Unlocking the Value of Capital One Transfer Partners

Howdy, y’all! In recent years, Capital One has been spinnin’ its wheels, supercharg’n its rewards program to offer cardholders a whole heap of opportunities to max out them miles through a mighty network of transfer partners. This here evolution has turned the way cardholders use their rewards on its head, transformin’ everyday spendin’ into extraordinary travel experiences. For all y’all wanderlustin’ folks and rewards aficionados, understandin’ how to wrangle these transfer partners is essential. It can lead to exceptional value, openin’ doors to destinations that might have seemed outta reach, and creating memorable travel experiences that last a lifetime. To truly unlock the potential of this program, one must dive deep into the strategies that make the most of Capital One’s comprehensive transfer partner network.

Overview of Capital One Rewards Program

Right at the heart of Capital One’s rewards ecosystem lies a range of travel rewards credit cards, most notably the acclaimed Venture and Venture X cards. These cards empower users to earn miles smoother than a buttered biscuit on a hot summer day with everyday purchases, transformin’ routine expenses into opportunities for adventure. Cardholders can accumulate between 1.25 and 2 miles per dollar spent, with special bonus categories amp’n up the earnin’ potential on select expenses. This means that whether you’re buyin’ groceries, dinin’ out, or bookin’ travel, every dollar brings ya closer to your next getaway faster than a jackrabbit on a date.

These miles offer remarkable flexibility in redemption options. Cardholders can use miles to cover travel purchases, effectively erasin’ travel expenses from their statements. Alternatively, miles can be redeemed by bookin’ new trips through Capital One Travel, tappin’ into a curated selection of flights, hotels, and more. For those seekin’ versatility, miles can even be exchanged for gift cards across a variety of retailers. However, for those aim’n to milk the maximum possible value from their accumulated miles, transferrin’ them to partner airline and hotel loyalty programs often provides the most significant advantage. Through strategic transfers, cardholders can unlock premium flights and accommodations that might otherwise require a much larger expenditure when paid for in cash.

To understand the nuances and benefits of these transfer options, it is helpful to explore in-depth guides on maximizing Capital One miles through transfer partners.

Capital One’s Extensive Network of Transfer Partners

By 2023, Capital One has diligently expanded its roster to include nearly 20 transfer partners, encompassin’ 15 airlines and four hotel programs. This extensive network is a testament to Capital One’s commitment to providin’ cardholders with unparalleled flexibility. Whether your travel aspirations take ya to bustling cities, serene beaches, or remote hideaways, the array of partners ensures that your miles can take ya there.

This broad spectrum of partnerships opens up a world of possibilities for redeemin’ miles. Cardholders are equipped with the tools to tailor their travel experiences, choosin’ from a diverse lineup of airlines and hotels that cater to a wide range of preferences and destinations. The ability to transfer miles seamlessly to these partners enhances the value of the Capital One rewards program, makin’ it a competitive choice for those seekin’ to make the most out of their spendin’.

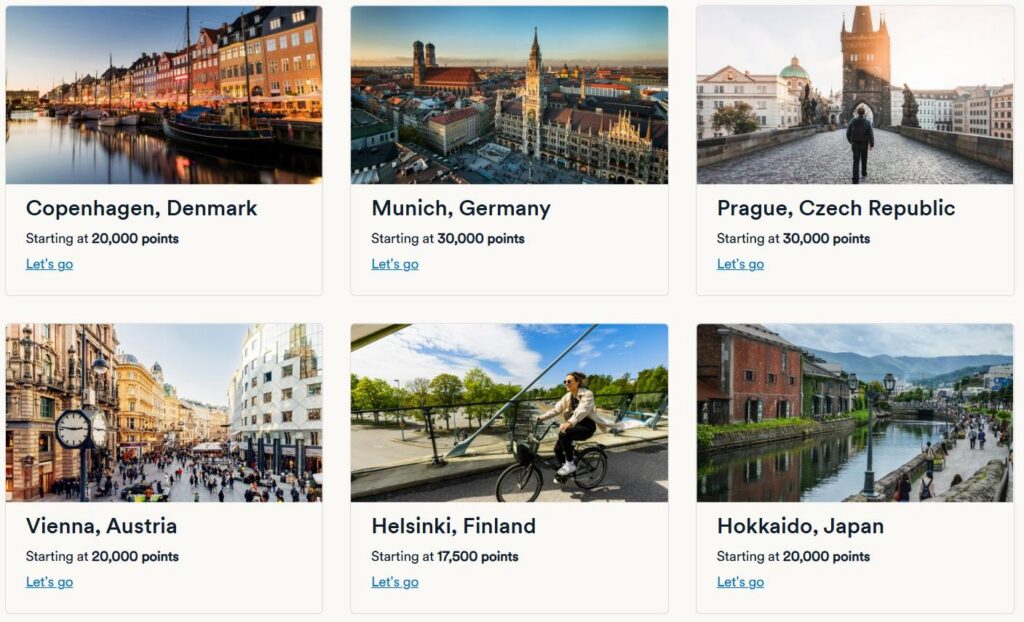

For a closer look at how these partnerships can benefit ya, consider reviewin’ the complete list of Capital One transfer partners and their exclusive perks.

