Buying Airline Stocks: Which Ones Give You Perks as a Shareholder in 2025?

Investing in airline stocks has always been a topic of keen interest for travelers and investors alike. The allure of this sector lies not only in its potential for financial returns but also in the unique benefits that some airlines extend to their shareholders. In the ever-evolving landscape of the airline industry, 2025 presents a unique opportunity for investors seeking to combine their financial ambitions with their passion for travel. Beyond potential dividends and capital appreciation, certain airlines offer additional incentives that can significantly enhance your travel experiences.

Imagine being able to explore new destinations or visit familiar places with substantial discounts, exclusive access, or elevated service, all because you own shares in the airline. This symbiotic relationship between investor and company goes beyond the traditional boundaries of shareholder value. In 2025, which airline stocks not only promise potential growth but also reward you as a shareholder? Let’s delve into the options available and understand the perks that come with owning airline shares.

The Evolution of Airline Shareholder Perks

Over the years, shareholder perks in the airline industry have undergone significant transformations, especially in regions like the United States and the United Kingdom. There was a time when investing in airlines was synonymous with enjoying generous benefits—flight discounts, priority check-ins, and access to exclusive lounges were among the perks that added tangible value to shareholders. However, this landscape began to shift as airlines faced mounting financial pressures.

The early 2000s marked a challenging era for the aviation industry. The aftermath of the 2001 terror attacks led to heightened security measures and a decline in air travel, directly impacting airlines’ profitability. The 2008 financial crisis further exacerbated these challenges, as economic downturns typically result in decreased discretionary spending on travel. Most recently, the 2020 pandemic brought unprecedented disruption, grounding fleets worldwide and leading to massive financial losses.

In response to these financial hurdles, many airlines re-evaluated their expenses, and shareholder perks were often among the casualties of cost-cutting measures. Major carriers like American Airlines and British Airways, once known for their generous shareholder programs, discontinued these benefits to focus on financial recovery and operational efficiency.

Despite this overall decline, the tradition of offering shareholder perks hasn’t entirely faded. In fact, some airlines, especially in regions less impacted by these crises or with different corporate cultures, continue to recognize the value of rewarding their investors. Notably, airlines in Japan and parts of Europe maintain or have reintroduced perks, acknowledging that these benefits can foster loyalty and encourage long-term investment.

Airlines Still Offering Shareholder Benefits in 2025

Even as many airlines have scaled back on shareholder perks, a select group continues to reward their investors with valuable travel benefits. For savvy investors and frequent travelers, these airlines represent an opportunity to enhance both their investment portfolio and their travel experiences.

Japanese Airlines: ANA and Japan Airlines

- All Nippon Airways (ANA) and Japan Airlines (JAL), two of Japan’s premier carriers, offer substantial discounts to their shareholders.

- Shareholders owning 100 shares or more receive 50% discount coupons on domestic and international flights.

- For instance, a shareholder planning a trip from Tokyo to Osaka can benefit from significant savings, effectively reducing the cost of travel by half.

- These perks make investing in these airlines particularly appealing for frequent travelers to and within Japan, allowing them to explore the country more affordably.

- The cultural emphasis on loyalty and long-term relationships in Japan may contribute to these companies’ commitment to maintaining shareholder benefits.

Air France-KLM

- Air France-KLM, one of Europe’s leading airline groups, provides its shareholders with an array of benefits.

- Shareholders are granted discounts on flights, priority services, and special invitations to exclusive events such as inaugural flights or airline-sponsored cultural events.

- For example, a shareholder might receive an invitation to the launch event of a new flight route or exclusive access to the airline’s VIP lounges.

- These benefits not only enhance the travel experience but also offer a closer connection to the airline’s brand and services, fostering a sense of community among investors.

Star Flyer

- Another Japanese carrier, Star Flyer, extends benefits to its shareholders, although specific details vary based on the number of shares held.

- Shareholders may receive discount coupons, complimentary tickets, or priority booking options.

- The airline’s commitment to providing a premium service experience is reflected in the perks offered to its investors, emphasizing quality and customer satisfaction.

Beyond Airlines: Travel Companies Offering Shareholder Perks

It’s not just airlines that are rewarding shareholders; several travel-related companies provide attractive incentives that can enhance your overall travel experience. By investing in these companies, shareholders can access benefits that extend beyond air travel, encompassing cruises, hotel stays, and more.

Cruise Lines: Carnival and Norwegian

- Carnival Corporation and Norwegian Cruise Line, two giants in the cruise industry, offer onboard credits to their shareholders.

- These credits can be substantial, ranging from $50 to $250 per cabin, depending on the length of the cruise.

- For example, a shareholder embarking on a seven-day Caribbean cruise might receive $100 in onboard credit, which can be used for spa services, specialty dining, shore excursions, or other onboard amenities.

- These perks enhance the cruising experience by providing added value, effectively lowering the out-of-pocket expenses during the trip.

Hotels and Hospitality Groups

- Accor Hotels, a global leader in the hospitality industry, grants Gold status to shareholders holding 50 shares or more.

