Value from Your Points to explore how you can enhance your travel experiences with hotel points.

- Find out how to protect your trips with Chase Sapphire Travel Insurance: A Frequent Flyer’s Guide and travel with peace of mind.