- Transfer Ratios: The majority of partners offer a favorable 1:1 transfer ratio, meanin’ that one Capital One mile translates directly to one point or mile in the partner’s loyalty program. This straightforward conversion enhances the value proposition for cardholders lookin’ to maximize their rewards. However, it’s important to note that some partners, such as EVA Air and Accor Hotels, feature different ratios like 2:1.5 and 2:1 respectively. Bein’ aware of these variations is crucial when plannin’ transfers to ensure you’re gettin’ the best possible value.

- Notable Partners: Capital One’s network includes esteemed airline partners like Air Canada Aeroplan, renowned for its extensive route network and competitive award pricing, and Turkish Airlines Miles&Smiles, which offers attractive redemption options to various global destinations. Other key partners include British Airways Avios, known for efficient short-haul redemptions, Avianca LifeMiles for access to Star Alliance flights, and Singapore Airlines KrisFlyer, famous for its premium cabins. On the hotel front, partnerships with Accor, Choice Hotels, and Wyndham Rewards provide cardholders with ample redemption opportunities, caterin’ to diverse accommodation preferences worldwide.

- New Additions: In its commitment to continually enhance the program’s value, Capital One has recently added partners such as British Airways Avios and Choice Hotels. These additions expand the horizons for cardholders, offerin’ more choices when it comes to redeemin’ miles for flights and stays. Keepin’ abreast of these updates can help cardholders take advantage of new opportunities as they arise.

How to Transfer Miles to Partners

Transferrin’ miles to a partner program is designed to be smoother than a possum on a greased log, enabling cardholders to swiftly convert their Capital One miles into partner loyalty points or miles. Here are the steps to guide ya through the process:

- Log In: Begin by accessin’ your Capital One account online through the official website or mobile app.

- Navigate: Once logged in, navigate to the rewards section of your account dashboard. Here, you will find various options for redeemin’ your miles. Select the option to transfer miles, which is typically labeled clearly for ease of use.

- Select Partner: From the list of available transfer partners, choose the airline or hotel program you wish to transfer your miles to. Consider your travel plans and the value offered by each partner to make an informed decision.

- Enter Details: You will be prompted to input your loyalty program account information for the selected partner. Ensure that the details are accurate to facilitate a smooth transfer. If you do not have an account with the partner program, you will need to create one prior to this step.

- Transfer Miles: Specify the number of miles you wish to transfer. Keep in mind any minimum transfer requirements or increments specified by Capital One or the partner program. Review the transfer details carefully before confirm’n the transaction to avoid any errors.

One of the advantages of the Capital One transfer system is that most transfers are processed instantly or within a short period, allowin’ you quick access to book flights or accommodations without significant delay. However, it’s crucial to have an existing and active account with the partner program before initiatin’ a transfer, as this will streamline the process and prevent any potential complications.

Maximizing Value with Transfer Partners

Transferrin’ miles to partner programs is a strategic move that can significantly enhance the value of your rewards, particularly when aim’n for premium cabins or high-value awards that might be otherwise cost-prohibitive. Here are some strategies and examples to consider when maximiz’n value with transfer partners:

- Air Canada Aeroplan: Air Canada’s Aeroplan program has revamped its award charts, now offerin’ competitive redemption rates, especially for flights to Europe and Asia. For example, a business class flight to Europe that might cost thousands of dollars can be booked for a reasonable number of miles through Aeroplan. Moreover, Aeroplan allows for stopovers on one-way flights for an additional 5,000 points, addin’ further value for travelers lookin’ to explore multiple destinations on a single trip.

- Turkish Airlines Miles&Smiles: Turkish Airlines’ Miles&Smiles program is renowned for its generous redemption rates to various destinations, includin’ Hawaii and Europe. For instance, a round-trip economy class ticket to Hawaii from the U.S. mainland can be obtained for as low as 15,000 miles, which is significantly lower than what other programs might require. This presents an excellent opportunity for cardholders to enjoy exotic locales for fewer miles.

- British Airways Avios: The British Airways Avios program excels in providing value for short-haul flights, especially within regions or between nearby countries. Since British Airways partners with American Airlines, cardholders can utilize Avios to book domestic routes within the United States. This is particularly advantageous when flyin’ to smaller airports or when flight prices are high due to demand, as the fixed mileage requirements for Avios redemptions can offer substantial savings.