- This status comes with benefits such as room upgrades upon availability, late check-outs, welcome drinks, and access to exclusive member rates.

- For frequent travelers who prefer staying at Accor properties like Sofitel, Novotel, or Mercure, these perks can significantly enhance their stays.

- InterContinental Hotels Group (IHG) offers shareholders with 100 shares up to 20% off their flexible rates.

- This discount applies across IHG’s extensive portfolio, including brands like InterContinental, Holiday Inn, and Crowne Plaza.

- The savings can accumulate substantially over multiple stays, making it an attractive benefit for investors and travelers alike.

- NH Hotel Group’s NH Discovery program provides Gold Status to anyone holding just one share.

- Benefits include complimentary Wi-Fi, room preferences, and exclusive offers, enhancing the guest experience from the very first stay.

- Meliá Hotels International offers immediate Silver status to its shareholders.

- Perks include priority check-in, late check-out, and access to exclusive promotions, adding comfort and convenience to hotel stays.

Budget-Friendly Investments for Perks

- Some companies require minimal investment to access significant benefits, lowering the barrier to entry for individual investors.

- For instance, holding just one share in certain companies like Royal Caribbean Cruises can unlock perks such as onboard credits of up to $250.

- This approach democratizes access to shareholder benefits, allowing even small investors to enjoy enhanced travel experiences.

- These perks function similarly to loyalty programs but have the added advantage of potential financial returns from the investment.

- By strategically investing in these companies, travelers can maximize value, combining the enjoyment of travel perks with the potential growth of their stock holdings.

The Financial Considerations of Investing for Perks

While the allure of travel perks is strong, it’s crucial to consider the financial implications of investing primarily for these benefits. A well-informed investment strategy balances the desire for perks with prudent financial planning.

- Market Risks: Investing in stocks always carries inherent risks. Share prices can fluctuate due to market conditions, industry trends, or company-specific news, and there’s always potential for loss.

- For example, an airline’s stock might decline due to rising fuel costs, regulatory changes, or unexpected events impacting travel demand.

- Investors should assess their risk tolerance and consider whether the potential perks justify the financial risks involved.

- Long-Term Value vs. Short-Term Perks: While perks are appealing, they should be viewed as an added bonus rather than the primary reason for investment.

- Focusing solely on perks might lead to overlooking critical factors such as the company’s financial health, management effectiveness, and competitive position.

- Long-term value creation should remain the cornerstone of any investment decision.

- Diversification: Relying heavily on investments in a single industry or company to gain perks could result in an unbalanced portfolio.

- Diversification across different sectors and asset classes is essential to mitigate risks.

- Investors might consider allocating only a portion of their portfolio to companies offering shareholder perks, ensuring a balanced and robust investment strategy.

- Tax Considerations: Depending on the jurisdiction, the value of perks received might have tax implications.

- Investors should consult with a tax professional to understand any potential liabilities associated with shareholder benefits.

The Positive Outlook for Airline Stocks in 2025

Beyond perks, airline stocks present compelling investment opportunities in 2025, driven by industry recovery and growth prospects. Understanding the broader trends can help investors make informed decisions that align with their financial goals.

Strong Industry Recovery

- The International Air Transport Association (IATA) predicts a return to airline profitability, with industry revenues reaching $964 billion.

- This represents a significant rebound, indicating robust demand for air travel and improved operational efficiencies.

- A 7.6% growth rate is expected, driven by increased passenger revenues as travel restrictions ease and consumer confidence returns.

- Factors contributing to this growth include pent-up travel demand, especially in leisure travel, and the resumption of corporate travel activities.

- Analysts are optimistic about the industry’s prospects.

- Investment firms like Deutsche Bank, Morgan Stanley, and UBS have raised earnings projections for key airlines, signaling confidence in their performance.

- For example, Deutsche Bank might highlight the anticipated revenue surge for major U.S. carriers due to increased international travel .

Airlines Recommended for Investment

- Delta Air Lines (DAL):

- Known for operational efficiency, a strong route network, and customer loyalty programs.

- The airline’s solid 2024 outlook is bolstered by strategic partnerships and fleet modernization efforts.

- Delta’s focus on enhancing customer experience positions it well for capturing market share.

- United Airlines (UAL):

- Considered undervalued by some analysts, with opportunities for growth as international routes reopen.

- United’s extensive global presence and membership in the Star Alliance provide competitive advantages.

- Ongoing investments in sustainability and technology may further enhance its appeal to investors.

- American Airlines (AAL):

- Demonstrates resilience with labor agreement certainty, ensuring operational stability.

- The airline is working on deleveraging its balance sheet and improving financial metrics.

- American’s strategic focus on key domestic and international hubs supports its long-term growth plans.

- Alaska Air Group (ALK):

- Thriving under its “Alaska Accelerate” plan, aiming to expand its network and enhance profitability.

- Shares have risen 68.9% over the past year, reflecting strong investor confidence.

- The acquisition of Hawaiian Airlines positions it for further growth in lucrative markets.