- Avianca LifeMiles: Avianca’s LifeMiles program provides solid redemption opportunities, particularly for flights operated by Star Alliance partners. This includes carriers such as United Airlines, Lufthansa, and Singapore Airlines. LifeMiles often runs promotions and offers competitive award pricing, makin’ it an attractive option for bookin’ international flights in both economy and premium cabins.

By strategically selectin’ the right transfer partner based on your travel goals and understandin’ the nuances of each program, you can significantly enhance the value of your miles. For more insights into these strategies, ya might find it beneficial to consult expert guides on optimizing rewards through Capital One transfer partners.

Benefits of Transferring Miles

Takin’ the step to transfer Capital One miles to partner programs unlocks a range of benefits that can elevate your travel experiences and provide greater value from your rewards. Here are some of the key advantages:

- Enhanced Value: One of the most compellin’ reasons to transfer miles is the potential for a higher cent-per-mile value. Compared to usin’ miles for statement credits or gift cards, redeemin’ through partner programs can yield substantially more value. For instance, securin’ a business class seat on an international flight usin’ transferred miles can represent a significant savin’ compared to the cash price of the ticket, stretchin’ the value of your miles further than standard redemption options.

- Premium Experiences: Transferrin’ miles opens up access to premium cabins, such as business and first class, which come with enhanced comfort, gourmet dinin’, and superior in-flight services. Additionally, certain hotel partners offer exclusive perks like suite upgrades, complimentary breakfasts, and late check-outs. These benefits can transform a regular trip into a luxurious experience without the associated high costs.

- Flexibility: The broad network of transfer partners provides immense flexibility, allowin’ cardholders to tailor their travel plans to suit personal preferences and specific destinations. Whether you’re aim’n for a serene beach getaway, a cultural exploration in a historic city, or a visit to relatives abroad, the variety of airlines and hotels available through partners ensures that your miles can be used where you need them most.

Important Considerations

While leveragin’ transfer partners can be highly advantageous, it’s important to approach the process thoughtfully. Here are some essential considerations to keep in mind to ensure a smooth and rewardin’ experience:

- Irreversible Transfers: Once ya transfer miles to a partner program, the transaction is final and cannot be undone. This means that if plans change or if ya find a better use for your miles elsewhere, ya won’t be able to retrieve them back into your Capital One account. Therefore, it’s highly advisable to confirm award availability and finalize your travel plans before initiatin’ a transfer. Doin’ so helps prevent your miles from bein’ stuck in a partner program with limited redemption options.

- Award Availability: Each loyalty program has its own inventory of award seats or rooms, which can sometimes be limited, especially during peak travel seasons or for popular destinations. Before transferrin’ miles, ensure that the flights or hotel stays ya desire are available for bookin’ through the partner program. This foresight helps avoid the frustration of havin’ miles in a program without the ability to use them as intended, commonly referred to as “orphaned” points.

- Expiration Policies: Partner programs have varying policies regardin’ point expiration. Some miles may expire after a period of inactivity, which could result in losin’ them if not used within the stipulated timeframe. Familiarize yourself with the expiration rules of the partner program to plan your redemptions accordingly and safeguard your miles from expirin’.

- Transfer Ratios: While many partners offer a 1:1 transfer ratio, some do not. Understandin’ the specific transfer ratios is crucial for accurately calculatin’ how many miles you will receive in the partner program. This knowledge ensures that ya can assess whether a transfer represents good value and meets the mileage requirements for your intended redemption.

Additional Cardholder Benefits

Beyond the robust rewards and transfer opportunities, Capital One travel rewards cards are packed with features that significantly enhance the overall cardholder experience. These additional benefits are designed to add value and convenience to your travels:

- Lounge Access: Premium cards like the Venture X come with complimentary access to a network of airport lounges worldwide. This perk provides a tranquil space away from the crowded terminals, where cardholders can enjoy comfortable seating, complimentary refreshments, Wi-Fi access, and sometimes even showers or business facilities. Lounge access transforms layovers or delayed flights into more pleasant experiences, addin’ a touch of luxury to your journey.

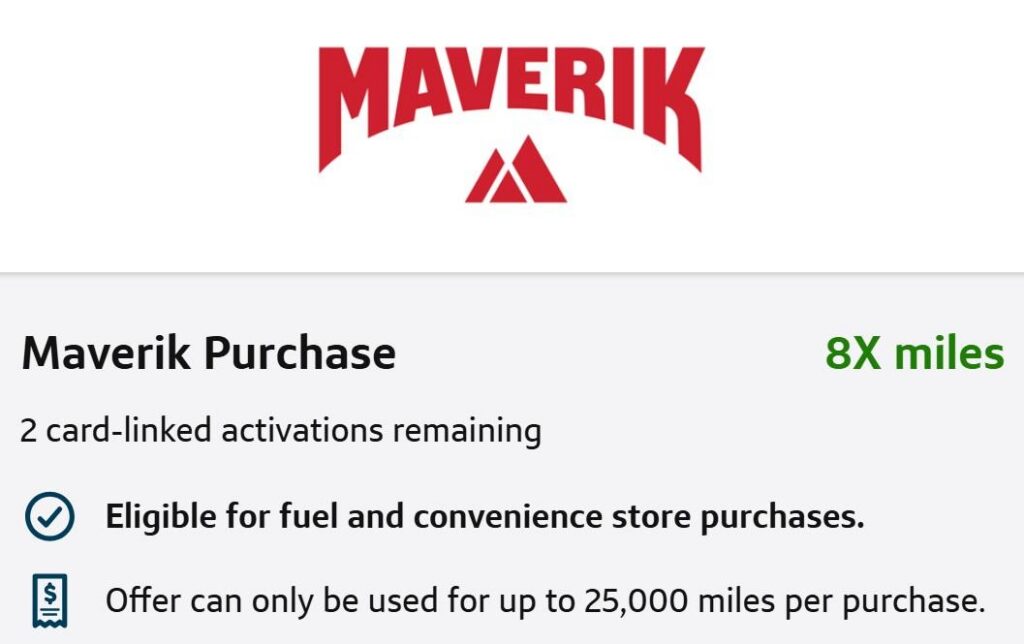

- Bonus Categories: To accelerate rewards accumulation, Capital One cards offer additional miles on specific spending categories. For example, makin’ travel bookings through Capital One Travel can earn ya extra miles per dollar spent. This incentivizes usin’ the Capital One platform for your travel arrangements, rewardin’ ya more generously for expenses ya would be makin’ anyway.

- No Foreign Transaction Fees: When travelin’ abroad, fees on purchases can quickly add up. Capital One travel rewards cards waive foreign transaction fees, allowin’ ya to make international purchases without incurrin’ extra charges. This benefit can save ya money and make your spendin’ more predictable when explorin’ foreign destinations.

- Flexible Redemption Options: The flexibility of the Capital One rewards program extends beyond transferrin’ miles to partners. Cardholders can choose to cover travel purchases made with the card by redeemin’ miles as a statement credit, book new travel through the Capital One Travel portal usin’ miles, or even redeem miles for gift cards or cash back. This array of options ensures that ya can utilize your miles in the way that best suits your needs and preferences.

Strategies for Effective Use of Transfer Partners

To fully capitalize on the opportunities presented by Capital One’s transfer partners, a strategic approach is essential. Here are some effective strategies to enhance your rewards experience:

- Plan Ahead: Begin by identifyin’ your travel goals, such as preferred destinations, dates, and desired cabin classes. Research the partner programs to understand which ones offer the best value for your specific plans. Monitorin’ award availability well in advance increases your chances of securin’ the flights or accommodations ya want. Some award seats are released up to a year in advance, so early plannin’ can be advantageous.

- Stay Informed: Partner programs periodically update their award charts, adjust mileage requirements, or launch promotional offers. Stayin’ informed about these changes can help ya take advantage of limited-time opportunities or avoid potential pitfalls due to increased mileage costs. Subscribin’ to newsletters or followin’ reputable travel blogs can keep ya updated on the latest developments.

- Leverage Alliances: Many partner airlines are members of larger alliances, such as Star Alliance or Oneworld. By transferrin’ miles to a partner within an alliance, ya gain access to award bookings across all member airlines. This significantly expands your options for routes and destinations. Understandin’ alliance networks helps ya make strategic transfers that align with your travel plans.

- Use Tools and Calculators: Capital One and other resources provide tools and conversion calculators to assist in plannin’. These tools help ya determine the number of miles needed for specific redemptions and compare the value across different partners. Utilizin’ these calculators ensures that ya make informed decisions that maximize the return on your miles.

Final Thoughts

Capital One’s extensive network of transfer partners is a mighty tool for elevatin’ your travel experiences. The program significantly enhances the value and flexibility of the miles ya earn, transformin’ routine spendin’ into extraordinary opportunities. By takin’ the time to understand how to effectively navigate and utilize these partnerships, ya can unlock premium travel experiences that deliver exceptional value.

Whether you’re dreamin’ of bookin’ a luxury hotel stay, securin’ a coveted business class seat for international travel, or enjoyin’ exclusive airline perks that enhance every step of your journey, Capital One transfer partners offer a pathway to make those aspirations a reality. Through strategic plannin’ and informed decision-makin’, cardholders can maximize the return on their spendin’, turnin’ miles into priceless memories and experiences.

Follow us back to BoardingArea for more insights and updates on maximizin’ your travel rewards.