- Alaska’s commitment to customer service and sustainability initiatives resonates with modern travelers.

- Ryanair (RYAAY):

- Europe’s low-cost leader with a robust growth model focused on efficiency and affordability.

- Ryanair’s aggressive expansion into new markets and high load factors contribute to its profitability.

- The airline’s cost leadership strategy positions it well against competitors in the European market.

- SkyWest (SKYW):

- Offers stability through its regional focus and strong partnerships with major airlines.

- SkyWest operates flights for larger carriers, providing essential connectivity in smaller markets.

- Its unique business model offers consistent revenue streams and less exposure to market volatility.

Industry Trends

- Shift to Service Quality: Airlines are investing in premium offerings, such as upgraded cabins, in-flight entertainment, and enhanced loyalty programs, to foster brand loyalty.

- For example, carriers might introduce new business class experiences tailored to post-pandemic travelers , appealing to those willing to pay extra for comfort and convenience.

- Consolidation: In the U.S., four airlines now control 80% of the market, leading to more stability and potentially higher profitability.

- This consolidation reduces competition, allowing airlines to have greater pricing power and capacity control.

- Investors may find opportunities in airlines that can leverage this market structure effectively.

- Technology Integration: Innovations are enhancing operational efficiency and customer experience.

- Investments in digital platforms, artificial intelligence for route optimization, and contactless services improve efficiency and reduce costs.

- Airlines adopting cutting-edge technology may have a competitive edge and better adaptability to changing market conditions.

Balancing Perks with Sound Investment Principles

While shareholder perks can undoubtedly enhance your travel experiences, they should complement, not dictate, your investment decisions. A balanced approach ensures that you’re making choices aligned with your overall financial objectives.

- Due Diligence: Always assess a company’s financial health, market position, and growth prospects.

- Reviewing financial statements, understanding revenue streams, and analyzing industry position are essential steps.

- Tools and resources such as comprehensive airline stock analysis platforms can aid in making informed decisions.

- Long-Term Perspective: Consider the potential for sustainable returns over immediate perks.

- Investing with a long-term horizon allows for the compounding of returns and may mitigate short-term market fluctuations.

- Perks should be seen as an added benefit that enhances value but not the sole reason for investment.

- Investment Platforms for Perks:

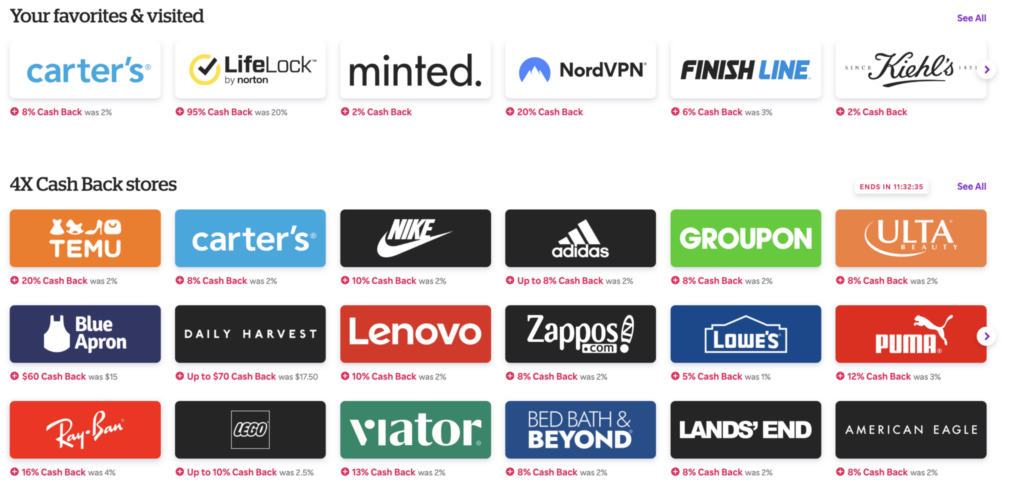

- Platforms like Tiicker and Stockperks help investors access shareholder benefits by consolidating information and streamlining eligibility verification.

- Understanding the requirements and processes through these platforms can ensure you make the most of the perks available.

- For example, Tiicker may provide detailed guides on accessing airline shareholder benefits in 2025 , assisting investors in navigating the available options.

Final Thoughts

Investing in airline stocks in 2025 offers the dual appeal of potential financial returns and travel perks. While the number of airlines offering shareholder benefits has decreased over the years, opportunities still exist, especially with certain international carriers and travel companies. By combining a strategic investment approach with the added value of shareholder perks, investors can enhance both their portfolios and their travel experiences.

However, it’s important to approach these investments with a clear understanding of the risks and a focus on long-term financial goals. Perks are a delightful bonus but should not overshadow the fundamental principles of sound investing. A well-considered investment strategy, grounded in thorough research and aligned with your financial objectives, will serve you best in the ever-changing landscape of the airline industry.

Follow us back to BoardingArea for more insights and updates on travel and investment opportunities.

*Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a professional financial advisor before making investment decisions.*